Strengthening Regulatory Frameworks

The regulatory landscape for biotechnology and genetic testing in South America is evolving, which is positively impacting the gene expression-analysis market. Governments are implementing clearer guidelines and standards for genetic testing and analysis, fostering a more conducive environment for research and development. This regulatory clarity is expected to enhance consumer confidence and encourage investment in gene expression analysis technologies. As of November 2025, several countries in the region are working towards harmonizing their regulations with international standards, which could facilitate cross-border collaborations and access to advanced technologies. The strengthening of regulatory frameworks is likely to support the growth of the gene expression-analysis market, as it ensures the safety and efficacy of genetic testing services.

Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are significantly impacting the gene expression-analysis market in South America. Innovations such as next-generation sequencing (NGS) and CRISPR technology are enhancing the accuracy and efficiency of gene expression studies. These technologies enable researchers to analyze complex genetic data more effectively, leading to breakthroughs in understanding diseases and developing targeted therapies. The market is projected to grow by approximately 12% annually as these technologies become more accessible to research institutions and clinical laboratories. Furthermore, the integration of bioinformatics tools is streamlining data analysis processes, making it easier for scientists to interpret results and apply findings in clinical settings, thereby driving the growth of the gene expression-analysis market.

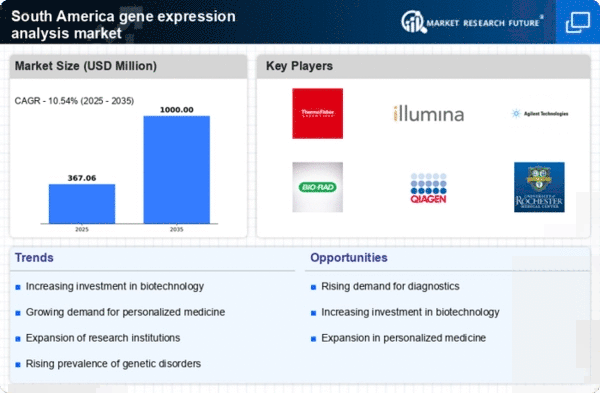

Increasing Investment in Biotechnology

The gene expression-analysis market in South America is experiencing a surge in investment from both public and private sectors. Governments are recognizing the potential of biotechnology to drive economic growth and improve healthcare outcomes. For instance, Brazil has allocated approximately $500 million to support biotechnology research and development initiatives. This influx of funding is likely to enhance the capabilities of local laboratories and research institutions, thereby fostering innovation in gene expression analysis. As a result, the industry is expected to expand, with a projected growth rate of 10% annually over the next five years. This investment trend not only boosts the gene expression-analysis market but also encourages collaboration between academia and industry, leading to advancements in personalized medicine and diagnostics.

Rising Prevalence of Genetic Disorders

The increasing incidence of genetic disorders in South America is driving demand for gene expression analysis. Conditions such as cystic fibrosis, sickle cell anemia, and various hereditary cancers are becoming more prevalent, necessitating advanced diagnostic tools. The gene expression-analysis market is poised to benefit from this trend, as healthcare providers seek to implement more precise diagnostic methods. In 2025, it is estimated that around 15% of the population in certain regions may be affected by genetic disorders, highlighting the urgent need for effective screening and treatment options. Consequently, the industry is likely to see a significant uptick in demand for gene expression analysis services, which are essential for understanding the underlying mechanisms of these disorders.

Growing Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in South America, which is influencing the gene expression-analysis market. As individuals become more health-conscious, there is an increasing demand for genetic testing and analysis to identify potential health risks. This trend is supported by educational campaigns and initiatives aimed at promoting genetic literacy among the population. In 2025, it is anticipated that around 30% of the population will seek genetic testing as part of their routine health check-ups. This growing awareness is likely to propel the gene expression-analysis market, as healthcare providers incorporate genetic testing into preventive care strategies. Consequently, the industry may witness a substantial increase in the adoption of gene expression analysis services.