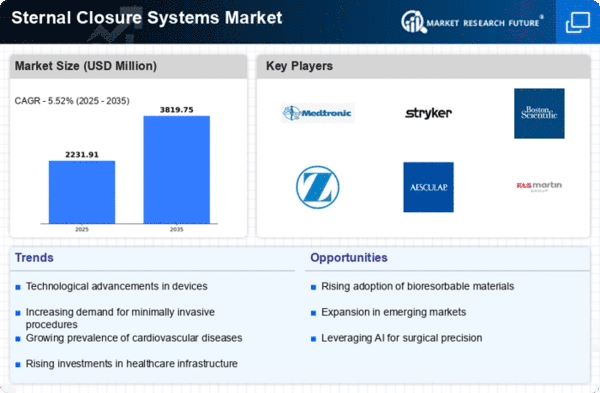

Market Trends and Projections

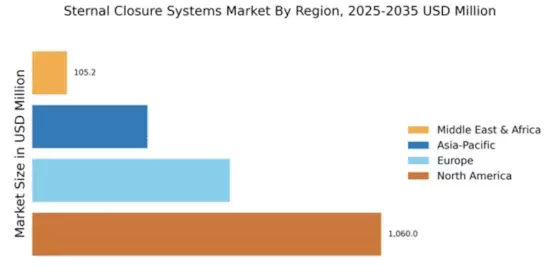

The Global Sternal Closure Systems Market Industry is poised for substantial growth, with projections indicating a market value of 2.12 USD Billion in 2024 and an anticipated increase to 3.82 USD Billion by 2035. The expected CAGR of 5.5% from 2026 to 2035 reflects the ongoing demand for innovative sternal closure solutions. This growth trajectory suggests a robust market environment, driven by factors such as technological advancements, an aging population, and increased awareness of surgical options. The evolving landscape of healthcare and surgical practices will likely continue to shape the dynamics of the sternal closure systems market.

Rising Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases globally drives the demand for effective surgical interventions, thereby propelling the Global Sternal Closure Systems Market Industry. As cardiovascular conditions remain a leading cause of mortality, the need for surgeries such as coronary artery bypass grafting is paramount. In 2024, the market is projected to reach 2.12 USD Billion, reflecting the urgency for advanced sternal closure techniques. The growing awareness of surgical options and the importance of post-operative recovery further enhance the market's growth potential. This trend indicates a sustained demand for innovative sternal closure systems that ensure patient safety and optimal recovery.

Growing Awareness of Surgical Options

Increased awareness of surgical options among patients and healthcare professionals plays a crucial role in shaping the Global Sternal Closure Systems Market Industry. Educational initiatives and patient advocacy programs have heightened understanding of the benefits of surgical interventions for various health conditions. This awareness leads to more patients seeking surgical solutions, thereby driving demand for sternal closure systems. As healthcare providers emphasize the importance of informed decision-making, the market is likely to experience growth. The focus on patient education and engagement may further enhance the adoption of advanced sternal closure technologies, contributing to overall market expansion.

Regulatory Support and Standardization

Regulatory support and standardization in the medical device sector positively impact the Global Sternal Closure Systems Market Industry. Governments and health organizations are increasingly establishing guidelines and standards to ensure the safety and efficacy of surgical products. This regulatory framework fosters innovation and encourages manufacturers to develop advanced sternal closure systems that meet stringent quality requirements. As compliance with these regulations becomes essential, the market may witness an influx of new products designed to enhance surgical outcomes. The emphasis on safety and quality assurance is likely to bolster consumer confidence, further driving market growth.

Technological Advancements in Surgical Techniques

Technological innovations in surgical techniques significantly influence the Global Sternal Closure Systems Market Industry. The introduction of minimally invasive procedures and robotic-assisted surgeries enhances surgical precision and reduces recovery times. These advancements not only improve patient outcomes but also increase the adoption of sternal closure systems. As healthcare providers seek to incorporate cutting-edge technology into their practices, the market is expected to grow. The anticipated CAGR of 5.5% from 2026 to 2035 underscores the potential for further innovation in sternal closure systems, which may lead to more effective and safer surgical interventions.

Aging Population and Increased Surgical Procedures

The global demographic shift towards an aging population contributes to the expansion of the Global Sternal Closure Systems Market Industry. Older adults are more susceptible to cardiovascular diseases and other conditions requiring surgical intervention. As the population aged 65 and older continues to grow, the demand for surgeries that necessitate sternal closure systems is likely to increase. This trend is evident in various regions, where healthcare systems are adapting to accommodate the rising number of surgical procedures. By 2035, the market is projected to reach 3.82 USD Billion, highlighting the significant impact of demographic changes on market dynamics.