Shift Towards Sustainable Practices

The Genetic Toxicology Testing Market is witnessing a notable shift towards sustainable practices, driven by growing environmental concerns and the need for eco-friendly testing methods. Companies are increasingly adopting alternative testing strategies that minimize animal use and reduce environmental impact. This transition is not only aligned with ethical considerations but also meets the demands of consumers and regulatory bodies advocating for sustainability. The market for alternative testing methods is projected to expand significantly, with estimates suggesting a growth rate of 6% per year. This shift is indicative of a broader trend within the industry, where sustainability is becoming a key driver of innovation and market growth.

Rising Awareness of Genetic Disorders

The increasing prevalence of genetic disorders is propelling the Genetic Toxicology Testing Market forward. As awareness of these disorders grows, there is a heightened demand for testing to identify potential genetic risks associated with various substances. This trend is particularly evident in the pharmaceutical sector, where companies are prioritizing genetic toxicology testing to ensure the safety of new drugs. The market is expected to see a growth rate of approximately 7.5% annually, as stakeholders recognize the importance of early detection and risk assessment in mitigating the impact of genetic disorders. This rising awareness is fostering a proactive approach to genetic safety, thereby enhancing the overall efficacy of drug development.

Regulatory Compliance and Safety Assessments

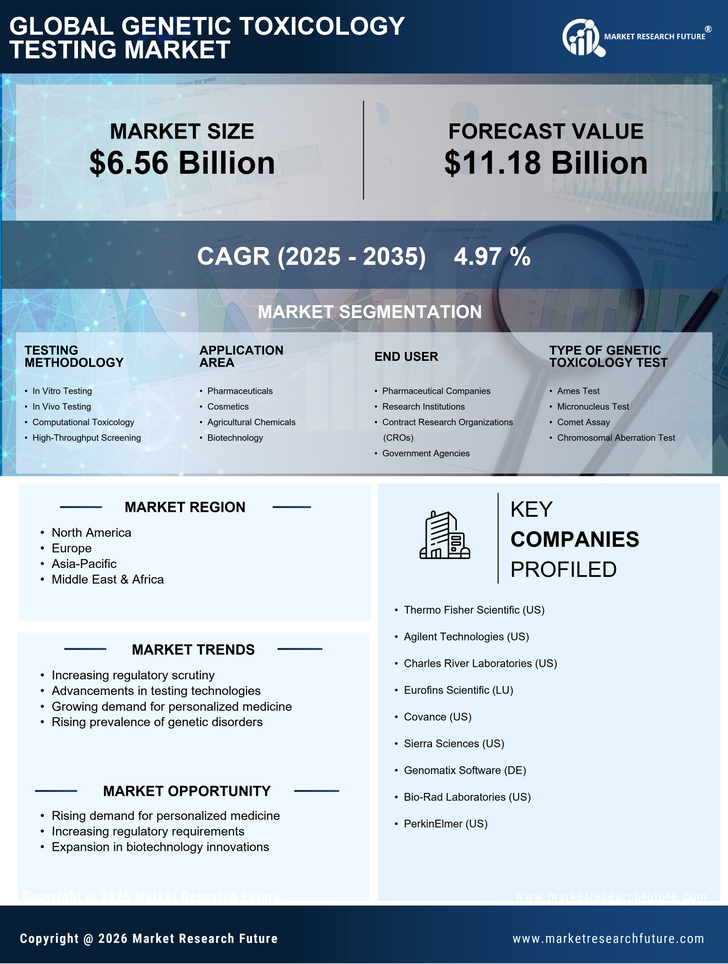

The Genetic Toxicology Testing Market is experiencing a surge in demand due to stringent regulatory requirements imposed by various health authorities. These regulations necessitate comprehensive safety assessments for pharmaceuticals and chemicals, ensuring that products do not pose genetic risks. As a result, companies are increasingly investing in genetic toxicology testing to comply with these regulations. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years, driven by the need for compliance with evolving safety standards. This trend underscores the importance of genetic toxicology testing in the development and approval processes of new drugs and chemicals, thereby enhancing consumer safety and trust.

Technological Advancements in Testing Methods

Innovations in testing methodologies are significantly influencing the Genetic Toxicology Testing Market. The advent of high-throughput screening techniques and advanced in vitro models has revolutionized the way genetic toxicity is assessed. These technologies not only enhance the accuracy and efficiency of testing but also reduce the time and costs associated with traditional methods. For instance, the integration of artificial intelligence in data analysis is streamlining the interpretation of results, leading to faster decision-making in drug development. As these technological advancements continue to evolve, they are expected to propel the market forward, with an anticipated growth rate of around 8% annually, reflecting the increasing reliance on sophisticated testing solutions.

Increased Investment in Research and Development

Investment in research and development (R&D) is a critical driver of the Genetic Toxicology Testing Market. Pharmaceutical and biotechnology companies are allocating substantial resources to R&D initiatives aimed at improving testing methodologies and understanding genetic toxicity mechanisms. This focus on innovation is essential for developing safer products and meeting regulatory requirements. The market is projected to grow at a CAGR of around 7% as companies strive to enhance their testing capabilities and expand their product portfolios. Increased R&D investment not only fosters technological advancements but also strengthens the competitive landscape, enabling companies to better address the complexities of genetic toxicology.