Emergence of Innovative Business Models

The virtual mobile-infrastructure market is being driven by the emergence of innovative business models that leverage mobile technology. Companies are increasingly adopting subscription-based services and pay-as-you-go models, allowing for greater flexibility and cost efficiency. This shift is particularly appealing to small and medium-sized enterprises (SMEs) in the UK, which may lack the resources for traditional infrastructure investments. As these businesses seek scalable solutions, the virtual mobile-infrastructure market is expected to grow. The adaptability of mobile infrastructure to various business needs positions it as a viable option for organisations looking to innovate and remain competitive.

Rising Demand for Remote Work Solutions

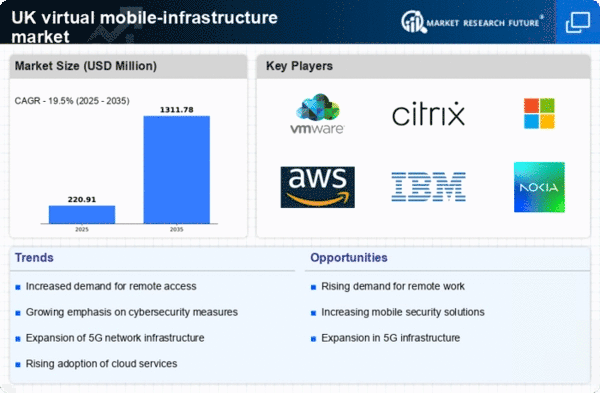

The virtual mobile-infrastructure market is experiencing a notable surge in demand for remote work solutions. As businesses in the UK increasingly adopt flexible working arrangements, the need for robust mobile infrastructure becomes paramount. According to recent data, approximately 40% of UK employees now work remotely at least part-time, necessitating reliable access to corporate resources from various locations. This shift is driving investments in virtual mobile infrastructure, enabling seamless connectivity and collaboration. Companies are prioritising solutions that enhance productivity while ensuring data security. The virtual mobile-infrastructure market is positioned to grow as organizations seek to effectively support their remote workforce.

Advancements in Mobile Network Technologies

The virtual mobile-infrastructure market is significantly influenced by advancements in mobile network technologies. The rollout of 5G networks across the UK is enhancing mobile connectivity, allowing for faster data transfer and improved user experiences. This technological evolution is expected to boost the adoption of virtual mobile infrastructure solutions, as businesses leverage the increased bandwidth and reduced latency. Reports indicate that 5G could potentially increase mobile data traffic by up to 1000% by 2025, creating a fertile environment for the virtual mobile-infrastructure market to thrive. Companies are likely to invest in infrastructure that can harness these advancements to improve operational efficiency.

Growing Emphasis on Data Privacy Regulations

The virtual mobile-infrastructure market is being shaped by the growing emphasis on data privacy regulations in the UK. With the implementation of stringent data protection laws, businesses are compelled to adopt solutions that ensure compliance while safeguarding sensitive information. The virtual mobile-infrastructure market is likely to benefit from this trend, as organisations seek to implement secure mobile solutions that align with regulatory requirements. The Information Commissioner's Office (ICO) has reported a rise in data breach incidents, prompting companies to invest in infrastructure that mitigates risks. This focus on compliance and security is expected to drive growth in the virtual mobile-infrastructure market.

Increased Investment in Digital Transformation

The virtual mobile-infrastructure market is seeing increased investment in digital transformation initiatives across various sectors in the UK. As organisations strive to enhance operational efficiency and customer engagement, they are turning to virtual mobile infrastructure as a key enabler. A recent survey indicated that over 60% of UK businesses plan to increase their digital transformation budgets in the coming year. This trend suggests a growing recognition of the importance of mobile solutions in achieving strategic objectives. Consequently, the virtual mobile-infrastructure market is likely to expand as companies seek to modernise their operations and improve service delivery.