Sustained release excipients Market Summary

As per Market Research Future analysis, the Sustained Release Excipients Market Size was estimated at 1.5 USD Billion in 2024. The Sustained Release Excipients industry is projected to grow from USD 1.62 Billion in 2025 to USD 3.498 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 8.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Sustained Release Excipients Market is poised for substantial growth driven by technological advancements and increasing patient-centric solutions.

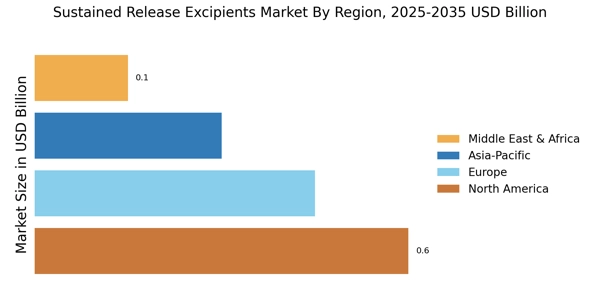

- The market is witnessing a growing demand for patient-centric solutions, particularly in North America, which remains the largest market.

- Advancements in material science are propelling the development of innovative excipients, especially in the Asia-Pacific region, recognized as the fastest-growing market.

- Gelatin continues to dominate the excipients segment, while polymers are emerging as the fastest-growing category due to their versatility.

- The increasing prevalence of chronic diseases and rising investment in research and development are key drivers fueling market expansion.

Market Size & Forecast

| 2024 Market Size | 1.5 (USD Billion) |

| 2035 Market Size | 3.498 (USD Billion) |

| CAGR (2025 - 2035) | 8.0% |

Major Players

BASF SE (DE), Evonik Industries AG (DE), Ashland Global Holdings Inc. (US), Dow Inc. (US), JRS Pharma (DE), Colorcon Inc. (US), FMC Corporation (US), Gattefossé (FR), Merck KGaA (DE), Shin-Etsu Chemical Co., Ltd. (JP)