Urinalysis Test Market Summary

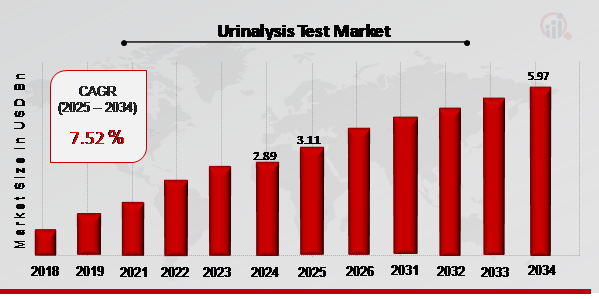

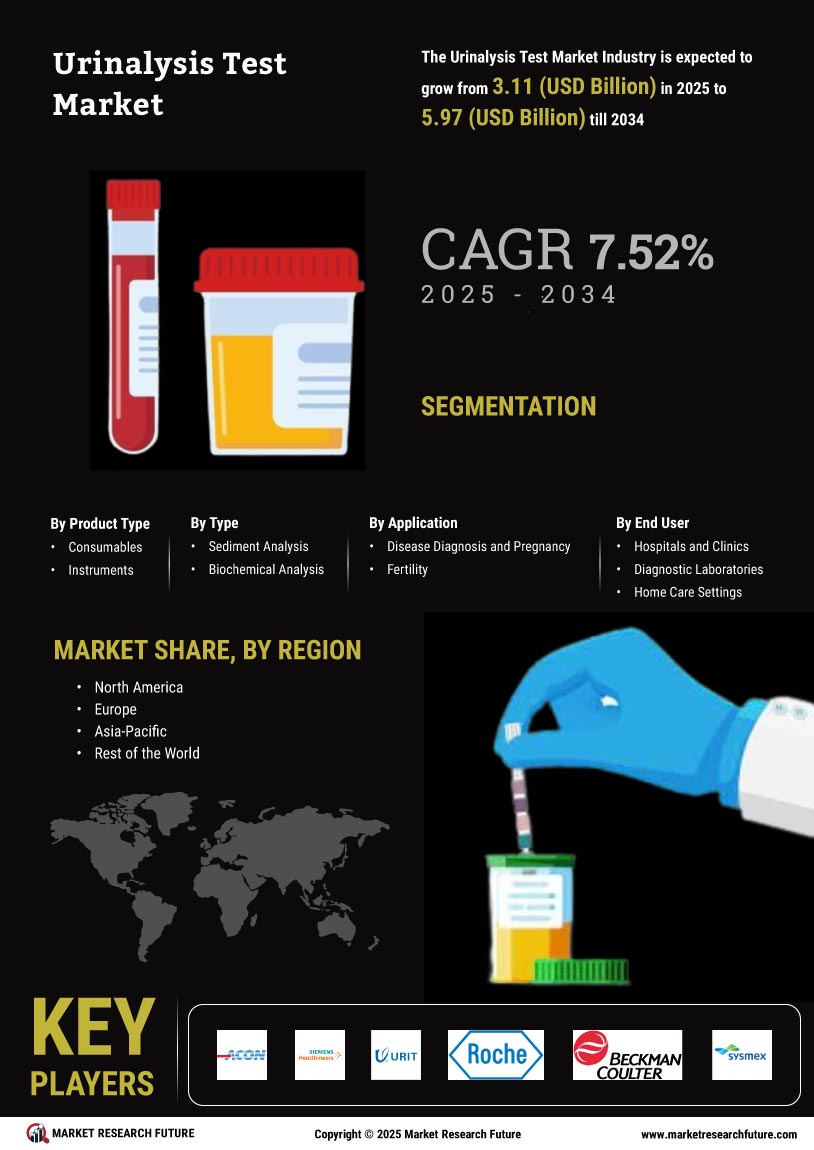

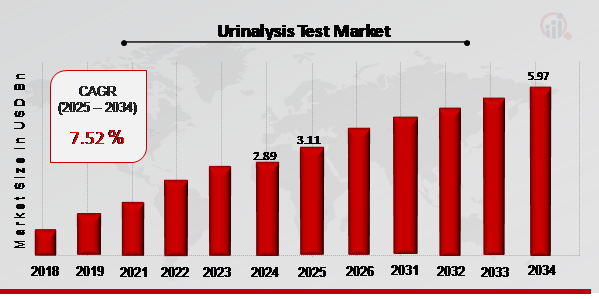

As per Market Research Future Analysis, the Urinalysis Test Market was valued at USD 2.89 Billion in 2024 and is projected to grow to USD 5.97 Billion by 2034, with a CAGR of 7.52% from 2025 to 2034. Key drivers include an increasing elderly population and rising urinary tract infections. The market is bolstered by advancements in medical equipment, improved healthcare infrastructure, and a growing demand for home testing kits. Government initiatives for early disease detection and the rising importance of preventive healthcare further enhance market growth. Notably, innovative research, such as a device for brain tumor detection using urine, highlights the market's potential for technological advancements.

