Emergence of Innovative Business Models

The emergence of innovative business models is reshaping the landscape of the virtual customer-premises-equipment market. Companies are exploring new ways to deliver services and engage with customers, often leveraging virtual solutions to enhance their offerings. This trend is particularly relevant in South America, where businesses are increasingly adopting subscription-based models and pay-as-you-go services. Such models allow for greater flexibility and cost-effectiveness, appealing to a diverse range of customers. As organizations seek to differentiate themselves in a competitive market, the virtual customer-premises-equipment market is likely to witness a surge in demand for solutions that support these innovative business approaches.

Growing Emphasis on Cybersecurity Solutions

The rising concern over cybersecurity threats is a pivotal driver for the virtual customer-premises-equipment market in South America. As businesses increasingly migrate to digital platforms, the need for robust security measures becomes paramount. Organizations are recognizing that traditional security approaches may not adequately protect their networks. Consequently, there is a growing emphasis on integrating advanced cybersecurity solutions within virtual customer-premises-equipment frameworks. This trend is likely to accelerate as cyber threats evolve, prompting companies to invest in comprehensive security strategies. The virtual customer-premises-equipment market is expected to see a corresponding increase in demand for integrated security features, which could enhance overall network resilience.

Rising Demand for Flexible Networking Solutions

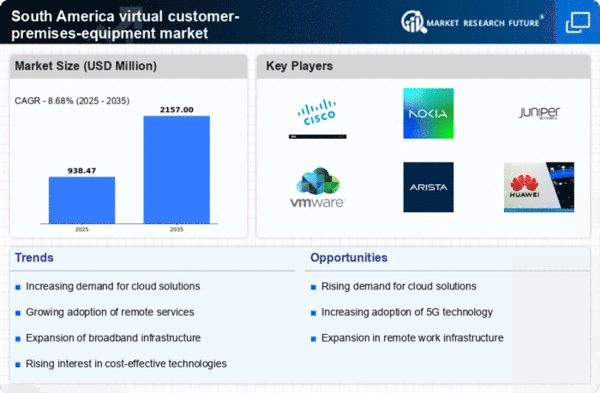

The virtual customer-premises-equipment market is experiencing a notable surge in demand for flexible networking solutions across South America. Businesses are increasingly seeking to adapt their network infrastructures to meet the dynamic needs of their operations. This shift is driven by the necessity for scalability and agility in network management. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are recognizing that traditional hardware-based solutions may not suffice in a rapidly evolving digital landscape. As a result, the adoption of virtual customer-premises-equipment is becoming a strategic priority for organizations aiming to enhance their operational efficiency and responsiveness.

Shift Towards Remote Work and Digital Collaboration

The ongoing shift towards remote work and digital collaboration is significantly influencing the virtual customer-premises-equipment market. As organizations adapt to new work paradigms, there is an increasing reliance on virtual solutions to facilitate communication and collaboration among distributed teams. This trend is particularly pronounced in South America, where companies are investing in technologies that enable seamless connectivity and productivity. The virtual customer-premises-equipment market is poised to benefit from this shift, as businesses prioritize solutions that support remote operations. It is estimated that by 2025, around 60% of the workforce in South America may engage in some form of remote work, further driving the demand for virtual solutions.

Increased Investment in Telecommunications Infrastructure

Investment in telecommunications infrastructure is a critical driver for the virtual customer-premises-equipment market in South America. Governments and private entities are channeling substantial resources into enhancing connectivity and expanding broadband access. This investment is essential for supporting the growing demand for high-speed internet and advanced communication services. Recent reports indicate that the telecommunications sector in South America is expected to witness an influx of over $10 billion in infrastructure development by 2026. Such investments are likely to create a conducive environment for the proliferation of virtual customer-premises-equipment, as businesses seek to leverage improved connectivity for their operations.