Advancements in Imaging Technologies

Technological advancements in optical imaging systems are a driving force behind the growth of the optical imaging market in Spain. Innovations such as high-resolution imaging, improved light sources, and advanced data processing algorithms are enhancing the capabilities of optical imaging devices. These advancements enable healthcare professionals to obtain more accurate and detailed images, which are crucial for effective diagnosis and treatment planning. As of 2025, the market is projected to witness a surge in the adoption of next-generation optical imaging technologies, with an expected market value of €600 million. This trend indicates a strong correlation between technological progress and the expansion of the optical imaging market in Spain.

Rising Prevalence of Chronic Diseases

The optical imaging market in Spain is significantly influenced by the rising prevalence of chronic diseases, such as cardiovascular disorders and cancer. As these conditions become more common, there is an increasing need for effective diagnostic tools that can facilitate early detection and monitoring. Optical imaging technologies, known for their precision and ability to provide real-time imaging, are becoming essential in managing these diseases. In 2025, it is estimated that the market for optical imaging solutions aimed at chronic disease management will account for approximately 30% of the total market share. This growing demand underscores the critical role that optical imaging plays in the healthcare landscape of Spain.

Growing Demand for Non-Invasive Procedures

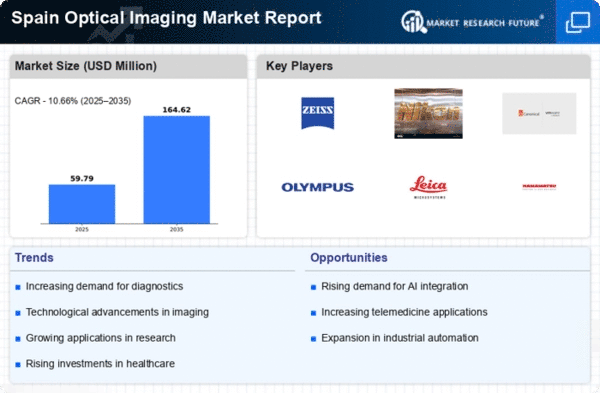

The optical imaging market in Spain experiences a notable increase in demand for non-invasive diagnostic procedures. This trend is driven by a growing awareness among patients and healthcare providers regarding the benefits of non-invasive techniques, which minimize patient discomfort and reduce recovery times. As a result, the market for optical imaging technologies, such as optical coherence tomography and fluorescence imaging, is projected to expand significantly. In 2025, the market is expected to reach approximately €500 million, reflecting a compound annual growth rate (CAGR) of around 8%. This shift towards non-invasive methods is likely to enhance the adoption of optical imaging solutions across various medical specialties, thereby propelling the overall growth of the optical imaging market in Spain.

Growing Research and Development Activities

The optical imaging market in Spain benefits from a robust environment for research and development activities. Academic institutions and private companies are increasingly investing in R&D to explore new applications and improve existing optical imaging technologies. This focus on innovation is likely to lead to the development of novel imaging techniques and products that cater to the evolving needs of the healthcare sector. By 2025, it is projected that R&D expenditures in the optical imaging field will reach €200 million, reflecting a growing commitment to advancing the capabilities of optical imaging solutions. This emphasis on research is expected to drive the market forward, fostering collaboration between academia and industry.

Increased Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure plays a crucial role in the growth of the optical imaging market. The government has allocated substantial funding to modernize healthcare facilities and integrate advanced imaging technologies. This investment is expected to facilitate the adoption of state-of-the-art optical imaging systems, which can improve diagnostic accuracy and patient outcomes. By 2025, it is anticipated that the healthcare sector's expenditure on imaging technologies will exceed €1 billion, with a significant portion directed towards optical imaging solutions. This influx of capital is likely to stimulate innovation and drive the development of new optical imaging applications, further solidifying the market's position in Spain.

Leave a Comment