Rising Fitness Culture

The increasing emphasis on fitness and wellness in the UK appears to be a primary driver for the sports drink market. As more individuals engage in regular physical activities, the demand for beverages that replenish electrolytes and provide energy has surged. Recent data indicates that approximately 30% of the UK population participates in some form of regular exercise, which correlates with a heightened interest in sports drinks. This trend is particularly evident among younger demographics, who are more likely to seek out products that support their active lifestyles. Consequently, brands are responding by developing formulations that cater to this health-conscious consumer base, thereby expanding their market presence. The sports drink market is likely to continue benefiting from this cultural shift towards fitness, as consumers increasingly prioritize hydration and performance enhancement in their beverage choices.

Focus on Functional Ingredients

The sports drink market is witnessing a growing trend towards functional ingredients that offer additional health benefits. Consumers are increasingly seeking products that not only hydrate but also provide nutritional value, such as added vitamins, minerals, and natural extracts. This shift is indicative of a broader trend towards holistic health, where consumers are more discerning about what they consume. Recent surveys suggest that over 40% of UK consumers are willing to pay a premium for sports drinks that contain functional ingredients. Brands are responding by reformulating their products to include these sought-after components, thereby enhancing their appeal. This focus on functionality is likely to drive innovation within the sports drink market, as companies strive to differentiate themselves in a competitive landscape.

Innovative Marketing Strategies

The sports drink market in the UK is experiencing a transformation driven by innovative marketing strategies. Brands are leveraging social media platforms and influencer partnerships to reach a broader audience, particularly among younger consumers. This approach not only enhances brand visibility but also fosters a community around fitness and hydration. Recent statistics suggest that nearly 70% of consumers aged 18-34 are influenced by social media when making purchasing decisions. As a result, companies are investing in targeted advertising campaigns that highlight the benefits of their products, such as improved performance and recovery. This shift in marketing tactics is likely to attract new customers and retain existing ones, thereby propelling growth within the sports drink market. The emphasis on engaging storytelling and relatable content may further solidify brand loyalty among consumers.

Increased Availability of Products

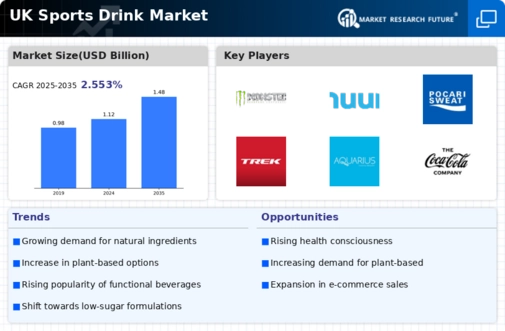

The expansion of distribution channels is a notable driver for the sports drink market in the UK. With the rise of e-commerce and the proliferation of convenience stores, consumers now have greater access to a variety of sports drink options. Recent data indicates that online sales of sports drinks have increased by over 25% in the past year, reflecting a shift in consumer purchasing habits. This increased availability not only caters to the growing demand for hydration solutions but also allows brands to reach a wider audience. Retailers are also diversifying their product offerings, ensuring that consumers can find both traditional and innovative sports drinks in their local stores. As the market continues to evolve, the convenience of purchasing these products is likely to play a crucial role in driving sales and expanding the consumer base.

Growing Demand for Natural Products

The sports drink market is increasingly influenced by the rising consumer preference for natural and organic products. As awareness of health and wellness continues to grow, many consumers are gravitating towards beverages that are free from artificial additives and preservatives. Recent market analysis indicates that sales of natural sports drinks have surged by approximately 15% in the last year, reflecting this shift in consumer behavior. Brands are responding by reformulating their offerings to include natural sweeteners and ingredients, appealing to the health-conscious demographic. This trend not only aligns with consumer values but also positions brands favorably in a market that is becoming more competitive. The emphasis on natural products is likely to shape the future of the sports drink market, as consumers increasingly prioritize transparency and quality in their beverage choices.