Rising Awareness of Eye Health

There is a notable increase in public awareness regarding eye health in South America, which is driving the optical coherence-tomography market. Educational campaigns and initiatives by health organizations are emphasizing the importance of regular eye examinations and early detection of diseases. This heightened awareness is leading to more individuals seeking preventive care and diagnostic services. As a result, the demand for advanced imaging technologies, such as optical coherence-tomography, is likely to grow. Reports indicate that approximately 60% of the population in urban areas is now aware of the benefits of regular eye check-ups, which is expected to translate into increased utilization of optical coherence-tomography services in the coming years.

Expansion of Telemedicine Services

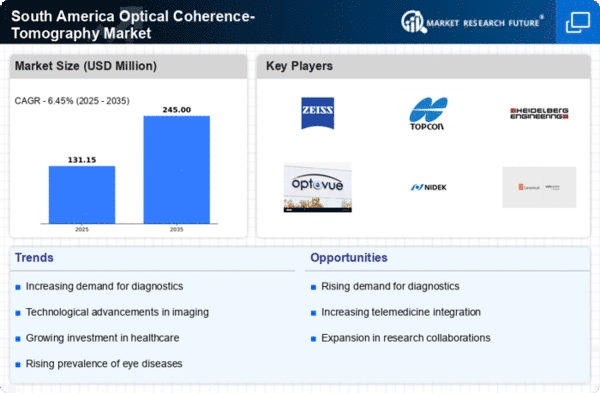

The expansion of telemedicine services in South America is emerging as a significant driver for the optical coherence-tomography market. As healthcare providers increasingly adopt telehealth solutions, the demand for remote diagnostic tools is growing. Optical coherence-tomography can be integrated into telemedicine platforms, allowing specialists to analyze imaging data remotely. This is particularly beneficial in regions with limited access to eye care professionals. The telemedicine market in South America is projected to grow at a CAGR of 25% over the next five years, indicating a strong potential for optical coherence-tomography to play a vital role in remote patient management. This trend not only enhances access to care but also promotes the utilization of advanced diagnostic technologies.

Increasing Prevalence of Eye Diseases

The rising incidence of eye diseases, particularly in aging populations, is a crucial driver for the optical coherence-tomography market in South America. Conditions such as diabetic retinopathy and age-related macular degeneration are becoming more prevalent, necessitating advanced diagnostic tools. According to health statistics, the prevalence of diabetic retinopathy in South America is estimated to be around 30%, highlighting the urgent need for effective screening methods. Optical coherence-tomography provides high-resolution imaging, enabling early detection and management of these conditions. As healthcare providers increasingly adopt this technology, the optical coherence-tomography market is likely to experience substantial growth, driven by the demand for accurate and timely diagnosis of eye diseases.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is significantly impacting the optical coherence-tomography market. Governments and private entities are allocating funds to enhance medical facilities, particularly in urban areas. For instance, Brazil has seen a surge in healthcare spending, with an increase of approximately 10% in the last fiscal year. This investment is facilitating the acquisition of advanced diagnostic equipment, including optical coherence-tomography systems. As hospitals and clinics upgrade their technology, the demand for optical coherence-tomography is expected to rise, reflecting a broader trend towards modernization in healthcare services. Enhanced infrastructure not only improves access to care but also promotes the adoption of innovative diagnostic solutions.

Technological Innovations in Imaging Techniques

Technological innovations in imaging techniques are propelling the optical coherence-tomography market forward in South America. The introduction of portable and more affordable optical coherence-tomography devices is making this technology accessible to a broader range of healthcare facilities, including smaller clinics and rural hospitals. These advancements are likely to enhance the diagnostic capabilities of practitioners, allowing for more widespread use of optical coherence-tomography in routine eye examinations. Furthermore, the integration of artificial intelligence in imaging analysis is expected to improve diagnostic accuracy and efficiency. As these innovations continue to emerge, the optical coherence-tomography market is poised for growth, driven by the need for enhanced diagnostic tools in eye care.