Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is a significant driver for the companion diagnostics-oncology market. Governments and private sectors are investing more in healthcare infrastructure, which includes the adoption of advanced diagnostic technologies. In 2025, healthcare spending in the region is expected to reach approximately $500 billion, with a notable portion allocated to oncology services. This financial commitment facilitates the integration of companion diagnostics into clinical practice, as healthcare providers seek to enhance treatment precision and patient care. The companion diagnostics-oncology market stands to gain from this trend, as increased funding allows for broader access to these essential diagnostic tools.

Growing Awareness of Genetic Testing

There is a notable increase in awareness regarding genetic testing among patients and healthcare professionals in South America, which is driving the companion diagnostics-oncology market. As more individuals become informed about the benefits of genetic testing in cancer treatment, the demand for companion diagnostics is likely to rise. Educational initiatives and advocacy programs are contributing to this awareness, leading to a more informed patient population that actively seeks personalized treatment options. The companion diagnostics-oncology market is expected to see a growth rate of around 12% as a result of this heightened awareness, as patients increasingly request genetic testing as part of their treatment plans.

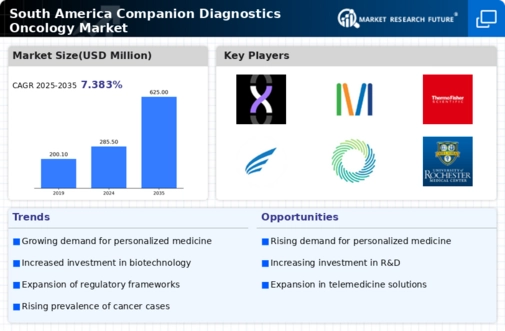

Increasing Demand for Personalized Medicine

The growing emphasis on personalized medicine is a key driver for the companion diagnostics-oncology market in South America. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient profiles, the demand for companion diagnostics is expected to rise. This shift is reflected in the market, which is projected to reach approximately $1.5 billion by 2027, with a compound annual growth rate (CAGR) of around 10%. Personalized medicine not only enhances treatment efficacy but also minimizes adverse effects, making it a preferred choice among oncologists. The companion diagnostics-oncology market is thus positioned to benefit from this trend, as more healthcare institutions adopt these technologies to improve patient outcomes.

Regulatory Support for Innovative Diagnostics

Regulatory bodies in South America are increasingly supportive of innovative diagnostic solutions, which is positively influencing the companion diagnostics-oncology market. Streamlined approval processes and favorable policies for new diagnostic tools are encouraging companies to invest in research and development. This regulatory environment fosters innovation, allowing for the rapid introduction of new companion diagnostics that can significantly improve cancer treatment outcomes. The companion diagnostics-oncology market is likely to experience accelerated growth, with an estimated increase of 8% in market size over the next few years, as regulatory support continues to enhance the landscape for these essential diagnostic tools.

Technological Advancements in Diagnostic Tools

Technological innovations in diagnostic tools are significantly impacting the companion diagnostics-oncology market in South America. The introduction of next-generation sequencing (NGS) and advanced biomarker identification techniques has revolutionized the way oncologists approach cancer treatment. These technologies enable more accurate and rapid identification of genetic mutations, which is crucial for selecting appropriate therapies. The companion diagnostics-oncology market is witnessing a surge in investments aimed at enhancing these technologies, with projections indicating a market growth of over 15% annually. As diagnostic accuracy improves, healthcare providers are more likely to integrate companion diagnostics into their treatment protocols, further driving market expansion.