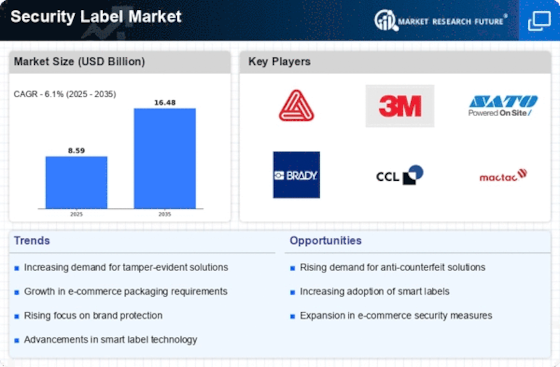

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Security Label market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Security Label industry must offer cost-effective items.

The government and private businesses are making significant investments in R&D for technological advancements in the Security Label industry to benefit clients and increase the market sector. In recent years, the Security Label industry has advantages such as the expanding usage of security labels across a range of end-use sectors, including food and beverage, electronics, healthcare, and automobiles.

Major players in the Security Label market, including tesa SE-A Beiersdorf Company, OpSec,

Brady Worldwide, Inc., Holosafe Security Labels Market, Star Label Products, Watson Label Products, DATA LABEL,

Covectra, Inc., MEGA FORTRIS GROUP, Label Lock, All4Labels Smart + Secure GmbH, Smartrac Technology GmbH, Invengo Technology Pte. Ltd, CILS International, and Tamperguard, and others are attempting to increase market demand by investing in research and development operations. Brady creates goods that improve the safety and intelligence of the world. The company is leader in the world for compliance, identity, and safety solutions for a variety of workplaces.

Brady is trusted by businesses all over the world because to our in-depth expertise and understanding in a variety of industries and applications, supported by our top-notch manufacturing capabilities. The company has more than 675 patents and 5,700 workers. By utilising the most recent technical developments, we are designing the future of RFID, safety, identification, printing, materials, and other areas. keeping individuals secure to promote greater productivity.

In March Brady announced agreement of multi-year deal to licence Honeywell International Inc.'s patented technology for the use of its worldwide shutter technology in barcode scanning equipment.

Since its founding in 2008, Holosafe Security Labels Market has offered brand protection and anti-counterfeiting solutions. Holosafe is a firm believer in continuous innovation when it comes to creating security printing methods to not only thwart counterfeiting but also improve the appearance of the label through attractive styling. It produces a whole line of holograms, mono cartons, and printed paper labels. According to the expanding demands of the domestic and foreign markets, Holosafe continuously updates its technical approaches.

Holosafe is currently one of the top brands in the security label sector in India and exports to many different nations because to its customer-centric business culture, years of business expertise, unwavering commitment to product quality, and testimonies from hundreds of satisfied customers.