Market Growth Projections

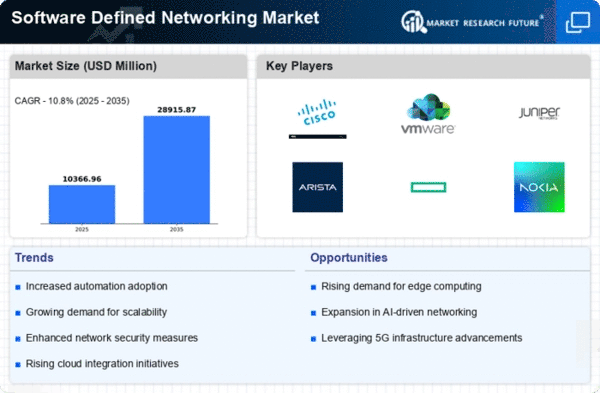

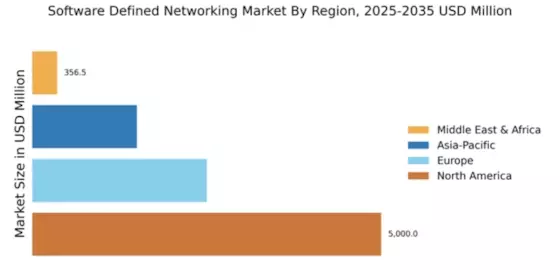

The Global Software Defined Networking Market (SDN) Market Industry is projected to experience substantial growth over the coming years. With an estimated market value of 9.36 USD Billion in 2024, it is expected to reach 32.1 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 11.85% from 2025 to 2035. This growth is indicative of the increasing reliance on SDN technologies across various sectors, driven by the need for enhanced network management, security, and scalability. As organizations continue to embrace digital transformation, the SDN market is likely to expand, presenting numerous opportunities for innovation and investment.

Emergence of 5G Technology

The emergence of 5G technology is poised to have a transformative impact on the Global Software Defined Networking Market (SDN) Market Industry. 5G networks require advanced management and orchestration capabilities to handle the increased data traffic and connectivity demands. SDN enables operators to dynamically allocate resources and optimize network performance in real-time, which is essential for delivering the high-speed, low-latency services promised by 5G. As the rollout of 5G continues, the integration of SDN solutions is likely to accelerate, fostering innovation and enhancing user experiences across various applications, from IoT to smart cities.

Growing Adoption of Cloud Services

The Global Software Defined Networking Market (SDN) Market Industry is significantly influenced by the growing adoption of cloud services. As organizations migrate to cloud-based infrastructures, the need for agile and scalable networking solutions becomes critical. SDN facilitates seamless integration with cloud environments, allowing for dynamic resource allocation and improved network performance. This trend is particularly pronounced among enterprises looking to enhance their digital transformation initiatives. By 2035, the market is anticipated to expand to 32.1 USD Billion, reflecting the increasing reliance on cloud technologies and the corresponding demand for SDN solutions that support these environments.

Regulatory Compliance and Standards

The Global Software Defined Networking Market (SDN) Market Industry is also shaped by the need for regulatory compliance and adherence to industry standards. Organizations are increasingly required to meet stringent regulations regarding data privacy and network security. SDN solutions offer the flexibility to implement compliance measures efficiently, allowing organizations to adapt their network configurations in response to changing regulatory landscapes. This adaptability is crucial for businesses operating in highly regulated sectors, such as finance and healthcare. As compliance requirements continue to evolve, the demand for SDN technologies that facilitate regulatory adherence is expected to rise, further driving market growth.

Enhanced Network Security Requirements

In the context of the Global Software Defined Networking (SDN) Market Industry, enhanced network security requirements are driving the adoption of SDN technologies. As cyber threats become more sophisticated, organizations are compelled to implement robust security measures within their networks. SDN provides centralized control and visibility, enabling real-time monitoring and rapid response to security incidents. This capability is particularly valuable in sectors such as finance and healthcare, where data protection is paramount. The increasing focus on cybersecurity is likely to propel the SDN market forward, as organizations seek solutions that not only optimize performance but also fortify their defenses against potential threats.

Increased Demand for Network Virtualization

The Global Software Defined Networking Market (SDN) Market Industry experiences heightened demand for network virtualization as organizations seek to enhance operational efficiency and reduce costs. Virtualization allows for the abstraction of network resources, enabling more flexible and scalable network management. In 2024, the market is projected to reach 9.36 USD Billion, driven by enterprises adopting SDN solutions to streamline their network infrastructures. This trend is particularly evident in sectors such as telecommunications and data centers, where the need for rapid deployment and adaptability is paramount. As businesses increasingly recognize the benefits of virtualization, the SDN market is expected to flourish.