Increasing Regulatory Support

Regulatory support is playing a crucial role in shaping the clinical trials market in South America. Governments are actively working to streamline the approval processes for clinical trials, thereby reducing the time and costs associated with bringing new therapies to market. In 2025, it is projected that regulatory timelines could decrease by up to 20%, making it more feasible for companies to conduct trials in the region. This supportive environment is likely to attract more international pharmaceutical companies to conduct research in South America, further bolstering the clinical trials market.

Growing Investment in Biotechnology

Investment in biotechnology is a significant driver of the clinical trials market in South America. The region has seen a rise in venture capital funding directed towards biotech firms, which are increasingly focusing on developing novel therapies. In 2025, it is anticipated that investments in biotechnology could exceed $500 million, reflecting a growing confidence in the potential of local companies to deliver innovative solutions. This influx of capital is likely to facilitate more clinical trials, thereby enhancing the overall research capabilities within the clinical trials market. The synergy between biotechnology and clinical research is expected to yield promising results for patients.

Rising Demand for Innovative Therapies

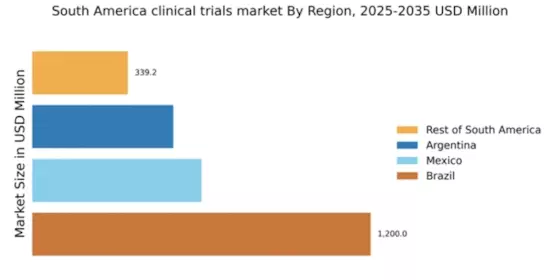

The clinical trials market in South America is experiencing a notable surge in demand for innovative therapies, particularly in the fields of oncology and rare diseases. This trend is driven by an increasing prevalence of chronic diseases and a growing population that seeks advanced treatment options. As pharmaceutical companies aim to develop new drugs, the clinical trials market is expected to expand significantly. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This rising demand is likely to encourage more investment in clinical research, thereby enhancing the overall landscape of the clinical trials market.

Enhanced Patient Recruitment Strategies

Effective patient recruitment strategies are becoming increasingly vital in the clinical trials market in South America. With a diverse population and varying health conditions, the ability to recruit suitable participants is crucial for the success of clinical trials. Innovative approaches, such as digital outreach and community engagement, are being employed to attract participants. In 2025, it is estimated that patient recruitment costs could account for up to 30% of the total clinical trial budget. This emphasis on recruitment not only accelerates trial timelines but also improves the quality of data collected, thereby fostering a more robust clinical trials market.

Emergence of Local Research Institutions

The emergence of local research institutions is significantly impacting the clinical trials market in South America. These institutions are increasingly collaborating with pharmaceutical companies to conduct clinical trials, leveraging their expertise and local knowledge. In 2025, it is estimated that partnerships between local institutions and global companies could increase by 25%, enhancing the capacity for conducting diverse clinical trials. This trend not only fosters innovation but also contributes to the development of a skilled workforce in the region, thereby strengthening the clinical trials market.