Research Methodology on Solar Encapsulation Market

Introduction

The present research is focusing on the analysis of the global market of solar encapsulation, to study its present and historic performance, along with its prospects. The purpose of the study is to analyze the latest trends, drivers, challenges, and opportunities in the solar encapsulation market. This study is expected to guide potential entrants and existing players in the market to make informed decisions to strengthen their business. It is going to provide analysis from an industry and market structure perspective, in terms of its competitive landscape, along with the evolution of market size and macro-economic & industry opportunities and challenges over the forecast period.

Objectives

The objectives of the published research report are stated as follows:

To understand the global market of solar encapsulation, its customer demographics and demand for the product

To assess the present and anticipated trends, drivers, challenges and opportunities in the solar encapsulation market

To study the global market size of solar encapsulation and its growth prospects in the future

To analyze the competitive landscape of the solar encapsulation market, along with the key developments and strategies of the leading players

To identify the potential opportunities in the solar encapsulation market

To prepare a comprehensive study of the solar encapsulation market, including its segmentation, types, and industries

Research Design

This study follows a secondary research approach, gathering information from the internet, published reports, and industry publications, to reach key points while analyzing the global solar encapsulation market. Relevant information is collected, analyzed and filtered based on the objectives of the present research, before its utilization.

Target Population

The target population of the study includes major solar encapsulation manufacturers, suppliers, raw material suppliers, technology providers and industry experts.

Sampling Technique

The sample size for conducting the research is 200. A standard stratified simple random sampling technique is used for selecting the sample. A relatively small sample size is used because the purpose is to carry out a qualitative analysis rather than a quantitative one.

Data Collection

Primary data is being collected mainly from the respondents, who possess real-time experience in the solar encapsulation industry. Secondary data is being gathered from a wide range of sources, including the internet, industry associations, published reports, and trade journals.

Data Analysis Technique

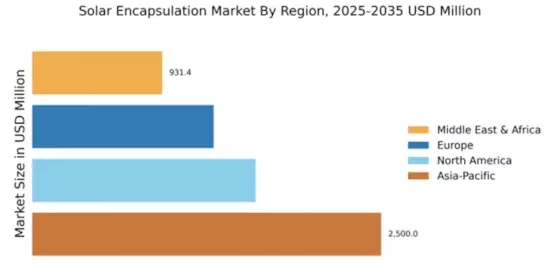

The data collected is analyzed by using statistical tools, such as factor analysis, correlation analysis, and regression analysis. The results obtained from the analysis are then checked for the consistency of the data collection process and hypotheses formulated. Finally, the data is interpreted in the form of tables, figures, and charts, to derive meaningful inferences.

Conclusion

The present research is focused on the analysis of the global market of solar encapsulation, to understand its current and anticipated trends, drivers, challenges, and opportunities. The research design and data collection process used in this study are explained in detail. The target population, sampling technique, and data analysis techniques are discussed in the paper. In conclusion, this paper provides an in-depth insight into the solar encapsulation market and its players, which will help both potential entrants and existing players to make informed decisions.