Market Analysis

In-depth Analysis of Steam Boiler Market Industry Landscape

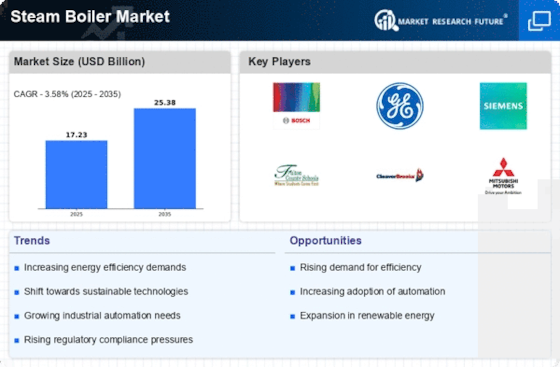

The steam boiler market is a crucial sector within the broader industrial equipment landscape, driven by the need for efficient energy generation and utilization across various industries. Market dynamics within this sector are influenced by several key factors that shape demand, supply, and overall competitiveness.

Firstly, the demand for steam boilers is closely linked to industrial activities such as power generation, chemical processing, food and beverage production, and manufacturing. As these industries expand or contract in response to economic conditions, regulatory requirements, and technological advancements, the demand for steam boilers fluctuates accordingly. For instance, rapid industrialization in emerging economies often spurs demand for steam boilers to meet growing energy needs, while shifts towards renewable energy sources may impact the adoption rate of traditional steam boilers.

Moreover, advancements in steam boiler technology play a significant role in market dynamics. Manufacturers constantly strive to enhance the efficiency, reliability, and environmental sustainability of their products through innovations in design, materials, and combustion systems. This drives competition among market players and influences purchasing decisions based on factors such as energy efficiency ratings, emissions compliance, and maintenance requirements. Additionally, the integration of digitalization and smart technologies into steam boiler systems enables real-time monitoring, predictive maintenance, and optimization of energy usage, further shaping market dynamics.

Furthermore, regulatory frameworks and environmental policies exert considerable influence on the steam boiler market. Governments worldwide implement stringent emission standards and energy efficiency regulations to mitigate environmental impact and promote sustainable development. Compliance with these regulations often necessitates the adoption of advanced boiler technologies, fuel switching, or the implementation of emission control systems, driving market demand for compliant solutions. Additionally, financial incentives and subsidies for renewable energy and energy-efficient equipment may stimulate market growth and influence purchasing decisions.

In addition to technological and regulatory factors, market dynamics are also shaped by macroeconomic trends and geopolitical factors. Economic growth, inflation rates, currency exchange rates, and geopolitical tensions can impact investment decisions, industrial output, and energy demand, thereby influencing the steam boiler market. For example, fluctuations in oil and gas prices affect the cost of fuel for steam boiler operation, prompting end-users to seek alternative fuel sources or invest in energy-saving technologies during periods of volatility.

Moreover, the competitive landscape of the steam boiler market is characterized by the presence of established manufacturers, emerging players, and regional market dynamics. Globalization and trade agreements facilitate the cross-border movement of goods and technology transfer, intensifying competition among market participants. Local market conditions, such as infrastructure development, energy policies, and industrial specialization, also influence the competitive dynamics within specific regions.

Overall, the steam boiler market is subject to a complex interplay of factors that shape demand, supply, and competitiveness. Technological advancements, regulatory frameworks, macroeconomic trends, and competitive forces all contribute to the evolving landscape of this critical industry sector. As stakeholders navigate these dynamics, innovation, sustainability, and market intelligence will be key drivers of success in meeting the evolving needs of industrial energy users.

Leave a Comment