Advancements in Telemedicine

The integration of telemedicine into healthcare services is transforming the sleep testing-services market in South America. Telehealth platforms enable patients to access sleep testing services remotely, which is particularly beneficial in regions with limited access to specialized care. This shift not only enhances convenience for patients but also expands the reach of healthcare providers. The sleep testing-services market is likely to see increased adoption of home sleep testing devices, which can be monitored and analyzed through telemedicine platforms. This trend may lead to a reduction in costs associated with traditional in-lab testing, making services more affordable for a broader population. As telemedicine continues to gain traction, it is expected to play a pivotal role in increasing the overall utilization of sleep testing services across South America.

Rising Consumer Health Consciousness

There is a notable increase in health consciousness among consumers in South America, which is positively impacting the sleep testing-services market. As individuals become more aware of the importance of sleep for overall health and well-being, they are more likely to seek professional help for sleep-related issues. This trend is reflected in the growing demand for sleep testing services, as consumers prioritize their health and are willing to invest in diagnostic solutions. The sleep testing-services market is adapting to this shift by offering more personalized and accessible testing options. Additionally, educational campaigns aimed at informing the public about sleep disorders and their consequences are likely to further stimulate demand. This heightened awareness may lead to a more proactive approach to sleep health, ultimately benefiting the market.

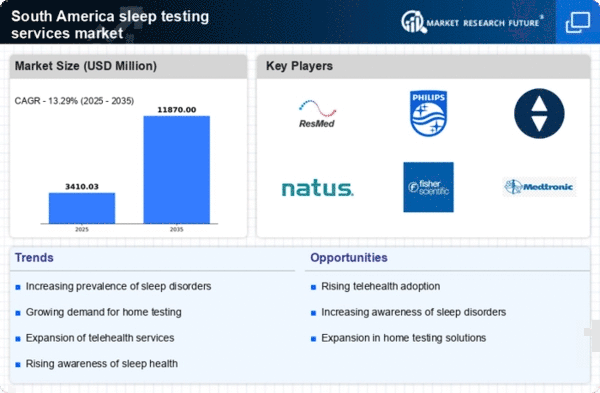

Increasing Prevalence of Sleep Disorders

The rising incidence of sleep disorders in South America is a crucial driver for the sleep testing-services market. Studies indicate that approximately 30% of the population experiences some form of sleep disturbance, which necessitates effective diagnostic services. This growing prevalence is likely to increase demand for sleep testing services, as individuals seek solutions for conditions such as sleep apnea and insomnia. The sleep testing-services market is responding to this trend by expanding service offerings and improving accessibility. As awareness of the health implications associated with untreated sleep disorders grows, healthcare providers are more inclined to recommend sleep testing, further propelling market growth. The economic burden of sleep disorders, estimated at billions of $ annually in healthcare costs, underscores the urgency for effective testing and treatment options in the region.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is a significant driver for the sleep testing-services market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, which includes the establishment of sleep centers equipped with advanced diagnostic tools. This trend is indicative of a broader commitment to improving healthcare access and quality. The sleep testing-services market stands to benefit from these investments, as more facilities become capable of offering comprehensive sleep studies. Furthermore, the expansion of healthcare infrastructure is likely to create job opportunities for sleep specialists, thereby improving the overall quality of care. As a result, the market may experience accelerated growth, with an anticipated increase in the number of patients seeking sleep testing services.

Collaboration Between Healthcare Providers and Technology Firms

The collaboration between healthcare providers and technology firms is emerging as a vital driver for the sleep testing-services market in South America. These partnerships are fostering innovation in sleep diagnostics, leading to the development of advanced testing devices and software solutions. Such collaborations may enhance the accuracy and efficiency of sleep studies, making them more appealing to both patients and healthcare professionals. The sleep testing-services market is likely to see an influx of new technologies that streamline the testing process and improve patient outcomes. As these partnerships continue to evolve, they could potentially lead to the introduction of cost-effective solutions that broaden access to sleep testing services. This synergy between healthcare and technology is expected to play a crucial role in shaping the future landscape of sleep testing in the region.