Rising Awareness of Genetic Research

The rising awareness of genetic research among the South American population is significantly impacting the biobanking market. As individuals become more informed about the importance of genetic testing and personalized medicine, there is a growing willingness to participate in biobanking initiatives. This trend is particularly evident in urban areas, where educational campaigns and outreach programs have successfully increased public engagement. In 2025, it is estimated that participation rates in biobanking studies could rise by 15%, driven by enhanced public understanding of the benefits of biobanking for health outcomes. This increased participation not only enriches the diversity of biological samples available but also supports the development of tailored medical treatments. Consequently, the heightened awareness of genetic research is likely to play a crucial role in the expansion of the biobanking market in South America.

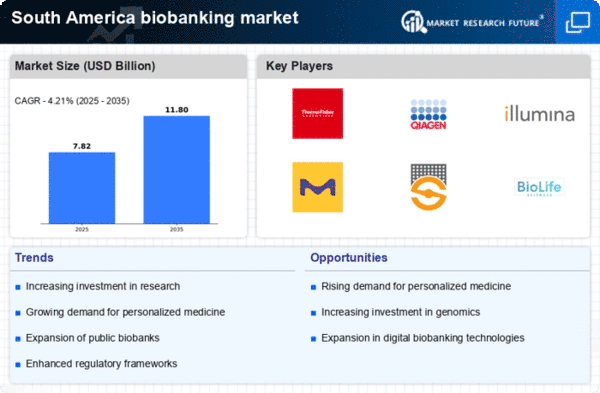

Growing Demand for Biobanking Services

The increasing demand for biobanking services in South America is driven by the rising need for personalized medicine and advanced research. As healthcare systems evolve, there is a notable shift towards precision medicine, which relies heavily on biobanked samples. The biobanking market in South America is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is fueled by the need for high-quality biological samples for research and clinical trials, which are essential for developing targeted therapies. Furthermore, the expansion of biobanks in academic and research institutions enhances the availability of diverse biological materials, thereby supporting innovative research initiatives. As a result, the demand for biobanking services is expected to continue its upward trajectory, reflecting the critical role of biobanks in advancing medical research and healthcare solutions.

Investment in Research and Development

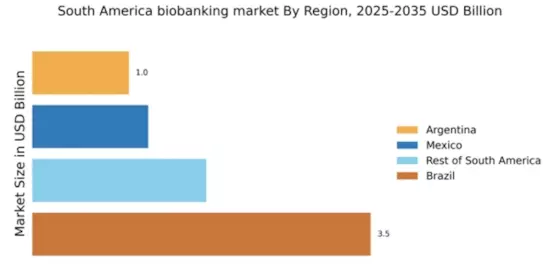

Investment in research and development (R&D) within the biobanking market is a significant driver of growth in South America. Governments and private entities are increasingly allocating funds to enhance biobanking infrastructure and capabilities. For instance, the Brazilian government has initiated several funding programs aimed at supporting biobanking initiatives, which are crucial for advancing scientific research. In 2025, it is estimated that R&D spending in the biobanking sector could reach approximately $200 million, reflecting a growing recognition of the importance of biobanks in medical research. This investment not only facilitates the establishment of new biobanks but also improves existing facilities, ensuring they meet international standards. Consequently, the enhanced R&D environment is likely to attract more researchers and institutions to utilize biobanking services, further propelling the market forward.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a vital driver for the biobanking market in South America. Partnerships between government agencies, academic institutions, and private companies are fostering innovation and resource sharing. Such collaborations often lead to the establishment of biobanks that are better equipped to meet the needs of researchers and healthcare providers. For example, joint ventures can result in the pooling of financial resources, expertise, and biological samples, enhancing the overall efficiency of biobanking operations. In 2025, it is anticipated that collaborative initiatives could account for nearly 30% of new biobanking projects in the region. This synergy not only accelerates research but also ensures that biobanks are aligned with the latest scientific advancements, ultimately benefiting the healthcare landscape in South America.

Technological Integration in Biobanking Operations

Technological integration in biobanking operations is a key driver for the biobanking market in South America. The adoption of advanced technologies such as automation, data management systems, and biobanking software is enhancing the efficiency and reliability of biobanking processes. In 2025, it is projected that nearly 40% of biobanks in the region will implement automated systems to streamline sample processing and storage. This technological advancement not only reduces human error but also improves sample tracking and data management, which are critical for research integrity. Furthermore, the integration of digital platforms facilitates better collaboration among researchers, enabling them to access and share biobanked samples more effectively. As a result, the ongoing technological evolution is expected to significantly contribute to the growth and sustainability of the biobanking market in South America.

Leave a Comment