Growing Demand for Data-Driven Insights

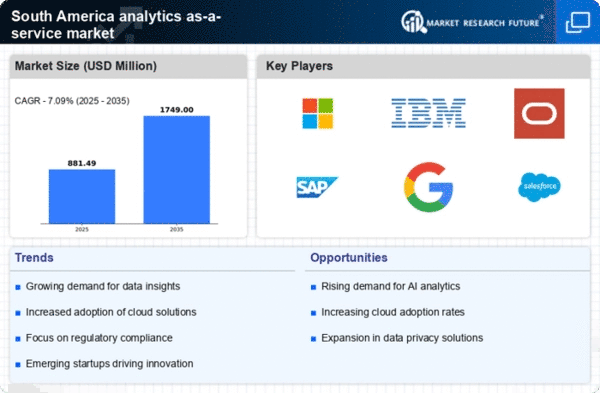

The analytics as-a-service market in South America is experiencing a notable surge in demand for data-driven insights. Businesses across various sectors are increasingly recognizing the value of leveraging data analytics to enhance decision-making processes. This trend is particularly pronounced in industries such as retail and finance, where companies are seeking to optimize operations and improve customer experiences. According to recent estimates, the analytics as-a-service market in South America is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for organizations to harness large volumes of data and extract actionable insights, thereby fostering a competitive edge in the market.

Increased Focus on Operational Efficiency

Organizations in South America are placing a heightened emphasis on operational efficiency, which is driving the growth of the analytics as-a-service market. By utilizing analytics solutions, companies can streamline processes, reduce costs, and enhance productivity. This trend is evident in sectors such as manufacturing and logistics, where data analytics is employed to optimize supply chain management and resource allocation. The analytics as-a-service market is expected to witness a growth rate of around 30% in these sectors as businesses increasingly seek to leverage data for operational improvements. This focus on efficiency is likely to continue shaping the market landscape in the coming years.

Rise of Small and Medium Enterprises (SMEs)

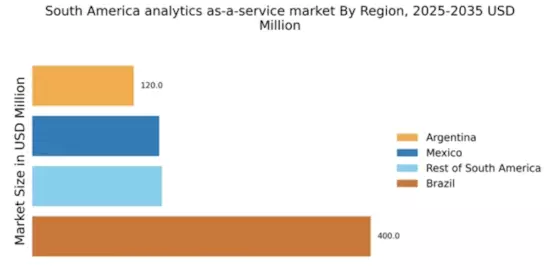

The proliferation of small and medium enterprises (SMEs) in South America is significantly impacting the analytics as-a-service market. SMEs are increasingly adopting analytics solutions to gain insights that were previously accessible only to larger corporations. This democratization of data analytics is fostering innovation and enabling SMEs to compete more effectively. As of 2025, SMEs are expected to account for nearly 40% of the total market share in the analytics as-a-service sector. The affordability and scalability of these services make them particularly attractive to SMEs, allowing them to leverage advanced analytics without substantial upfront investments.

Emergence of Advanced Analytics Technologies

The emergence of advanced analytics technologies is reshaping the analytics as-a-service market in South America. Technologies such as machine learning and predictive analytics are becoming more accessible, enabling organizations to derive deeper insights from their data. This trend is particularly relevant in sectors like healthcare and finance, where predictive analytics can enhance patient outcomes and risk management strategies. As of November 2025, the adoption of these advanced technologies is projected to contribute to a market growth of approximately 20%, as businesses seek to harness the power of data to drive innovation and improve service delivery.

Government Initiatives Supporting Digital Transformation

Government initiatives aimed at promoting digital transformation are playing a crucial role in the growth of the analytics as-a-service market in South America. Various countries in the region are implementing policies to encourage the adoption of digital technologies across industries. These initiatives often include funding programs, tax incentives, and training programs designed to enhance digital skills among the workforce. As a result, businesses are increasingly investing in analytics solutions to align with government objectives and improve their operational capabilities. This supportive environment is expected to drive a market growth rate of around 15% in the analytics as-a-service sector over the next few years.