Regulatory Changes and Compliance

The healthcare payer-services market is significantly influenced by regulatory changes and compliance requirements. In South Korea, the government has implemented various policies aimed at enhancing healthcare accessibility and affordability. For instance, the introduction of the National Health Insurance Service (NHIS) has mandated that all citizens be covered, thereby expanding the payer base. This regulatory framework is expected to drive growth in the healthcare payer-services market, with an estimated increase in market size by 15% over the next few years. Compliance with these regulations necessitates that payers invest in robust systems to manage claims and ensure adherence to standards, which could further stimulate market activity.

Technological Advancements in Healthcare

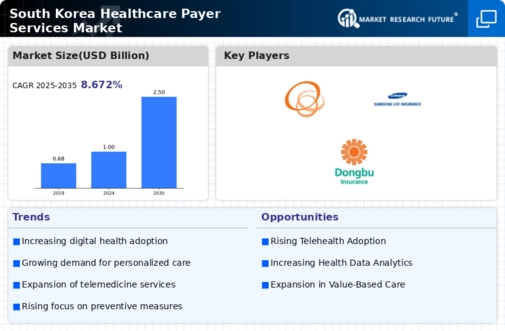

The healthcare payer-services market is experiencing a notable transformation due to rapid technological advancements. Innovations such as artificial intelligence (AI) and machine learning are streamlining claims processing and enhancing fraud detection capabilities. In South Korea, the integration of these technologies is projected to reduce operational costs by approximately 20% over the next five years. Furthermore, telemedicine and digital health platforms are gaining traction, allowing payers to offer more efficient services. This shift not only improves patient engagement but also optimizes resource allocation within the healthcare payer-services market. As technology continues to evolve, it is likely that the market will see increased competition among payers striving to adopt cutting-edge solutions.

Consumer Demand for Personalized Healthcare

The healthcare payer-services market is witnessing a shift in consumer expectations, with a growing demand for personalized healthcare solutions. South Korean consumers are increasingly seeking tailored services that cater to their individual health needs. This trend is prompting payers to invest in data analytics and customer relationship management systems to better understand patient preferences. As a result, the market is likely to see a rise in personalized health plans and wellness programs, which could enhance customer satisfaction and retention rates. It is estimated that personalized healthcare offerings could lead to a 25% increase in market engagement over the next few years.

Integration of Health Information Technology

The integration of health information technology (HIT) is emerging as a pivotal driver in the healthcare payer-services market. In South Korea, the push for interoperability among various healthcare systems is gaining momentum, facilitating seamless data exchange between payers, providers, and patients. This integration is expected to enhance care coordination and improve overall healthcare outcomes. Moreover, the implementation of electronic health records (EHRs) is projected to reduce administrative costs by up to 15%, thereby allowing payers to allocate resources more effectively. As HIT continues to evolve, it is likely to play a crucial role in shaping the future landscape of the healthcare payer-services market.

Aging Population and Chronic Disease Management

The demographic shift towards an aging population in South Korea is a critical driver for the healthcare payer-services market. As the proportion of elderly individuals rises, there is an increasing prevalence of chronic diseases, necessitating more comprehensive healthcare services. This trend is projected to result in a 30% increase in healthcare expenditures by 2030. Payers are thus compelled to adapt their service offerings to meet the growing demand for chronic disease management programs. This adaptation not only enhances patient outcomes but also positions payers to capture a larger share of the market, as they develop tailored solutions for this demographic.

Leave a Comment