Software Defined Radio Size

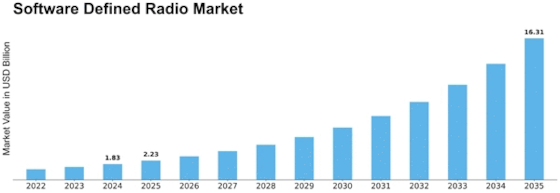

Software Defined Radio Market Growth Projections and Opportunities

The Software Defined Radio (SDR) market is characterized by dynamic and evolving market dynamics, reflecting the transformative impact of software-based radio technologies on the communication and radio frequency (RF) industry. One key dynamic is the continuous technological advancements in software-defined radio solutions. As digital signal processing capabilities improve and software algorithms become more sophisticated, SDR systems offer enhanced flexibility, interoperability, and performance. This ongoing innovation drives the demand for SDR across diverse applications, from military communication systems to commercial wireless networks.

The increasing adoption of SDR in military applications is a significant market dynamic. Modern defense forces seek agile and versatile communication solutions, and SDR's ability to reconfigure and adapt to changing communication requirements makes it a preferred choice. The military's focus on secure and resilient communication, electronic warfare capabilities, and spectrum efficiency drives the integration of SDR technologies into defense communication systems. The dynamic nature of contemporary military operations amplifies the demand for SDR, as it enables real-time adjustments to communication protocols and frequencies.

Interoperability is a crucial market dynamic shaping the SDR landscape. With the proliferation of diverse communication standards and protocols, there is a growing need for communication systems that can seamlessly operate across different frequencies and networks. SDR's inherent flexibility allows it to adapt to various standards, making it a versatile solution for applications ranging from public safety communications to industrial IoT. The pursuit of interoperable communication systems fuels the adoption of SDR, especially in environments where multiple standards coexist.

Global demand for advanced wireless communication technologies is a driving force in the SDR market dynamics. As 5G networks and beyond continue to evolve, there is an increasing need for communication systems that can accommodate higher data rates, low latency, and improved reliability. SDR's adaptability to different communication standards positions it as a key enabler for the evolution of wireless networks, supporting the transition to more advanced and efficient communication technologies.

Cost-effectiveness is a noteworthy market dynamic influencing the adoption of SDR solutions. Traditionally, radio communication systems required dedicated hardware for each specific standard, leading to increased costs and complexity. SDR's software-based approach allows for the reuse of existing hardware, reducing the need for constant hardware upgrades. The cost-effectiveness of SDR solutions appeals to industries and organizations seeking efficient and economical ways to upgrade and modernize their communication infrastructure.

The impact of commercial applications, particularly in the telecommunications sector, is a significant market dynamic. SDR technologies play a vital role in enabling the deployment and management of wireless communication networks. From cellular base stations to software-defined radios in mobile devices, the SDR market is driven by the demand for more flexible and adaptable communication solutions in the commercial space. The push towards virtualized and software-driven network architectures further amplifies the role of SDR in shaping the dynamics of the telecommunications industry.

Security considerations and the need for resilient communication systems contribute to the market dynamics of SDR in defense and public safety applications. The programmable nature of SDR allows for the implementation of advanced encryption and security protocols, addressing the evolving threat landscape. The ability to quickly adapt to emerging security challenges enhances the attractiveness of SDR solutions for government and defense agencies, as well as for critical infrastructure and public safety organizations.

Regulatory frameworks and standardization efforts are influential market dynamics for SDR. The industry's adherence to regulatory requirements and the establishment of common standards for SDR technologies contribute to market growth. Standardization fosters interoperability, eases integration challenges, and accelerates the adoption of SDR across different applications and industries. Industry collaboration in defining and adhering to standards is instrumental in shaping the market dynamics of SDR.

The growing emphasis on spectrum efficiency and management is a noteworthy market dynamic for SDR. As the demand for wireless communication services increases, efficient utilization of available frequency bands becomes crucial. SDR's ability to dynamically adapt to spectrum availability, avoid interference, and optimize spectrum usage aligns with the industry's pursuit of effective spectrum management. The evolving regulatory landscape, including initiatives for spectrum sharing and cognitive radio, further influences the market dynamics of SDR.

Leave a Comment