Rising E-commerce Sector

The expansion of the e-commerce sector serves as a vital driver for the Global Smart Labels Market Industry. With online shopping gaining immense popularity, retailers are adopting smart labels to streamline logistics and enhance customer experience. Smart labels enable efficient tracking of shipments, reducing delivery times and improving customer satisfaction. Furthermore, they assist in managing returns and inventory more effectively. The growth of e-commerce is expected to contribute significantly to the market's valuation, as businesses seek innovative solutions to meet the demands of a rapidly evolving retail landscape.

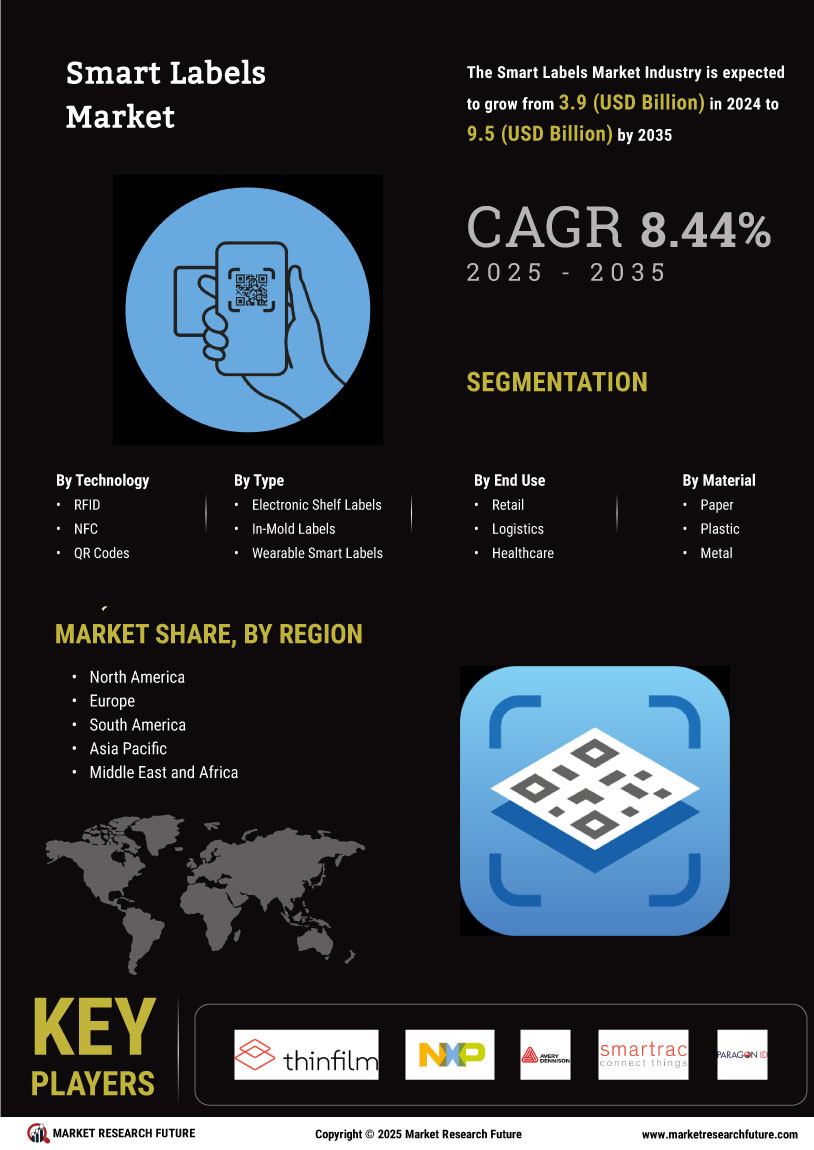

Market Growth Projections

The Global Smart Labels Market Industry is projected to experience substantial growth, with a market value of 3.9 USD Billion in 2024, anticipated to reach 9.5 USD Billion by 2035. This growth trajectory suggests a robust CAGR of 8.43% from 2025 to 2035, indicating a strong demand for smart labeling solutions across various sectors. The increasing integration of smart labels in logistics, retail, and healthcare highlights their versatility and importance in modern supply chains. As industries continue to innovate and adopt these technologies, the market is likely to witness significant advancements and opportunities.

Technological Advancements

The Global Smart Labels Market Industry experiences robust growth driven by rapid technological advancements. Innovations in RFID, NFC, and QR code technologies enhance the functionality and efficiency of smart labels. For instance, RFID tags are increasingly utilized in supply chain management, enabling real-time tracking of goods. This technology not only reduces operational costs but also improves inventory accuracy. As of 2024, the market is valued at 3.9 USD Billion, with projections indicating a rise to 9.5 USD Billion by 2035. The anticipated CAGR of 8.43% from 2025 to 2035 underscores the potential for continued innovation in this sector.

Environmental Sustainability Initiatives

Environmental sustainability initiatives increasingly influence the Global Smart Labels Market Industry. Companies are adopting eco-friendly practices, including the use of sustainable materials for smart labels. This shift is driven by consumer demand for environmentally responsible products and the need to reduce carbon footprints. Smart labels can also contribute to waste reduction by improving inventory management and minimizing product spoilage. As businesses align their operations with sustainability goals, the market for smart labels is expected to expand, reflecting a growing commitment to environmental stewardship across various sectors.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the Global Smart Labels Market Industry. Various industries, particularly pharmaceuticals and food, are subject to stringent regulations that necessitate accurate labeling and traceability. Smart labels provide a reliable solution for meeting these compliance requirements, ensuring that products are correctly labeled and monitored throughout the supply chain. This adherence to safety standards not only protects consumers but also enhances brand reputation. As regulations continue to evolve, the demand for smart labels is likely to increase, driving market growth and innovation.

Growing Demand for Supply Chain Transparency

The demand for enhanced supply chain transparency significantly propels the Global Smart Labels Market Industry. Businesses are increasingly adopting smart labels to provide real-time data on product origin, handling, and delivery status. This trend is particularly evident in the food and pharmaceutical sectors, where traceability is crucial for compliance and consumer safety. Smart labels facilitate better inventory management and reduce losses due to spoilage or theft. As companies strive to meet regulatory requirements and consumer expectations, the market is poised for substantial growth, reflecting the increasing importance of transparency in global supply chains.