Rising Incidence of Rabies Cases

The increasing incidence of rabies cases in South America is a critical driver for the rabies diagnostics market. Reports indicate that rabies remains a significant public health concern, particularly in rural areas where access to healthcare is limited. The World Health Organization estimates that thousands of rabies-related deaths occur annually in the region, prompting governments and health organizations to prioritize rabies control measures. This heightened awareness and urgency lead to increased demand for effective diagnostic tools, as timely detection is essential for preventing the disease's spread. Consequently, investments in diagnostic technologies are likely to rise, fostering growth in the rabies diagnostics market.

Government Initiatives and Funding

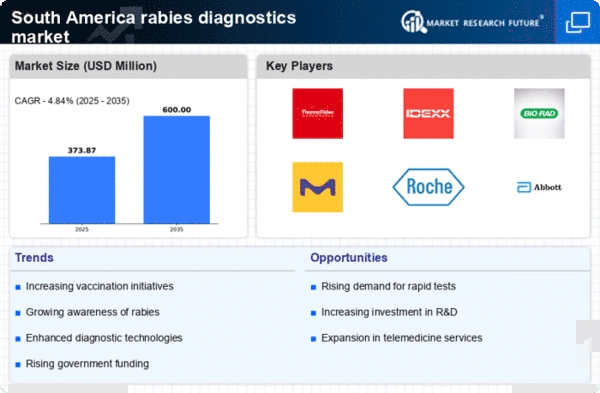

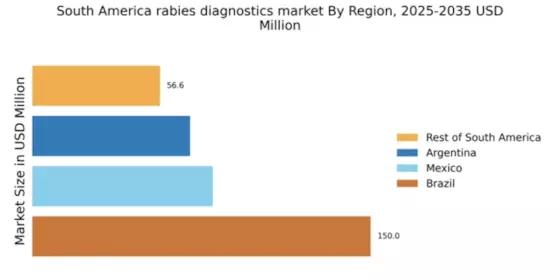

Government initiatives aimed at controlling rabies outbreaks significantly influence the rabies diagnostics market. In South America, various countries have launched national rabies control programs, which include funding for diagnostic research and development. For instance, Brazil has allocated substantial resources to enhance rabies surveillance and diagnostics, reflecting a commitment to public health. Such initiatives not only improve the availability of diagnostic tools but also encourage collaboration between public and private sectors. As a result, the rabies diagnostics market is expected to expand, driven by increased funding and support for innovative diagnostic solutions.

Technological Advancements in Diagnostics

Technological advancements in diagnostic methods are transforming the rabies diagnostics market in South America. Innovations such as rapid antigen tests and molecular diagnostics are becoming more prevalent, offering faster and more accurate results. These advancements are crucial in regions where timely diagnosis can significantly impact treatment outcomes. The market for rabies diagnostics is projected to grow as healthcare providers increasingly adopt these technologies. Furthermore, the integration of digital health solutions, such as telemedicine, may enhance access to diagnostic services, particularly in remote areas. This trend indicates a promising future for the rabies diagnostics market as technology continues to evolve.

Increased Veterinary Awareness and Practices

The growing awareness among veterinarians regarding rabies prevention and control is a notable driver for the rabies diagnostics market. In South America, veterinarians play a pivotal role in rabies surveillance and management, particularly in areas with high animal populations. Enhanced training and education programs for veterinary professionals are leading to improved diagnostic practices. As veterinarians become more adept at recognizing rabies symptoms and utilizing diagnostic tools, the demand for these products is likely to increase. This trend suggests a robust growth trajectory for the rabies diagnostics market, driven by the veterinary sector's proactive approach to rabies management.

Rising Pet Ownership and Animal Health Awareness

The rise in pet ownership across South America is contributing to the growth of the rabies diagnostics market. As more households adopt pets, there is a corresponding increase in awareness regarding animal health and rabies prevention. Pet owners are becoming more proactive in seeking vaccinations and diagnostic services for their animals, which drives demand for rabies diagnostics. Additionally, public health campaigns aimed at educating pet owners about rabies risks further bolster this trend. The rabies diagnostics market is likely to benefit from this heightened focus on animal health, as more individuals seek reliable diagnostic solutions for their pets.