Growing Aging Population

The aging population in South America is a critical driver for the peripheral neuropathy market. As individuals age, the risk of developing neuropathic conditions increases, primarily due to age-related diseases such as diabetes and hypertension. According to recent statistics, approximately 15% of the elderly population in South America suffers from some form of neuropathy. This demographic shift is likely to escalate the demand for effective treatment options and management strategies within the peripheral neuropathy market. Healthcare providers are increasingly focusing on tailored therapies to address the unique needs of older patients, which may lead to a surge in market growth. Furthermore, the rising prevalence of comorbidities among the elderly could further complicate treatment protocols, necessitating innovative solutions in the peripheral neuropathy market.

Emerging Telehealth Solutions

The rise of telehealth solutions in South America is emerging as a significant driver for the peripheral neuropathy market. Telemedicine offers patients convenient access to healthcare services, particularly for those in remote or underserved areas. This trend is particularly relevant for managing chronic conditions like peripheral neuropathy, where regular follow-up and monitoring are essential. Recent surveys indicate that telehealth usage has surged by over 30% in the past year, reflecting a shift in patient preferences towards remote consultations. As telehealth continues to gain traction, it is likely to facilitate better patient engagement and adherence to treatment plans, ultimately contributing to the growth of the peripheral neuropathy market.

Rising Awareness of Neuropathy

There is a notable increase in awareness regarding peripheral neuropathy in South America, which serves as a significant driver for the market. Educational campaigns and community outreach programs have been instrumental in informing the public about the symptoms and risks associated with neuropathy. This heightened awareness is reflected in a growing number of patients seeking medical advice, leading to an estimated 20% increase in diagnoses over the past few years. As more individuals recognize the importance of early intervention, the peripheral neuropathy market is likely to experience a corresponding rise in demand for diagnostic tools and treatment options. Additionally, healthcare professionals are becoming more adept at identifying neuropathic conditions, which may further contribute to market expansion as patients receive timely and appropriate care.

Increasing Healthcare Expenditure

Rising healthcare expenditure in South America is a pivotal driver for the peripheral neuropathy market. Governments and private sectors are allocating more resources to healthcare, which is facilitating better access to diagnostic and therapeutic services for neuropathy patients. Recent data indicates that healthcare spending in the region has increased by approximately 10% annually, allowing for improved infrastructure and availability of advanced treatment options. This trend is likely to enhance patient access to specialized care, thereby driving demand for neuropathy management solutions. Additionally, as healthcare systems evolve, there is a growing emphasis on integrated care models that address the multifaceted needs of patients with peripheral neuropathy, further propelling market growth.

Advancements in Pharmaceutical Research

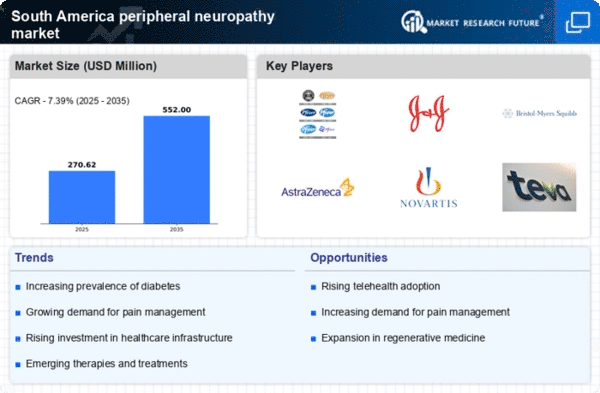

The peripheral neuropathy market in South America is witnessing significant advancements in pharmaceutical research, which is driving innovation in treatment options. Recent studies have focused on developing novel medications that target specific neuropathic pain pathways, potentially improving patient outcomes. The market is projected to grow at a CAGR of 7% over the next five years, driven by the introduction of new therapies that offer better efficacy and safety profiles. Furthermore, collaborations between pharmaceutical companies and research institutions are fostering the development of personalized medicine approaches, which may enhance treatment effectiveness for diverse patient populations. As these advancements continue to emerge, the peripheral neuropathy market is likely to benefit from increased investment and interest from stakeholders.