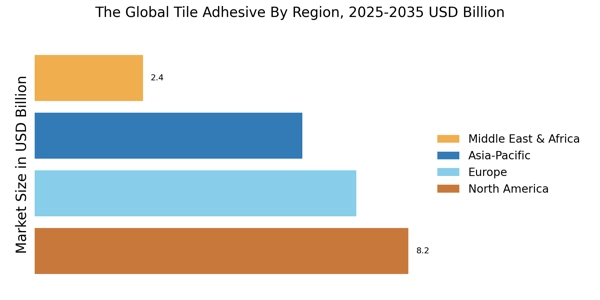

North America : Market Leader in Innovation

North America is the largest market for tile adhesives, holding approximately 35% of the global market share. The region's growth is driven by increasing construction activities, particularly in residential and commercial sectors, alongside a rising demand for eco-friendly products. Regulatory support for sustainable building practices further catalyzes market expansion, with initiatives promoting energy-efficient materials. The United States and Canada are the leading countries in this region, with major players like Laticrete International Inc and Mapei S.p.A. dominating the competitive landscape. The presence of established companies and a focus on innovation in adhesive technologies contribute to a robust market environment, ensuring a steady supply of high-quality products to meet growing consumer demands.

Europe : Diverse Market Dynamics

Europe is the second-largest market for tile adhesives, accounting for around 30% of the global share. The region's growth is propelled by stringent regulations promoting sustainability and energy efficiency in construction. Countries like Germany, France, and Italy remain central to expansion within the germany tile adhesive market and italy tile adhesive market, supported by increasing investments in infrastructure and renovation projects.

Germany leads the market, followed closely by France and Italy, with key players such as Henkel AG and Bostik significantly influencing the competitive landscape. The focus on innovative and environmentally friendly products is reshaping market dynamics, as manufacturers adapt to changing consumer preferences and regulatory requirements. This competitive environment fosters continuous improvement and product development.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the tile adhesive market, driven by urbanization and increasing construction activities. The region holds approximately 25% of the global market share, with strong momentum across the china tile adhesive market, india tile adhesive market, and japan tile adhesive market. . Government initiatives to boost infrastructure development and housing projects are significant catalysts for market expansion, alongside a growing preference for high-performance adhesives.

China is the largest market in this region, with India following closely. The competitive landscape is characterized by the presence of both local and international players, including Sika AG and Ardex GmbH. The focus on innovation and product differentiation is crucial as manufacturers strive to meet the diverse needs of a rapidly growing consumer base, ensuring a dynamic market environment.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant player in the tile adhesive market, holding about 10% of the global share. The growth is primarily driven by substantial investments in infrastructure projects and a booming construction sector, particularly in countries like the UAE and South Africa, strengthening the broader gcc tile adhesive market.

The UAE is leading the market, with South Africa also showing promising growth. Key players such as Fischer and Weber are establishing a strong presence, focusing on innovative solutions tailored to local market needs.

The competitive landscape is evolving, with an increasing number of manufacturers entering the market to capitalize on the growing demand for tile adhesives in construction and renovation projects, similar to expansion trends seen in the brazil tile adhesive market and mexico tile adhesive market.