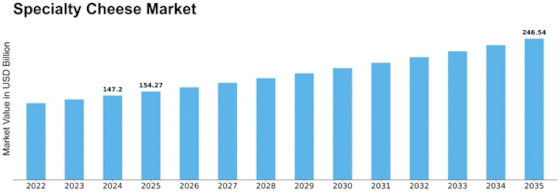

Specialty Cheese Size

Specialty Cheese Market Growth Projections and Opportunities

The specialty cheese market is shaped by a myriad of factors that collectively influence its dynamics. One of the primary drivers is the evolving consumer palate and the increasing demand for unique and artisanal food experiences. Specialty cheeses, characterized by distinctive flavors, textures, and production methods, cater to the growing consumer interest in exploring diverse and high-quality cheese varieties. The desire for premium and indulgent culinary experiences contributes to the popularity of specialty cheeses among consumers seeking unique and flavorful options. Global economic factors also play a significant role in the specialty cheese market. Economic growth, rising disposable incomes, and an expanding middle class contribute to increased consumer spending on premium and gourmet food products, including specialty cheeses. The willingness to invest in high-quality and unique flavors drives the demand for artisanal cheeses, supporting the growth of the specialty cheese market. Cultural influences and culinary traditions are pivotal in shaping the demand for specialty cheeses. Different cultures have distinct cheese-making traditions and preferences, influencing the types of specialty cheeses that are popular in various regions. The rich cultural heritage associated with artisanal cheese production contributes to the regional diversity within the specialty cheese market. Understanding and respecting these cultural nuances are essential for market players to successfully cater to diverse consumer tastes. Government regulations and labeling standards are critical factors in the specialty cheese market. Compliance with regulations related to food safety, quality control, and labeling ensures the authenticity and integrity of specialty cheese products. Adhering to these standards not only meets regulatory requirements but also builds consumer trust in the safety and origin of specialty cheeses, particularly as consumers become more conscious of the provenance of their food. Marketing and branding strategies significantly impact the specialty cheese market, as consumers are increasingly influenced by storytelling and the backstory of food products. Effective marketing campaigns that highlight the unique characteristics, regional origins, and craftsmanship behind specialty cheeses can contribute to increased consumer awareness and appreciation. The storytelling aspect resonates with consumers seeking a connection with the producers and the cultural roots of the specialty cheeses they purchase. Technological advancements in cheese production, aging, and packaging contribute to the efficiency and quality of specialty cheese manufacturing. Innovations in cheese-making techniques, such as precision fermentation and controlled aging environments, help producers achieve consistent quality and unique flavor profiles. Additionally, advancements in packaging technology play a role in preserving the freshness and quality of specialty cheeses, extending their shelf life, and enhancing the overall consumer experience. Environmental sustainability is an emerging consideration in the specialty cheese market. Consumers are increasingly concerned about the environmental impact of food production, including the dairy industry. Market players are responding by exploring sustainable practices, such as responsible sourcing of milk, waste reduction, and eco-friendly packaging solutions. Brands that align with these sustainability values can establish a positive reputation and appeal to environmentally-conscious consumers. Market volatility in terms of milk prices, changes in consumer preferences, and economic fluctuations can significantly impact the specialty cheese market. Fluctuations in the prices of key ingredients, such as milk, may influence production costs and pricing for consumers. Adapting to changing consumer preferences and addressing potential supply chain challenges is crucial for market participants to remain resilient and responsive to market dynamics.

Leave a Comment