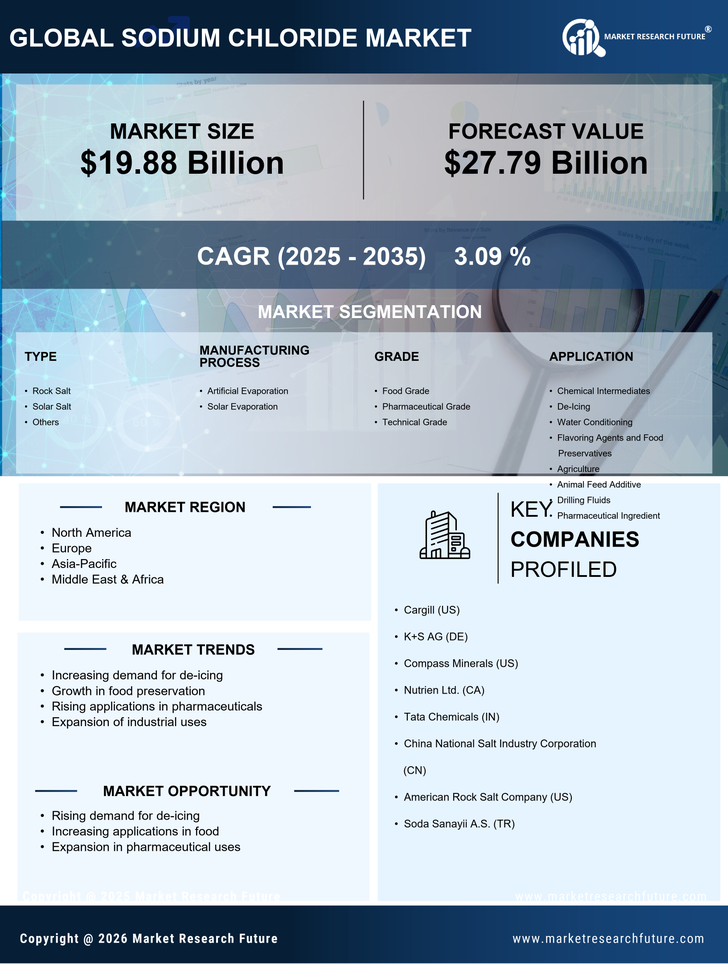

Rising Demand in Food Industry

The Sodium Chloride Market experiences a notable surge in demand from the food sector, primarily due to its essential role as a preservative and flavor enhancer. As consumer preferences shift towards processed and packaged foods, the need for sodium chloride has escalated. In 2023, the food segment accounted for approximately 40% of the total sodium chloride consumption, reflecting a robust growth trajectory. This trend is likely to continue as manufacturers seek to enhance product shelf life and flavor profiles. Furthermore, the increasing popularity of ready-to-eat meals and snacks is expected to further bolster the sodium chloride market, as these products often require higher salt content for preservation and taste. Consequently, the food industry's expansion is a pivotal driver for the sodium chloride market, indicating a sustained demand in the foreseeable future.

Growth in Chemical Manufacturing

The Sodium Chloride Market is significantly influenced by the growth in chemical manufacturing, where sodium chloride serves as a fundamental raw material. It is utilized in the production of various chemicals, including chlorine and caustic soda, which are essential for numerous industrial applications. In recent years, the chemical sector has witnessed a steady increase in production capacities, with a reported growth rate of around 5% annually. This expansion is anticipated to continue, driven by rising industrial activities and the demand for chemical products across multiple sectors. As a result, the sodium chloride market is likely to benefit from this upward trend, as chemical manufacturers increasingly rely on sodium chloride for their operations. The interdependence between the sodium chloride market and the chemical manufacturing sector underscores the importance of this driver in shaping market dynamics.

Increasing Use in De-icing Applications

The Sodium Chloride Market is experiencing a notable increase in demand for de-icing applications, particularly in regions that experience harsh winter conditions. Sodium chloride is widely used for road de-icing, as it effectively lowers the freezing point of water, thereby enhancing road safety during winter months. In 2023, it was estimated that approximately 30% of sodium chloride consumption was attributed to de-icing applications. As climate patterns continue to evolve, the frequency and intensity of winter storms are expected to rise, leading to a heightened need for effective de-icing solutions. This trend suggests that the sodium chloride market will likely see sustained growth in this segment, as municipalities and transportation agencies prioritize road safety and maintenance. The increasing reliance on sodium chloride for de-icing purposes is a critical driver for the market, reflecting its essential role in winter weather management.

Expansion of Pharmaceutical Applications

The Sodium Chloride Market is witnessing an expansion in pharmaceutical applications, where sodium chloride is utilized in various formulations, including intravenous solutions and oral rehydration salts. The growing emphasis on healthcare and wellness has led to an increased demand for sodium chloride in the pharmaceutical sector. In recent years, the market for saline solutions has expanded, with a projected growth rate of approximately 6% annually. This growth is driven by the rising prevalence of dehydration-related conditions and the need for effective rehydration therapies. Additionally, sodium chloride's role in drug formulation and as a stabilizing agent further enhances its importance in the pharmaceutical industry. As healthcare continues to evolve, the sodium chloride market is likely to benefit from this trend, indicating a promising outlook for its applications in pharmaceuticals.

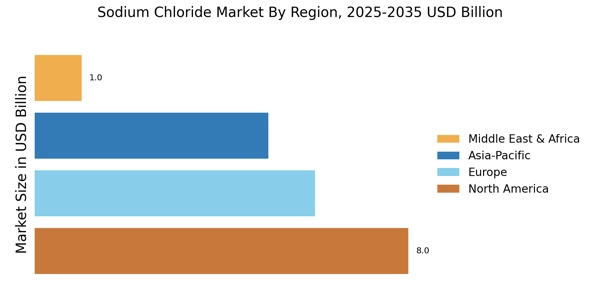

Emerging Markets and Economic Development

The Sodium Chloride Market is poised for growth due to the emergence of new markets and ongoing economic development in various regions. As developing economies expand, there is an increasing demand for sodium chloride across multiple sectors, including food processing, chemical manufacturing, and pharmaceuticals. In 2023, emerging markets accounted for approximately 25% of the total sodium chloride consumption, reflecting a growing trend. This demand is likely to be fueled by urbanization, rising disposable incomes, and changing consumer preferences. Furthermore, as infrastructure projects and industrial activities ramp up in these regions, the need for sodium chloride is expected to rise correspondingly. The potential for growth in emerging markets presents a significant opportunity for stakeholders in the sodium chloride market, suggesting a favorable outlook for the industry in the coming years.