Investment in Healthcare Infrastructure

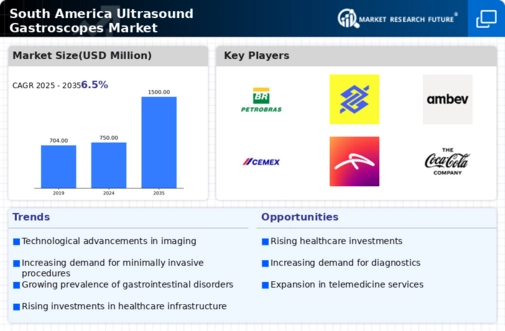

Significant investments in healthcare infrastructure across South America are propelling the ultrasound gastroscopes market. Governments and private entities are increasingly allocating funds to enhance medical facilities, particularly in urban areas. This investment is aimed at improving access to advanced medical technologies, including ultrasound gastroscopes, which are essential for accurate diagnosis and treatment of gastrointestinal conditions. Reports indicate that healthcare spending in South America is projected to grow by 5% annually, creating a favorable environment for the ultrasound gastroscopes market. Enhanced infrastructure not only facilitates the adoption of new technologies but also improves patient outcomes, thereby driving demand for these diagnostic tools.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare in South America, which is influencing the ultrasound gastroscopes market. As individuals become more informed about the importance of early detection of gastrointestinal issues, the demand for non-invasive diagnostic procedures is likely to rise. Educational campaigns and health initiatives are encouraging regular screenings, which include the use of ultrasound gastroscopes. This shift towards preventive care is expected to expand the market, as healthcare providers adapt to meet the needs of a more health-conscious population. The ultrasound gastroscopes market stands to gain from this trend, as patients seek out advanced diagnostic options to proactively manage their health.

Technological Integration in Medical Practices

The integration of advanced technologies in medical practices is a significant driver for the ultrasound gastroscopes market. Innovations such as artificial intelligence and machine learning are being incorporated into ultrasound gastroscopes, enhancing their diagnostic capabilities. This technological evolution is appealing to healthcare providers in South America, as it allows for more accurate and efficient patient assessments. The ultrasound gastroscopes market is likely to experience growth as these technologies become more prevalent, improving the overall quality of care. Furthermore, the ability to provide real-time imaging and analysis is expected to attract more healthcare facilities to adopt these advanced diagnostic tools.

Rising Prevalence of Gastrointestinal Disorders

The increasing incidence of gastrointestinal disorders in South America is a primary driver for the ultrasound gastroscopes market. Conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and inflammatory bowel disease are becoming more prevalent, leading to a heightened demand for diagnostic tools. According to health statistics, approximately 30% of the population in some South American countries report symptoms related to these disorders. This trend necessitates advanced diagnostic equipment, including ultrasound gastroscopes, which are favored for their non-invasive nature. The ultrasound gastroscopes market is thus positioned to benefit from this growing patient population, as healthcare providers seek efficient and effective diagnostic solutions to address these rising health concerns.

Increasing Demand for Minimally Invasive Procedures

The rising preference for minimally invasive procedures among patients in South America is driving the ultrasound gastroscopes market. Patients are increasingly opting for diagnostic methods that reduce recovery time and minimize discomfort. Ultrasound gastroscopes, known for their non-invasive nature, align with this demand, offering a viable alternative to traditional endoscopic procedures. Market analysis suggests that the demand for minimally invasive techniques is growing at a rate of 6% annually, indicating a robust market potential. The ultrasound gastroscopes market is well-positioned to capitalize on this trend, as healthcare providers seek to enhance patient satisfaction and outcomes through less invasive diagnostic options.

Leave a Comment