UAV Navigation System Market Summary

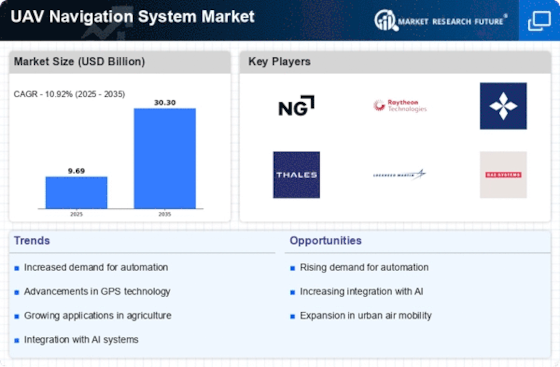

As per MRFR analysis, the UAV Navigation System Market was estimated at 9.69 USD Billion in 2024. The UAV Navigation System industry is projected to grow from 10.75 USD Billion in 2025 to 30.3 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.92 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The UAV Navigation System Market is poised for substantial growth driven by technological advancements and increasing applications across various sectors.

- The integration of AI and machine learning is transforming UAV navigation systems, enhancing their operational efficiency.

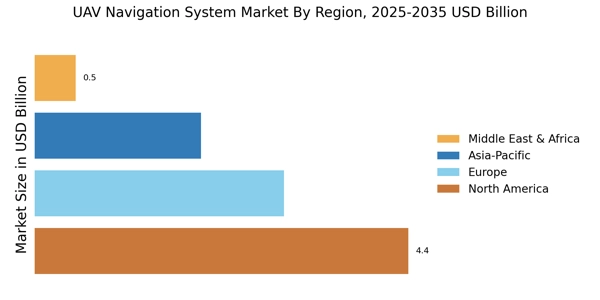

- North America remains the largest market for UAV navigation systems, while Asia-Pacific is emerging as the fastest-growing region.

- The military segment continues to dominate the market, whereas the agriculture segment is experiencing rapid growth due to increased UAV adoption.

- Technological advancements and rising demand for UAVs in various industries are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 9.69 (USD Billion) |

| 2035 Market Size | 30.3 (USD Billion) |

| CAGR (2025 - 2035) | 10.92% |

Major Players

Northrop Grumman (US), Raytheon Technologies (US), General Atomics (US), Thales Group (FR), Lockheed Martin (US), BAE Systems (GB), Elbit Systems (IL), Leonardo (IT), AeroVironment (US)

Leave a Comment