Toxicology Drug Screening Market Summary

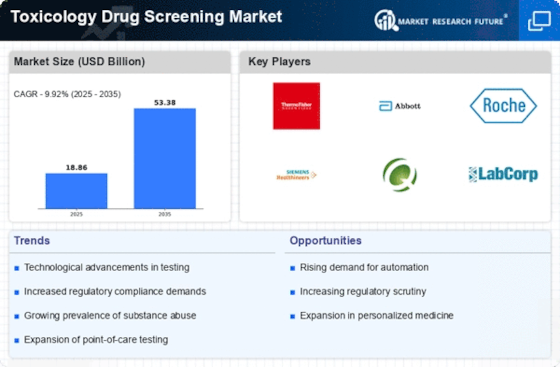

As per Market Research Future analysis, the Toxicology Drug Screening Market Size was estimated at 18.86 USD Billion in 2024. The Toxicology Drug Screening industry is projected to grow from 20.73 USD Billion in 2025 to 53.38 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.92% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Toxicology Drug Screening Market is experiencing robust growth driven by technological advancements and increasing regulatory compliance.

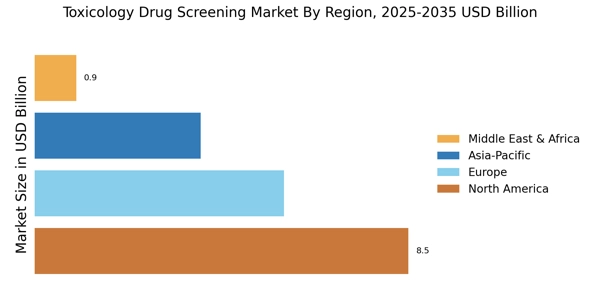

- North America remains the largest market for toxicology drug screening, driven by stringent regulatory requirements and high substance abuse rates.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rising awareness of health risks and preventive healthcare initiatives.

- Monitoring and Logging segments dominate the market, while the Security segment is witnessing rapid growth due to heightened workplace drug testing.

- Key market drivers include rising substance abuse rates and increased workplace drug testing, which are propelling demand for advanced screening technologies.

Market Size & Forecast

| 2024 Market Size | 18.86 (USD Billion) |

| 2035 Market Size | 53.38 (USD Billion) |

| CAGR (2025 - 2035) | 9.92% |

Major Players

Thermo Fisher Scientific (US), Abbott Laboratories (US), Roche Diagnostics (CH), Siemens Healthineers (DE), Quest Diagnostics (US), LabCorp (US), PerkinElmer (US), Bio-Rad Laboratories (US), Mayo Clinic Laboratories (US)

.png)