Growing Focus on Quality Control

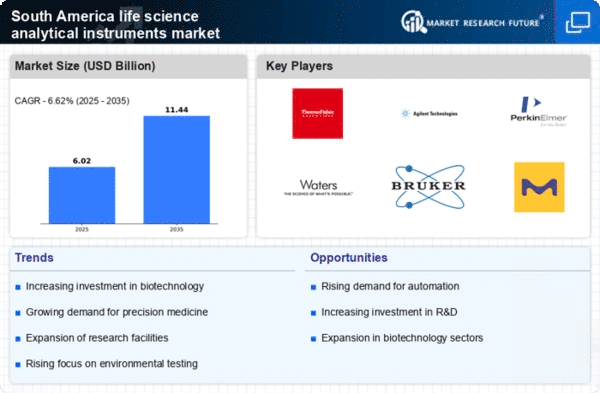

The growing emphasis on quality control in laboratories and manufacturing facilities is driving the life science-analytical-instruments market in South America. With increasing regulatory scrutiny and the need for compliance with international standards, organizations are investing in advanced analytical instruments to ensure product quality and safety. In 2025, it is estimated that the quality control segment will account for approximately 30% of the total market share in the life science-analytical-instruments market. This trend is particularly evident in the pharmaceutical and food industries, where rigorous testing and validation processes are critical. As companies strive to maintain high-quality standards, the demand for reliable and precise analytical instruments is expected to rise, further propelling market growth.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in South America is a key driver for the life science-analytical-instruments market. As the biopharmaceutical sector expands, there is a growing need for advanced analytical instruments to ensure the quality and efficacy of these products. In 2025, the biopharmaceutical market in South America is projected to reach approximately $20 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This surge necessitates sophisticated analytical tools for drug development, quality control, and regulatory compliance, thereby propelling the life science-analytical-instruments market forward. Furthermore, the focus on personalized medicine and biologics is likely to enhance the demand for innovative analytical solutions, as companies strive to meet the specific needs of patients and regulatory bodies.

Investment in Research and Development

Investment in research and development (R&D) within the life sciences sector is a significant driver for the life science-analytical-instruments market in South America. Governments and private entities are increasingly allocating funds to enhance R&D capabilities, which is expected to reach $5 billion by 2026. This investment fosters innovation and the development of new analytical technologies, which are essential for advancing scientific research and improving healthcare outcomes. As R&D activities intensify, the demand for high-performance analytical instruments rises, facilitating the analysis of complex biological samples and the development of novel therapeutics. Consequently, the life science-analytical-instruments market is likely to benefit from this trend, as researchers seek cutting-edge tools to support their investigations.

Emergence of Advanced Analytical Techniques

The emergence of advanced analytical techniques is reshaping the landscape of the life science-analytical-instruments market in South America. Techniques such as mass spectrometry, chromatography, and next-generation sequencing are gaining traction due to their ability to provide detailed insights into complex biological systems. The market for these advanced techniques is projected to grow at a CAGR of 10% through 2026, driven by their applications in drug discovery, genomics, and proteomics. As researchers and laboratories seek to enhance their analytical capabilities, the demand for sophisticated instruments that can support these techniques is likely to increase. This trend not only boosts the life science-analytical-instruments market but also fosters innovation in scientific research and development.

Increasing Collaboration Between Academia and Industry

The increasing collaboration between academia and industry is a notable driver for the life science-analytical-instruments market in South America. Partnerships between universities, research institutions, and private companies are fostering innovation and accelerating the development of new analytical technologies. In 2025, it is anticipated that collaborative research initiatives will account for over 25% of the total funding in the life sciences sector. These collaborations often lead to the establishment of research centers and innovation hubs, which require state-of-the-art analytical instruments to support their projects. As a result, the life science-analytical-instruments market is likely to experience growth as these partnerships drive demand for advanced analytical solutions that meet the evolving needs of researchers and industry professionals.