Expansion of Internet Connectivity

The big data market in South America is significantly influenced by the expansion of internet connectivity across the region. As more individuals and businesses gain access to high-speed internet, the volume of data generated is expected to increase exponentially. This proliferation of data presents both opportunities and challenges for organizations seeking to harness big data for insights. Enhanced connectivity facilitates the collection of real-time data from various sources, including IoT devices and social media platforms. Reports suggest that internet penetration in South America has reached approximately 70%, which is likely to further accelerate the growth of the big data market. Consequently, businesses are compelled to adopt robust data management and analytics solutions to effectively process and analyze the influx of information.

Growing Focus on Data Security and Governance

The big data market in South America is increasingly characterized by a growing focus on data security and governance. As organizations collect and analyze vast amounts of data, concerns regarding data privacy and compliance with regulations are becoming paramount. Businesses are compelled to implement robust data governance frameworks to protect sensitive information and ensure compliance with local and international standards. This heightened emphasis on security is likely to drive investments in advanced data protection technologies, such as encryption and access controls. Reports indicate that spending on data security solutions in South America is expected to increase by approximately 30% over the next few years, reflecting the critical need for organizations to safeguard their data assets in an evolving regulatory landscape.

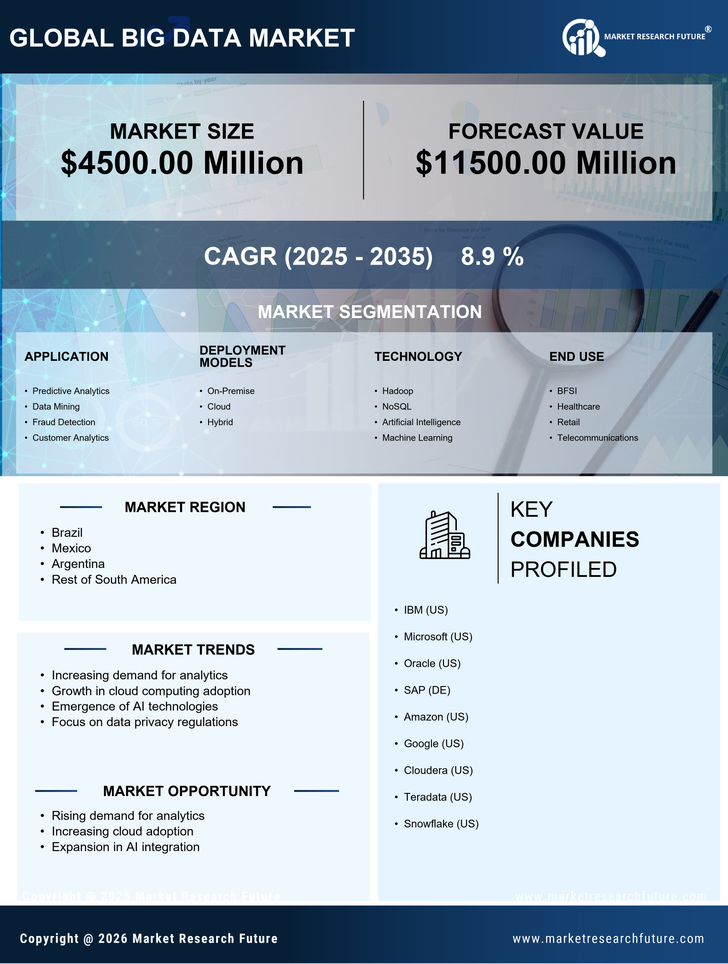

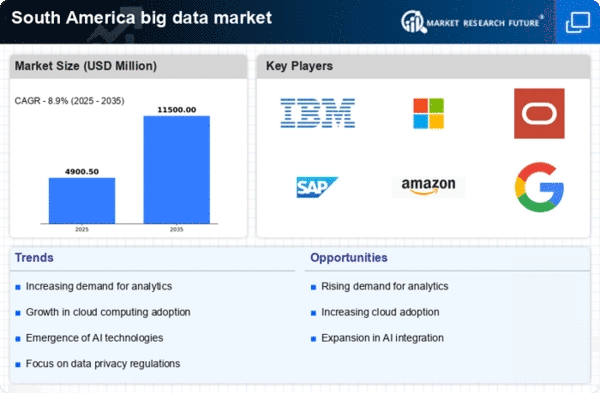

Rising Demand for Data-Driven Decision Making

The big data market in South America is experiencing a notable surge in demand for data-driven decision making. Organizations across various sectors are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. This trend is particularly evident in industries such as retail and finance, where data insights are utilized to optimize customer experiences and improve risk management. According to recent estimates, the market for data analytics in South America is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader shift towards data-centric business models, compelling companies to invest in advanced analytics capabilities to remain competitive in the evolving landscape.

Emergence of Artificial Intelligence Technologies

The big data market in South America is witnessing a transformative impact from the emergence of artificial intelligence (AI) technologies. AI applications, such as machine learning and natural language processing, are increasingly being integrated into data analytics processes, enabling organizations to derive deeper insights from vast datasets. This integration is particularly relevant in sectors like healthcare and finance, where predictive analytics can enhance decision-making and operational efficiency. The adoption of AI-driven analytics tools is projected to grow significantly, with estimates suggesting that the AI market in South America could reach $10 billion by 2027. This trend indicates a shift towards more sophisticated data analysis capabilities, positioning businesses to capitalize on the potential of big data.

Government Initiatives Supporting Data Innovation

The big data market in South America is benefiting from various government initiatives aimed at fostering data innovation. Governments are increasingly recognizing the strategic importance of data in driving economic growth and enhancing public services. Initiatives such as funding for research and development in data technologies and the establishment of data innovation hubs are becoming more prevalent. For instance, several South American countries have launched programs to support startups focused on big data solutions, which could potentially stimulate job creation and technological advancement. These efforts are likely to create a conducive environment for the growth of the big data market, as they encourage collaboration between public and private sectors to leverage data for societal benefits.