Rising Aging Population

The demographic shift towards an aging population in South America is a critical driver for the medical automation market. As the elderly population increases, there is a corresponding rise in chronic diseases, necessitating more efficient healthcare delivery systems. Automation technologies, such as remote monitoring and telehealth solutions, are becoming essential in managing the healthcare needs of this demographic. Reports indicate that by 2030, the population aged 65 and older in South America will account for over 15% of the total population. This trend suggests a growing reliance on the medical automation market to provide innovative solutions that cater to the unique needs of older patients.

Government Initiatives and Funding

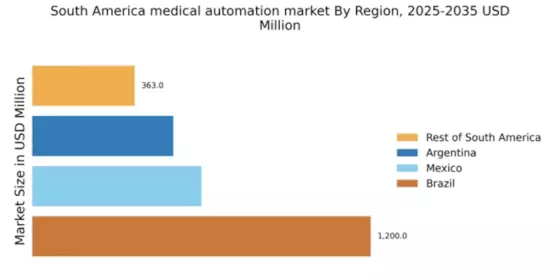

Government initiatives aimed at improving healthcare infrastructure in South America are significantly impacting the medical automation market. Various countries in the region are allocating funds to modernize healthcare facilities and integrate advanced technologies. For instance, Brazil has launched programs to enhance digital health services, which include automation in hospitals. This governmental support is expected to boost investments in the medical automation market, with funding projected to reach $500 million by 2026. Such initiatives not only facilitate the adoption of automation technologies but also encourage public-private partnerships, further driving market growth.

Focus on Cost Reduction and Efficiency

The emphasis on cost reduction and operational efficiency is a significant driver for the medical automation market in South America. Healthcare providers are under pressure to minimize expenses while maintaining high-quality care. Automation technologies offer solutions that can streamline workflows, reduce human error, and optimize resource allocation. For instance, automated billing systems and electronic health records can significantly cut administrative costs. The medical automation market is thus witnessing a shift towards solutions that not only enhance efficiency but also contribute to overall cost savings. It is estimated that automation could reduce operational costs by up to 30% in some healthcare facilities, making it an attractive option for providers.

Technological Advancements in Medical Devices

Technological advancements in medical devices are propelling the medical automation market in South America. Innovations such as smart diagnostic tools, automated laboratory systems, and AI-driven imaging technologies are enhancing the accuracy and efficiency of medical procedures. The integration of these advanced devices into healthcare settings is expected to increase operational efficiency and improve patient outcomes. The medical automation market is likely to benefit from these advancements, with the market for automated medical devices projected to reach $1 billion by 2025. This growth reflects the increasing adoption of technology in healthcare, driven by both providers and patients seeking better healthcare experiences.

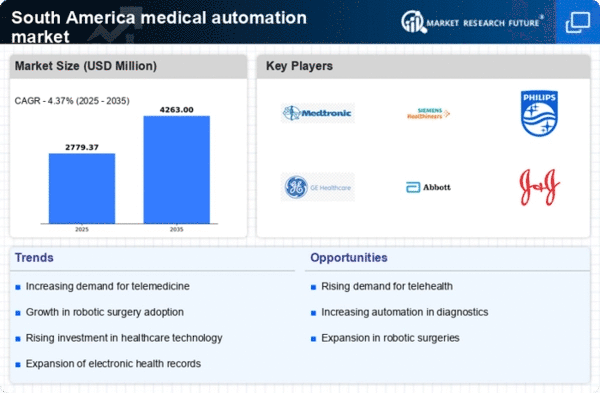

Increasing Demand for Efficient Healthcare Solutions

The medical automation market in South America is experiencing a notable surge in demand for efficient healthcare solutions. This demand is driven by the need to enhance patient care while reducing operational costs. Hospitals and clinics are increasingly adopting automated systems to streamline processes such as patient management, billing, and inventory control. According to recent data, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth indicates a shift towards automation as healthcare providers seek to improve service delivery and patient outcomes. The medical automation market is thus positioned to play a crucial role in transforming healthcare delivery across the region.