Leading market players are investing heavily in research and development to expand their product lines, which will help the security assurance market grow even more. There are some strategies for action that market participants are implementing to increase their presence around the world's global footprint, with important market developments including new product launches, contractual agreements and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the security assurance industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturer use in the global security assurance industry to benefit clients and increase the market sector. In recent years, the security assurance industry has offered some of the most significant technological advancements.

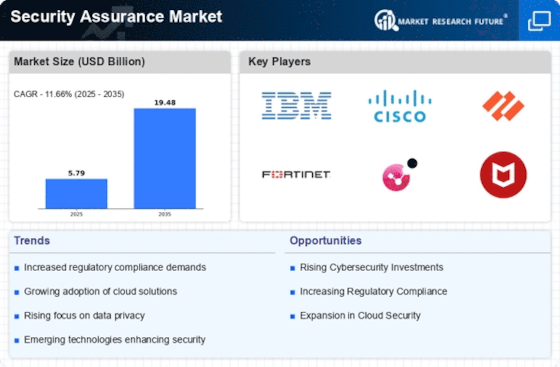

Major players in the security assurance market, including Avaya Inc.(US), IBM Corporation (US), Infosys Limited (India), Micro Focus (UK), NETSCOUT (US), SAS Institute Inc. (US), Capgemini (France), Spirent Communications (UK), Radix Security Inc. (Israel), Tenable Inc. (US), Telos Corporation (US), Happiest Minds (India), CIPHER Security LLC (US), BizCarta Technologies India Pvt Ltd, Aura Information Security (Australia), and others are attempting to grow market demand by investing in research and development operations.

Telos Corporation provides the most security-aware companies in the world with tools to ensure the safety of their employees, data, and infrastructure around the clock. Solutions for IT risk management and information security are available from Telos, as are cloud

security solutions for the protection of cloud-based assets and the facilitation of continuous compliance with industry and government security standards, and enterprise security solutions for the administration of identities, the protection of mobile communications, the management of internal communications, and the protection of computer networks. The company's clientele consists of businesses, industries subject to government oversight, and governments.

In March 2023, Telos is delighted to announce a partnership with IBM Security as part of IBM's Active Governance Services (AGS), which helps businesses overcome obstacles related to cybersecurity compliance and regulatory concerns through the operationalization and automation of formerly manual processes.

NETSCOUT SYSTEMS protects the connected world from cyberattacks and performance and availability problems with its unique visibility platform and solutions driven by its pioneering deep packet inspection at scale technology. NETSCOUT works with the world's biggest businesses, service providers, and government agencies.

In June NETSCOUT SYSTEMS, INC. created the Visibility without Borders platform to help key companies keep goods and services moving by combining performance, security, and availability into one common data framework. By autonomously finding areas of complexity, fragility, and risk, the platform unlocks insights at a scale never before seen.

It gives the intelligence needed to increase visibility, improve agility, and keep data and applications safe.