Advancements in Material Science

Innovations in material science are playing a crucial role in shaping the Thermally Conductive Filler Dispersants Market. The development of new materials with enhanced thermal conductivity and dispersion properties is enabling manufacturers to create more efficient thermal management solutions. For instance, the introduction of nanomaterials and advanced polymer composites has led to significant improvements in thermal performance. These advancements not only enhance the effectiveness of thermal interface materials but also expand their applications across various industries, including aerospace and renewable energy. As research continues to yield novel materials, the Thermally Conductive Filler Dispersants Market is likely to witness a surge in product offerings, catering to diverse thermal management needs.

Growth in Renewable Energy Sector

The expansion of the renewable energy sector is contributing to the growth of the Thermally Conductive Filler Dispersants Market. As the world shifts towards sustainable energy sources, there is an increasing need for efficient thermal management solutions in applications such as solar panels and wind turbines. Thermally conductive fillers play a vital role in enhancing the performance and durability of these renewable energy technologies. Market analysis suggests that the renewable energy sector is poised for significant growth, which will likely drive demand for thermally conductive filler dispersants. This trend highlights the importance of thermal management in supporting the transition to a more sustainable energy landscape.

Increasing Applications in Electronics

The proliferation of electronic devices is driving the growth of the Thermally Conductive Filler Dispersants Market. With the rise of high-performance electronics, there is an escalating need for effective thermal management solutions to ensure device reliability and longevity. Thermally conductive fillers are increasingly utilized in applications such as LED lighting, power electronics, and consumer electronics, where efficient heat dissipation is essential. Market data indicates that the electronics sector accounts for a substantial share of the thermally conductive filler market, with expectations of continued growth as technology advances. This trend underscores the importance of thermally conductive filler dispersants in maintaining optimal performance in electronic applications.

Rising Demand for Energy-Efficient Solutions

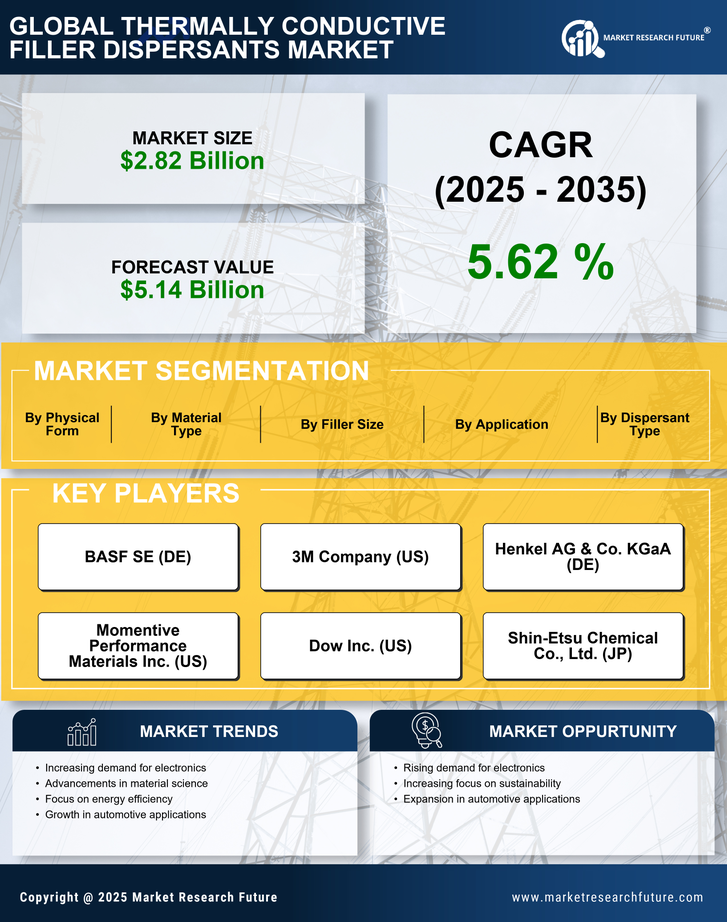

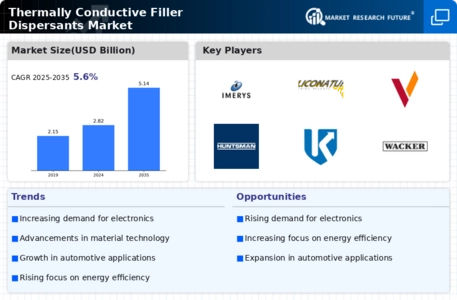

The Thermally Conductive Filler Dispersants Market is experiencing a notable increase in demand for energy-efficient materials. As industries strive to reduce energy consumption and enhance thermal management, the need for effective thermal interface materials becomes paramount. This trend is particularly evident in sectors such as electronics and automotive, where efficient heat dissipation is critical. The market for thermally conductive fillers is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This growth is driven by the increasing adoption of energy-efficient technologies, which necessitate the use of advanced thermal management solutions, thereby propelling the Thermally Conductive Filler Dispersants Market forward.

Regulatory Support for Thermal Management Solutions

Regulatory frameworks aimed at enhancing energy efficiency and reducing environmental impact are influencing the Thermally Conductive Filler Dispersants Market. Governments and regulatory bodies are increasingly promoting the use of materials that improve thermal management in various applications. This support is evident in initiatives that encourage the adoption of energy-efficient technologies across industries, including construction and manufacturing. As regulations become more stringent regarding energy consumption and emissions, the demand for thermally conductive fillers is expected to rise. This regulatory environment not only fosters innovation within the Thermally Conductive Filler Dispersants Market but also encourages manufacturers to develop sustainable and efficient thermal management solutions.