Advancements in Biotechnology

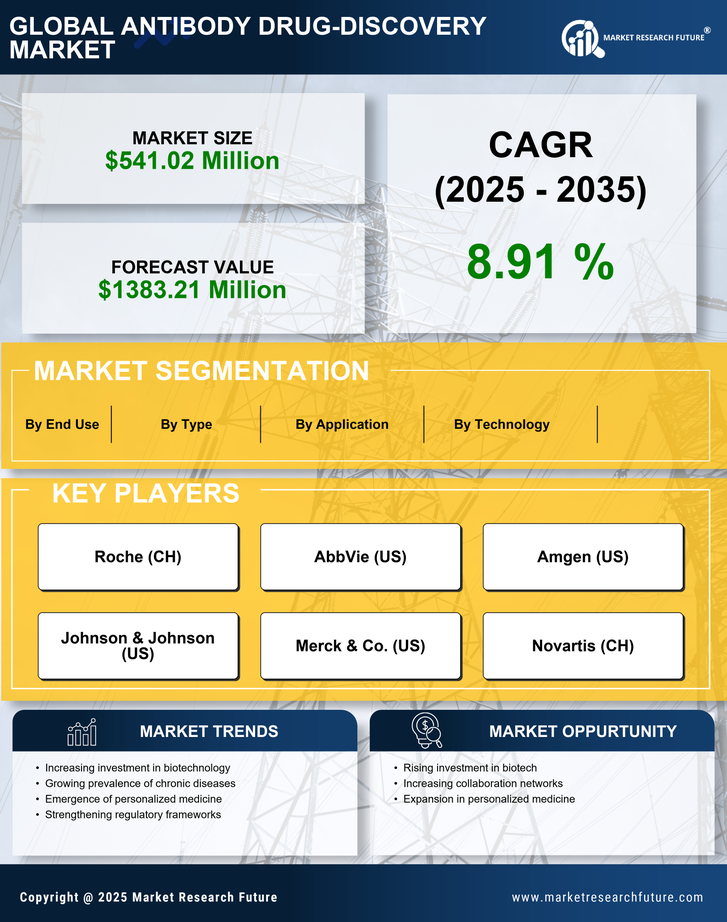

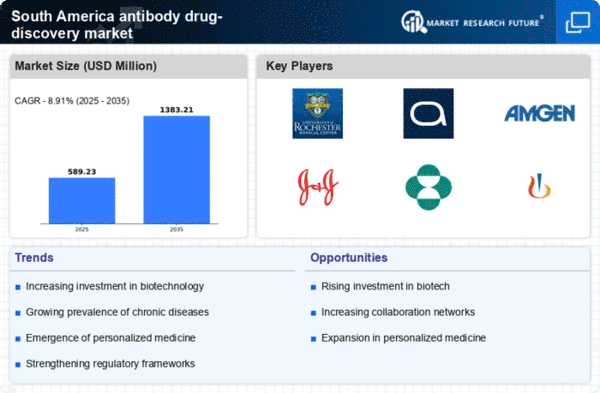

Technological advancements in biotechnology are significantly influencing the antibody drug-discovery market in South America. Innovations such as CRISPR gene editing, high-throughput screening, and next-generation sequencing are enhancing the efficiency and accuracy of antibody development. These technologies enable researchers to identify and optimize antibodies more rapidly, reducing the time and cost associated with drug development. The South American biotechnology sector has seen substantial growth, with investments reaching over $1 billion in recent years. This influx of funding is likely to accelerate the discovery of new antibody therapies, thereby expanding the market and improving patient outcomes across the region.

Supportive Government Policies

Supportive government policies in South America are fostering a conducive environment for the antibody drug-discovery market. Initiatives aimed at promoting research and development, such as tax incentives and grants for biotech firms, are encouraging innovation in the sector. Governments are increasingly recognizing the importance of biotechnology in addressing public health challenges, leading to the establishment of funding programs that support antibody research. For instance, several South American countries have allocated millions of dollars to enhance their biotechnology infrastructure. This governmental backing is likely to stimulate growth in the antibody drug-discovery market, as it enables companies to pursue ambitious research projects and bring new therapies to market more efficiently.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the antibody drug-discovery market in South America. Patients increasingly seek treatments tailored to their specific genetic profiles, which is driving the development of monoclonal antibodies and other targeted therapies. This trend is supported by a growing body of research indicating that personalized treatments can lead to better efficacy and fewer side effects. As healthcare providers and patients recognize the benefits of personalized approaches, the demand for antibody-based therapies is expected to rise. Market analysts project that the personalized medicine segment could account for over 30% of the total antibody drug-discovery market in the coming years, reflecting a significant shift in treatment paradigms.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a pivotal driver for the antibody drug-discovery market. Conditions such as cancer, autoimmune disorders, and infectious diseases are becoming more prevalent, necessitating innovative therapeutic solutions. According to recent health statistics, chronic diseases account for approximately 60% of all deaths in the region, highlighting the urgent need for effective treatments. This growing health burden is prompting pharmaceutical companies to invest in antibody-based therapies, which are often more targeted and effective than traditional treatments. As a result, the antibody drug-discovery market is likely to expand significantly, with an increasing number of research initiatives aimed at developing novel antibodies to address these pressing health challenges.

Rising Collaboration Between Academia and Industry

The increasing collaboration between academic institutions and the pharmaceutical industry is a key driver of the antibody drug-discovery market in South America. Universities and research centers are often at the forefront of scientific innovation, and their partnerships with industry players facilitate the translation of research into viable therapies. These collaborations can lead to the sharing of resources, expertise, and funding, which are essential for successful drug development. Recent data indicates that joint ventures and partnerships in the biotechnology sector have increased by over 40% in the past five years. This trend is likely to continue, further enhancing the antibody drug-discovery market as new discoveries emerge from these synergistic efforts.