Aging Population

The demographic shift towards an aging population in South Korea is significantly impacting the health supplements market. As the proportion of elderly individuals increases, there is a corresponding rise in the demand for supplements that cater to age-related health concerns. Products aimed at improving joint health, cognitive function, and overall vitality are particularly sought after. Data indicates that by 2030, nearly 20% of the South Korean population will be aged 65 and older, creating a substantial market for health supplements tailored to this demographic. The health supplements market is likely to see innovations in formulations and marketing strategies that specifically address the needs of older consumers, thereby driving growth in this segment.

Rise of Fitness Culture

The burgeoning fitness culture in South Korea is a key driver of the health supplements market. With an increasing number of individuals engaging in regular physical activity, there is a heightened interest in products that can enhance athletic performance and recovery. This trend is evidenced by the growing popularity of protein powders, amino acids, and pre-workout supplements. Market data suggests that the fitness supplement segment is expected to witness a growth rate of around 10% annually over the next five years. The health supplements market is thus adapting to this trend by offering a wider range of products that cater to fitness enthusiasts, including those focused on weight management and muscle building.

Increasing Health Awareness

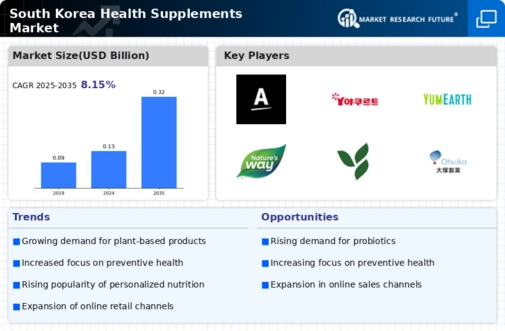

The health supplements market in South Korea is experiencing a notable surge due to increasing health awareness among the population. As individuals become more conscious of their health and wellness, they are actively seeking products that can enhance their overall well-being. This trend is reflected in the rising demand for dietary supplements, vitamins, and minerals. According to recent data, the market is projected to grow at a CAGR of approximately 8.5% from 2025 to 2030. This growth is indicative of a broader shift towards preventive health measures, where consumers prioritize maintaining their health rather than merely treating illnesses. The health supplements market is thus positioned to benefit from this heightened awareness, as consumers are more inclined to invest in products that support their health goals.

Regulatory Support and Standards

Regulatory support and the establishment of stringent quality standards are fostering growth in the health supplements market in South Korea. The government has implemented regulations that ensure product safety and efficacy, which in turn boosts consumer confidence. This regulatory framework encourages manufacturers to adhere to high-quality standards, thereby enhancing the overall reputation of the health supplements market. As consumers become more discerning, the presence of robust regulations is likely to drive demand for certified products. Furthermore, the government's initiatives to promote health and wellness are expected to further stimulate market growth, as they align with the increasing consumer focus on health.

Technological Advancements in Product Development

Technological advancements are playing a crucial role in shaping the health supplements market in South Korea. Innovations in formulation, delivery methods, and ingredient sourcing are enabling manufacturers to create more effective and appealing products. For instance, the use of nanotechnology in supplement formulation is enhancing bioavailability, allowing consumers to experience better results. Additionally, advancements in e-commerce platforms are facilitating easier access to a diverse range of health supplements. The health supplements market is likely to continue evolving as companies leverage technology to meet consumer demands for quality and efficacy, potentially leading to increased market penetration and consumer trust.