Research Methodology on Small Cell Networks Market

1. Introduction

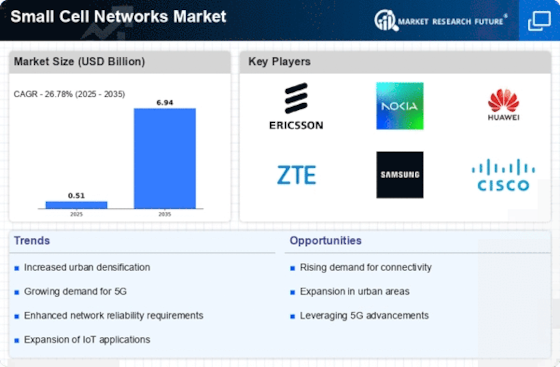

The development of advanced technologies such as the Internet of Things (IoT) and fifth-generation mobile networks (5G) has increased the demand for reliable and efficient mobile networks. Mobile network operators are now focusing on the development of small-cell networks to meet these demands. This research aims to provide a detailed analysis of the global small-cell network market. The report includes a thorough review of the market and its dynamics, along with a comprehensive overview of the market's growth drivers, current trends, key stakeholders, and regulatory aspects. The report also provides in-depth market segmentation, regional analysis, and other related data points to provide a comprehensive view of the market.

2. Research Approach and Scope

This research looks to provide an in-depth review and analysis of the global small cell networks market, as well as its various influencing factors. To do this, a combination of qualitative and quantitative research methods have been employed. Qualitative research methods involve desk research to collect information by analyzing market and industry reports, press releases, and relevant case studies. In addition, we conducted interviews with market experts and key stakeholders, to gain insights into the trends and changes in the industry. Once the primary research is completed and evaluated, additional secondary research was conducted to gain further insights, such as industry data, independent studies, and other relevant reports.

The literature review for this report looks to provide a comprehensive view of the global small cell network markets across the world. Our research includes a thorough examination of the market and its various influencing factors, in addition to the various historical and forecasted market size based on product type and application. The research also looks to provide an in-depth view of the market's current trends and potential opportunities, as well as the key stakeholders and game changers in the industry.

3. Research Methodology

The data and research methodologies used for this study are as follows:

Primary Research:

We conducted online surveys and interviews and conducted discussions with Subject Matter Experts and selected industry players, to gain valuable insights into the global small cell networks market and forecast for 2023 to 2030.

Secondary Research:

We conducted a comprehensive search of research papers, industry reports, market analyses, and press releases to gather industry trends and data.

Data Collection & Validation:

Information gathered from the various primary and secondary sources was verified, compared, and validated using established statistical and market measuring tools, such as Market Sight, Symphony Edge, and Axios. The data collected is also validated using current market trends with expert opinions.

4. Data Analysis

The collected data is analysed using different tools and statistical techniques. For the market sizing and segmentation, an analysis was applied using Porter’s Five Forces Model, Value Chain Analysis, SWOT Analysis, and Market Scenario Analysis. The collected data is also analysed using market research techniques such as market segmentation, market share analysis, Porter's Five Forces Model, Value Chain Analysis, and Gap Analysis.

5. Conclusions and Recommendations

Based on our research, we make the following conclusions and recommendations regarding the global small cell networks market:

-The market is primarily driven by factors such as increasing demand for enhanced mobile connectivity and the growing preference of mobile network operators towards the deployment of small cell networks.

-The market is segmented by product type into Home eNodeB, Macrocell/ Metrocell, and Enterprise eNodeB.

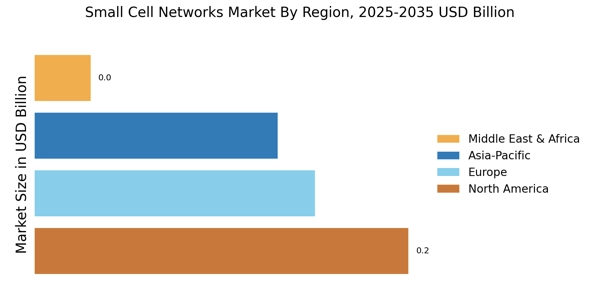

-Regionally, the market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and Rest of the World.

-The key stakeholders in the market include radio access network providers and small cell OEMs.

-We recommend that all stakeholders focus on technology innovation and product development, to strengthen their position in the market And capitalize on the growth opportunities present in the market.