Rising Demand for Efficiency

The pharmacy automation market in South America is experiencing a notable surge in demand for efficiency. As healthcare providers strive to optimize operations, automation technologies are increasingly viewed as essential tools. The integration of automated dispensing systems and robotic solutions can significantly reduce medication errors and enhance workflow efficiency. According to recent data, pharmacies that have adopted automation report a reduction in operational costs by up to 30%. This trend is likely to continue as more pharmacies recognize the potential for automation to streamline processes and improve service delivery. Consequently, the rising demand for efficiency is a key driver propelling the growth of the pharmacy automation market in the region.

Regulatory Support for Automation

Regulatory bodies in South America are increasingly supporting the adoption of automation in pharmacies. This support is manifested through the establishment of guidelines and incentives aimed at enhancing pharmacy operations. For instance, certain countries have introduced policies that encourage the use of automated systems to ensure compliance with safety standards. This regulatory environment fosters innovation and investment in the pharmacy automation market, as stakeholders seek to align with governmental objectives. The potential for reduced regulatory burdens and increased funding opportunities may further stimulate market growth, making regulatory support a significant driver in the pharmacy automation market.

Increasing Focus on Cost Reduction

Cost reduction is a primary concern for pharmacies in South America, driving the adoption of automation solutions. By automating routine tasks, pharmacies can minimize labor costs and reduce the likelihood of costly errors. The pharmacy automation market is responding to this need, with systems designed to enhance productivity while lowering operational expenses. Reports suggest that pharmacies implementing automation can achieve savings of up to 25% in labor costs. This focus on cost reduction is likely to propel further investment in automation technologies, as pharmacies seek to remain competitive in a challenging economic environment.

Technological Advancements in Automation

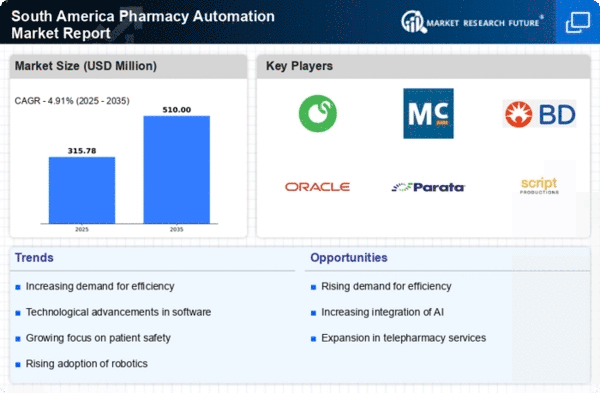

Technological advancements are playing a crucial role in shaping the pharmacy automation market in South America. Innovations such as artificial intelligence, machine learning, and advanced robotics are enhancing the capabilities of automated systems. These technologies enable pharmacies to manage inventory more effectively, predict demand, and optimize supply chains. As a result, pharmacies can reduce waste and improve service levels. The market for pharmacy automation is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years, driven by these technological advancements. This trend indicates a strong future for automation solutions in the pharmacy sector.

Growing Patient Population and Demand for Services

The growing patient population in South America is exerting pressure on pharmacies to enhance service delivery. As the demand for pharmaceutical services increases, pharmacies are turning to automation to manage higher volumes efficiently. The pharmacy automation market is thus positioned to benefit from this trend, as automated systems can handle increased workloads without compromising quality. With an estimated annual growth rate of 5% in the patient population, the need for efficient pharmacy operations is more pressing than ever. This growing demand for services is a critical driver for the expansion of the pharmacy automation market in the region.