Emergence of Targeted Therapies

The emergence of targeted therapies is reshaping the landscape of the Small Molecule Drug Discovery Market. These therapies are designed to specifically target molecular pathways involved in disease progression, offering a more precise approach to treatment. The shift towards personalized medicine has led to an increased focus on developing small molecules that can effectively interact with specific biological targets. This trend is evident in oncology, where targeted small molecule drugs have shown promising results in clinical trials. As the demand for more effective and tailored treatment options grows, the Small Molecule Drug Discovery Market is expected to expand, driven by the need for innovative solutions that address the complexities of various diseases.

Regulatory Support for Drug Development

Regulatory bodies are increasingly providing support for drug development, which is positively impacting the Small Molecule Drug Discovery Market. Initiatives aimed at expediting the approval process for new drugs, such as the FDA's Breakthrough Therapy designation, are encouraging pharmaceutical companies to pursue small molecule drug development. These regulatory incentives not only reduce the time to market but also lower the associated costs, making it more feasible for companies to invest in innovative therapies. As regulatory frameworks continue to evolve, they are likely to create a more favorable environment for the Small Molecule Drug Discovery Market, facilitating the introduction of novel drugs that can address critical health challenges.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a primary driver for the Small Molecule Drug Discovery Market. As these conditions become more prevalent, there is an escalating demand for effective therapeutic solutions. According to recent estimates, chronic diseases account for approximately 70% of all deaths worldwide, underscoring the urgent need for innovative drug development. This scenario compels pharmaceutical companies to invest significantly in small molecule drugs, which are often more effective and have fewer side effects compared to larger biologics. The focus on developing targeted therapies for these diseases is likely to propel the growth of the Small Molecule Drug Discovery Market, as companies strive to meet the increasing healthcare demands.

Advancements in Drug Discovery Technologies

Technological advancements in drug discovery methodologies are transforming the Small Molecule Drug Discovery Market. Innovations such as high-throughput screening, artificial intelligence, and machine learning are enhancing the efficiency and accuracy of drug development processes. For instance, high-throughput screening allows researchers to rapidly test thousands of compounds, significantly reducing the time required to identify potential drug candidates. Furthermore, the integration of AI in predictive modeling is streamlining the identification of viable small molecules, thereby accelerating the discovery timeline. As these technologies continue to evolve, they are expected to drive the growth of the Small Molecule Drug Discovery Market, enabling pharmaceutical companies to bring new therapies to market more swiftly and cost-effectively.

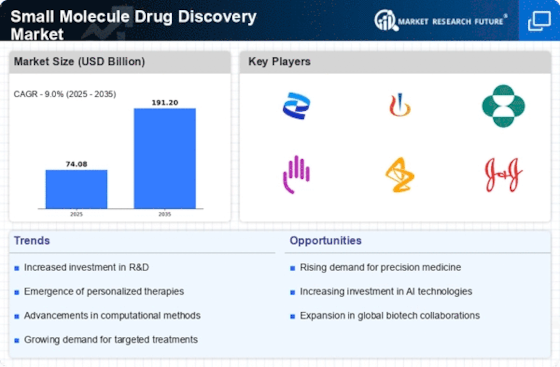

Growing Investment in Research and Development

The increasing investment in research and development (R&D) by pharmaceutical companies is a crucial factor influencing the Small Molecule Drug Discovery Market. In recent years, R&D expenditures have surged, with many companies allocating a significant portion of their budgets to discover and develop new small molecule drugs. This trend is driven by the need to address unmet medical needs and the potential for high returns on investment. For example, the pharmaceutical industry has seen R&D spending reach over 180 billion dollars annually, reflecting a commitment to innovation. This robust investment landscape is likely to foster advancements in small molecule drug discovery, ultimately enhancing the therapeutic options available to patients and driving market growth.