Research Methodology on Telecom Equipment Market

A comprehensive research methodology is used to analyze the global telecom equipment market and collect the data required to provide accurate insights and understanding of the market size, share, and growth rate. This research is conducted with the application of the following methods:

Research design-

The research design used is a descriptive research design which is used to accurately depict the current state of the market, identifying factors that may affect the growth of the market. Since the study aims to provide an in-depth analysis of the current and expected market trends, a qualitative approach is employed.

Primary Data Collection-

The primary research is conducted utilizing surveys and interviews of relevant experts, industry players, decision-makers, and senior management personnel. This is supplemented with secondary research conducted to gain a clear understanding of the market dynamics, market situation, industry and competitive landscape, and other related factors. The primary data collected and analyzed include real-time and historical customer and market surveys, as well as customer intelligence from key industry players.

Secondary Data Collection-

The secondary sources of data collection for this report include; databases, financial reports, SEC filings, and market reports from renowned publishers. Company websites and reliable news sources are been used to obtain information for the report. The references to the secondary sources used for this research are included in the report.

Market sizing-

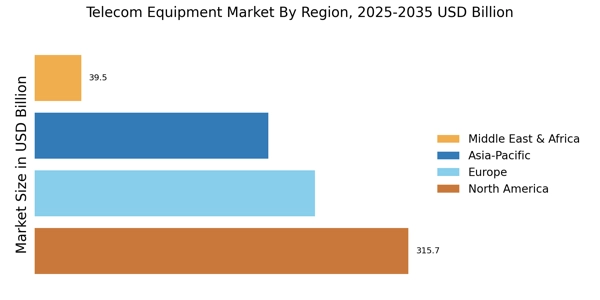

Market sizing is estimated with top-down, bottom-up, and hybrid methods. The bottom-up approach is primarily used to identify the total revenue generated by industry participants, while the top-down approach is used to project the total revenue in the overall market.

Data Triangulation-

Data triangulation is used to validate the collected data in terms of accuracy, precision, and credibility. It is also used to reduce any possible bias or inaccuracies in the data. Data triangulation is conducted by using a combination of different models, databases, and primary research with key market participants.

Market Modelling-

The market model is developed using the data from the triangulated data sources. This includes cross-sectional, time-series, and forecasting models. These models are used to project the total revenue and expected market growth rate of the market, based on certain factors and parameters. The models are then validated based on historical data.

Data Analysis-

After the collection of data through primary and secondary sources, comprehensive data analysis is conducted by an expert team. This is to ensure the data is correctly and accurately portrayed in the report. Advanced analytics methods such as a SWOT and Porter’s five-force analysis are employed to gain a clear understanding of the market and competitive landscape.

Feedback from stakeholders-

Feedback from industry experts and stakeholders is collected throughout the research process and embedded in the report from time to time. This has enabled us to gain insights into the recent developments and market trends that would be useful for the market players in formulating their strategic decisions and ensuring the report does not miss out on any critical insights.