Market Trends

Key Emerging Trends in the Steam Boiler Market

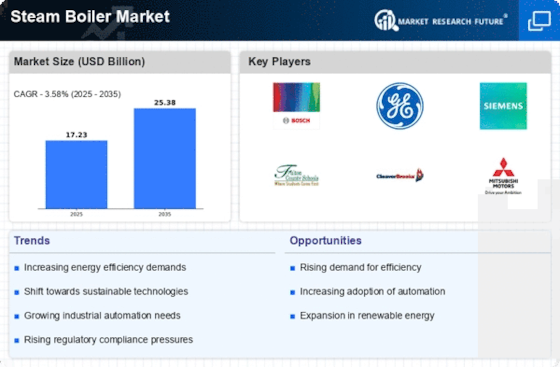

The steam boiler market is experiencing dynamic shifts in recent years, driven by various market trends and technological advancements. One prominent trend is the increasing demand for energy-efficient and eco-friendly boiler solutions. With growing concerns about environmental sustainability, industries are actively seeking boilers that minimize emissions and optimize energy usage. This shift is fueled by stricter regulations and incentives aimed at reducing carbon footprints across sectors. Manufacturers are responding by innovating new designs and incorporating advanced combustion technologies to enhance boiler efficiency while lowering emissions.

Additionally, there's a noticeable trend towards the adoption of modular and compact boiler systems. Industries are seeking flexible solutions that can be easily integrated into existing infrastructure and scaled up or down as needed. Modular boilers offer greater versatility and efficiency, allowing for more customized solutions to meet specific operational requirements. Moreover, their compact design saves valuable space, making them ideal for installations in constrained environments such as urban areas or industrial facilities with limited footprint.

Another key trend in the steam boiler market is the growing popularity of biomass and waste-to-energy boilers. With increasing focus on renewable energy sources and waste management, biomass boilers are gaining traction as sustainable alternatives to traditional fossil fuel boilers. Biomass boilers utilize organic materials such as wood chips, agricultural residues, or municipal solid waste to generate steam, reducing reliance on finite fossil fuels and mitigating environmental impact. This trend aligns with global efforts to transition towards a more sustainable and circular economy, driving investments in bioenergy infrastructure and technologies.

Furthermore, advancements in digitalization and automation are reshaping the steam boiler market landscape. Industrial Internet of Things (IIoT) technologies and predictive maintenance solutions are enabling real-time monitoring and optimization of boiler performance. Remote monitoring capabilities allow operators to efficiently manage boiler operations, identify potential issues, and preemptively address maintenance needs, minimizing downtime and optimizing productivity. Additionally, data analytics and machine learning algorithms are being leveraged to enhance boiler efficiency, optimize fuel consumption, and improve overall operational reliability.

The market is also witnessing a shift towards decentralized and distributed energy systems, driving demand for smaller-scale and onsite boiler installations. Distributed energy solutions offer greater resilience and energy independence by decentralizing power generation and reducing reliance on centralized grid infrastructure. This trend is particularly prevalent in industries such as food processing, chemical manufacturing, and healthcare, where uninterrupted steam supply is critical for operations. Onsite boiler installations provide greater control over energy costs and reliability, offering businesses greater flexibility and security in volatile energy markets.

Moreover, emerging economies are emerging as significant growth markets for steam boilers, driven by rapid industrialization, urbanization, and infrastructure development. Countries in Asia Pacific, Latin America, and Africa are witnessing increasing investments in manufacturing, construction, and power generation sectors, driving demand for steam boilers across various industries. Rising population, expanding middle class, and increasing disposable incomes are fueling demand for consumer goods, automobiles, and construction materials, driving growth in manufacturing and industrial sectors, and consequently, boosting demand for steam boilers.

The steam boiler market is undergoing significant transformation driven by various market trends such as increasing demand for energy-efficient and eco-friendly solutions, adoption of modular and compact boiler systems, growing popularity of biomass and waste-to-energy boilers, advancements in digitalization and automation, shift towards decentralized energy systems, and growth opportunities in emerging economies. Manufacturers and stakeholders in the steam boiler industry need to stay abreast of these trends and innovations to capitalize on emerging opportunities and maintain a competitive edge in the evolving market landscape.

Leave a Comment