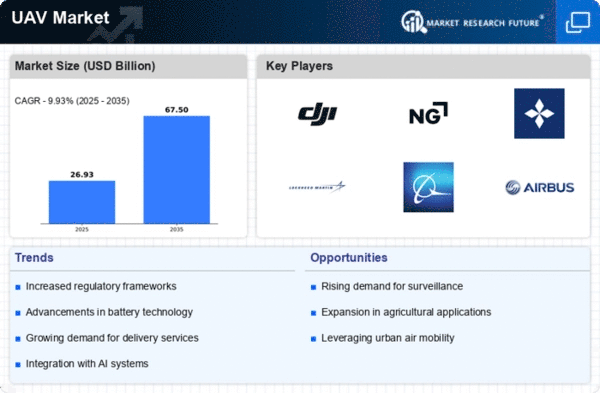

The UAV Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand across various sectors, including defense, agriculture, and logistics. Major players such as DJI (CN), Northrop Grumman (US), and General Atomics (US) are strategically positioned to leverage innovation and partnerships to enhance their market presence. DJI (CN) focuses on consumer and commercial applications, emphasizing product innovation and user-friendly technology, while Northrop Grumman (US) and General Atomics (US) concentrate on defense and military applications, investing heavily in R&D to develop advanced UAV systems that meet evolving security needs. Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological prowess and strategic collaborations.

Key business tactics within the UAV Market include localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with a mix of established players and emerging startups. This fragmentation allows for diverse offerings and innovation, yet the influence of key players remains substantial, as they set industry standards and drive technological advancements.

In November 2025, Northrop Grumman (US) announced a partnership with a leading AI firm to integrate advanced machine learning capabilities into its UAV systems. This strategic move is likely to enhance the operational efficiency and decision-making capabilities of their drones, positioning Northrop Grumman as a frontrunner in the defense UAV segment. The integration of AI is expected to streamline operations and improve mission outcomes, reflecting a broader trend towards automation in the UAV sector.

In October 2025, General Atomics (US) unveiled a new line of UAVs designed specifically for maritime surveillance. This launch is significant as it addresses the growing need for advanced surveillance capabilities in maritime environments, particularly in light of increasing geopolitical tensions. By expanding its product offerings, General Atomics aims to capture a larger share of the defense market, indicating a strategic focus on niche applications that require specialized UAV solutions.

In September 2025, Airbus (FR) announced the successful completion of a trial for its new hybrid UAV technology, which combines electric and fuel-based propulsion systems. This innovation is poised to enhance flight endurance and reduce operational costs, aligning with the industry's shift towards sustainability. Airbus's commitment to developing eco-friendly UAV solutions reflects a growing trend among manufacturers to prioritize environmental considerations in their product development strategies.

As of December 2025, the UAV Market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident, suggesting that future competitive advantages will hinge on the ability to innovate and adapt to changing market demands.

Leave a Comment