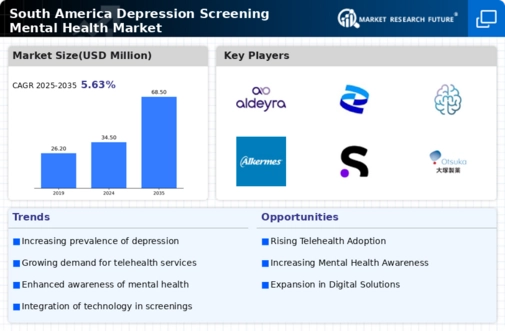

Rising Mental Health Awareness

The increasing awareness surrounding mental health issues in South America plays a crucial role in driving the depression screening-mental-health market. Public campaigns and educational programs have contributed to a cultural shift, encouraging individuals to seek help for mental health concerns. According to recent studies, approximately 30% of the population acknowledges experiencing mental health challenges, which has led to a heightened demand for screening services. This awareness is further supported by the efforts of non-governmental organizations and health authorities, which aim to destigmatize mental health issues. As a result, the depression screening-mental-health market is likely to expand, with more individuals seeking professional help and screening services to address their mental health needs.

Increased Access to Healthcare Services

Access to healthcare services in South America has improved significantly, which is a key driver for the depression screening-mental-health market. With the expansion of public health initiatives and the establishment of community health centers, more individuals can access mental health services. Reports indicate that around 40% of the population now has access to mental health professionals, which facilitates early detection and intervention for depression. This increased accessibility is essential for promoting mental health awareness and encouraging individuals to undergo screening. Consequently, the depression screening-mental-health market is expected to grow as more people utilize available resources to address their mental health concerns.

Integration of Mental Health in Primary Care

The integration of mental health services into primary care settings is emerging as a significant driver for the depression screening market in South America. This approach allows for a more holistic view of patient health, enabling healthcare providers to identify and address mental health issues alongside physical health concerns. Studies suggest that approximately 25% of primary care visits now include mental health screenings, reflecting a shift towards comprehensive care. This integration not only improves patient outcomes but also increases the likelihood of individuals receiving timely depression screenings. As healthcare systems continue to adopt this model, the depression screening-mental-health market is poised for growth.

Government Funding for Mental Health Programs

Government funding for mental health programs is a pivotal driver of the depression screening-mental-health market in South America. Increased investment in mental health initiatives has led to the establishment of various programs aimed at improving access to screening and treatment. Recent reports indicate that government spending on mental health has risen by 20% over the last few years, reflecting a commitment to addressing mental health issues. This funding supports training for healthcare professionals and the development of community outreach programs, which are essential for increasing awareness and encouraging individuals to seek screening. As government support continues, the depression screening-mental-health market is expected to thrive.

Technological Advancements in Screening Tools

Technological advancements in screening tools are transforming the depression screening-mental-health market in South America. The development of digital platforms and mobile applications for mental health assessment has made screening more accessible and efficient. Recent data indicates that the use of telehealth services for mental health has increased by 50% in the past year, allowing individuals to receive screenings from the comfort of their homes. These innovations not only enhance the user experience but also facilitate timely interventions. As technology continues to evolve, it is likely that the depression screening-mental-health market will expand, driven by the demand for more efficient and user-friendly screening solutions.