Increasing Prevalence of Epilepsy

The rising incidence of epilepsy in South Korea is a crucial driver for the epilepsy market. Recent estimates suggest that approximately 0.5-1% of the population is affected by epilepsy, translating to around 250,000 to 500,000 individuals. This growing patient population necessitates enhanced treatment options and healthcare services, thereby stimulating market growth. The increasing awareness and diagnosis of epilepsy contribute to this trend, as more individuals seek medical attention. Furthermore, the aging population in South Korea is likely to exacerbate the prevalence of epilepsy, as age is a significant risk factor. Consequently, the epilepsy market is poised for expansion, driven by the need for effective management strategies and innovative therapies to cater to this demographic.

Government Initiatives and Funding

Government initiatives and funding play a significant role in the development of the epilepsy market in South Korea. The government has recognized the need for enhanced research and treatment options for epilepsy, leading to increased funding for clinical studies and public health initiatives. Recent allocations have focused on improving access to care and supporting innovative research projects aimed at understanding the underlying causes of epilepsy. Such initiatives not only foster advancements in treatment but also encourage collaboration between academic institutions and the pharmaceutical industry. As a result, the epilepsy market is likely to benefit from a more robust research environment, ultimately leading to the development of new therapies and improved patient outcomes.

Advancements in Treatment Modalities

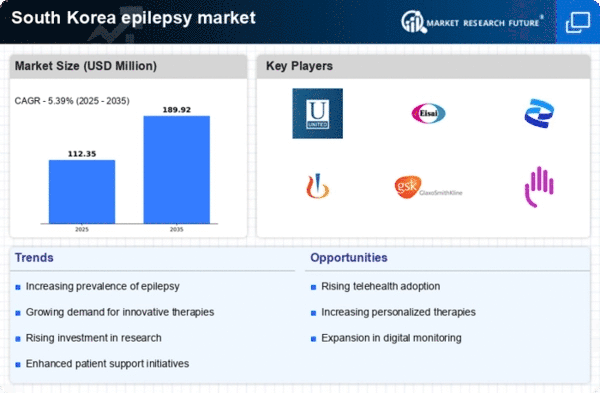

Innovations in treatment modalities are significantly influencing the epilepsy market in South Korea. The introduction of novel antiepileptic drugs (AEDs) and advanced surgical techniques has transformed the management of epilepsy. For instance, the development of targeted therapies and neuromodulation techniques, such as responsive neurostimulation, offers new hope for patients with refractory epilepsy. The market for AEDs alone is projected to reach approximately $1 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. These advancements not only improve patient outcomes but also enhance the overall quality of life for individuals living with epilepsy. As healthcare providers increasingly adopt these innovative treatments, the epilepsy market is likely to experience robust growth, driven by the demand for effective and personalized care.

Integration of Digital Health Solutions

The integration of digital health solutions is emerging as a transformative driver for the epilepsy market in South Korea. The proliferation of mobile health applications and telemedicine platforms enables patients to manage their condition more effectively. These digital tools facilitate remote monitoring, medication adherence, and real-time communication with healthcare providers. As a result, patients experience improved management of their epilepsy, which can lead to better health outcomes. The market for digital health solutions in the epilepsy sector is expected to grow significantly, with projections indicating a potential increase of over 20% annually. This trend reflects a shift towards more patient-centered care, where technology plays a crucial role in enhancing the overall management of epilepsy.

Rising Awareness and Education Initiatives

The growing awareness and education initiatives surrounding epilepsy are pivotal in shaping the epilepsy market. Various organizations and healthcare providers are actively working to educate the public about epilepsy, its symptoms, and treatment options. This increased awareness leads to earlier diagnosis and treatment, which is essential for effective management. In South Korea, campaigns aimed at reducing stigma and promoting understanding of epilepsy have gained traction, resulting in a more informed population. As awareness levels rise, more individuals are likely to seek medical assistance, thereby driving demand for epilepsy treatments and services. This trend is expected to bolster the epilepsy market, as healthcare systems adapt to accommodate the needs of a more knowledgeable patient base.