Growing Aging Population

The aging population in South America is a crucial driver for the orthopedic biomaterial market. As individuals age, they often experience musculoskeletal disorders, leading to an increased demand for orthopedic interventions. It is estimated that by 2030, the population aged 60 and above in South America will reach approximately 20% of the total population. This demographic shift necessitates the use of advanced orthopedic biomaterials to address conditions such as osteoporosis and joint degeneration. Consequently, the orthopedic biomaterial market is likely to witness substantial growth as healthcare providers seek innovative solutions to cater to the needs of this demographic.

Advancements in Surgical Techniques

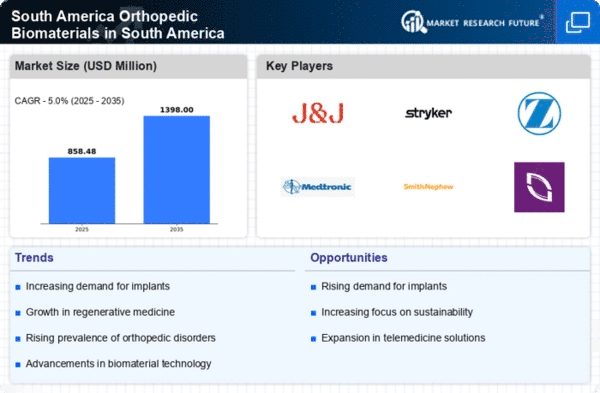

Innovations in surgical techniques are transforming the orthopedic biomaterial market in South America. Minimally invasive procedures are gaining traction, leading to a demand for biomaterials that can support these advanced techniques. The market for orthopedic biomaterials is projected to grow at a CAGR of around 8% over the next five years, driven by the need for materials that enhance surgical outcomes. Surgeons are increasingly adopting new technologies that require compatible biomaterials, thus propelling the orthopedic biomaterial market forward. This evolution in surgical practices necessitates ongoing research and development to create materials that meet the specific requirements of modern orthopedic procedures.

Rising Incidence of Sports Injuries

The prevalence of sports injuries in South America is on the rise, contributing significantly to the orthopedic biomaterial market. With an increasing number of individuals participating in sports and physical activities, the demand for effective treatment options is escalating. Reports indicate that sports-related injuries account for nearly 30% of all orthopedic cases in the region. This trend drives the need for advanced biomaterials that can facilitate faster recovery and improved outcomes. As a result, the orthopedic biomaterial market is expected to expand as manufacturers develop specialized products tailored to the needs of athletes and active individuals.

Increased Focus on Regenerative Medicine

The orthopedic biomaterial market is experiencing a shift towards regenerative medicine in South America. There is a growing emphasis on developing biomaterials that not only replace damaged tissues but also promote healing and regeneration. This trend is supported by advancements in stem cell research and tissue engineering, which are becoming integral to orthopedic treatments. The orthopedic biomaterial market is likely to benefit from this focus, as healthcare providers seek innovative solutions that enhance patient recovery. The potential for regenerative therapies to reduce the need for invasive surgeries could further drive market growth in the coming years.

Government Initiatives to Improve Healthcare Access

Government initiatives aimed at improving healthcare access in South America are positively impacting the orthopedic biomaterial market. Various countries in the region are implementing policies to enhance healthcare infrastructure and increase funding for medical technologies. This is expected to lead to a rise in the availability of orthopedic services and, consequently, a higher demand for biomaterials. The orthopedic biomaterial market stands to gain from these initiatives, as increased access to healthcare will likely result in more patients seeking orthopedic treatments. As governments prioritize healthcare improvements, the market for orthopedic biomaterials is poised for growth.