Key Market Trends & Highlights

The Urinalysis Test Market is experiencing significant growth driven by various factors.

- The market is expected to grow from USD 3.11 Billion in 2025 to USD 5.97 Billion by 2034.

- Around 150 million people globally experience urinary tract infections annually, driving demand.

- The Biochemical Analysis segment dominated the market in 2022 and is projected to grow faster during 2022-2030.

- Diagnostic Laboratories held the largest market share in 2022, driven by the increasing prevalence of age-related disorders.

Market Size & Forecast

2024 Market Size: USD 2.89 Billion

2025 Market Size: USD 3.11 Billion

2034 Market Size: USD 5.97 Billion

CAGR (2025-2034): 7.52%

Largest Regional Market Share in 2022: North America.

Major Players

Key players include ACON Laboratories (US), Siemens Healthineers (Germany), URIT Medical Electronic Ltd (China), Roche Diagnostics, Beckman Coulter (US), Sysmex Corporation (Japan), DIRUI (China), and Arkray Inc. (Japan).

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Key industry drivers boosting market expansion include the rising number of persons over the age of 65 and the prevalence of urinary tract infections. The urinalysis test market has benefited from the development and expansion of the medical equipment sector, which produces urinalysis products including urine analyzers and pregnancy testing tools. The availability of improved healthcare infrastructure, the rise in unmet healthcare needs, the rising prevalence of chronic diseases like diabetes, and the surge in demand for urine analyzers, strips, and control solutions are all expected to drive the growth of the urinalysis test market in untapped, emerging markets.

In addition, the need for better healthcare services and the government's heavy investments in healthcare infrastructure have led to rapid growth in the healthcare sector in emerging nations. Due to an increase in consumers' preference for online buying over more conventional purchasing methods, e-commerce (or electronic commerce) has become an indispensable tool for businesses of all sizes around the world. Additionally, this helps the market expand. Diseases including those affecting the urinary tract and the kidneys can be detected early with the help of government-sponsored screening programs.

In addition, the growing relevance of preventive healthcare and the frequency of chronic diseases have increased the demand for technologically sophisticated urinalysis instruments. With the help of these gadgets, patients may keep tabs on their health without having to make as many trips to the doctor's office. As a result, the market has expanded. The rising importance of preventative care and early diagnosis in the healthcare system also bodes well for the urinalysis test market.

February 2023,

Researchers at Japan's Nagoya University claim to have created a device that can use a patient's urine to determine whether or not they have a brain tumor by analyzing a certain membrane protein. Because this protein can be measured noninvasively, it may one day be utilized to spot tumors in the brain at an early enough stage that they can be surgically removed. Survival rates for those diagnosed with brain tumors have remained almost stable for over 30 years, according to research conducted by Nagoya University.

Cell-free DNA (cfDNA) in urine was captured and released onto nanowire surfaces using a method developed by the study team.

Urinalysis Test Market Trends

Urinary Tract Infections are becoming more common to boost the market growth. Governments also implement screening initiatives to diagnose illnesses like renal and urinary disorders early. For instance, 12,497 students from primary and secondary schools in Pingyang, Cangnan, and Yongjia in Wenzhou, China, were screened for urinalysis under school urinary analysis programs. The detection rate for urine abnormalities was 36% in primary and 95% in secondary school students. The demand for urinalysis tests is anticipated to increase as these programs increase.

The segment's growth is influenced by increased investment in creating urine testing kits for use at home to diagnose diseases. For instance, Vivoo raised USD 6 million in November 2021 to develop at-home urine tests that offer dietary and lifestyle recommendations. Developing nations with high price sensitivity favored inexpensive but equally functional analyzers for routine urinalysis tests. Therefore, creating inexpensive urinalysis tests is anticipated to drive market expansion and has enhanced the Urinalysis Test market CAGR across the globe in recent years.

Urinalysis Test Market Segment Insights

Urinalysis Test Product Type Insights

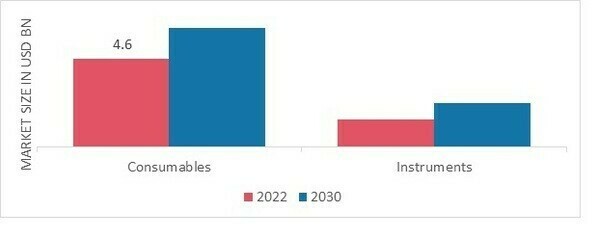

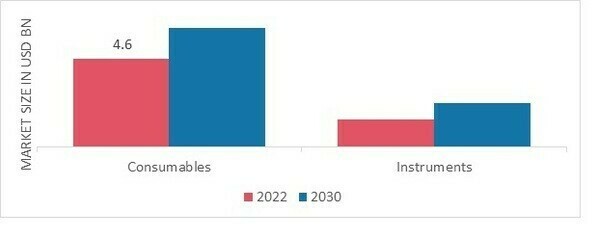

The Urinalysis Test Market segmentation, based on Product type, includes Consumables and Instruments. The Consumables segment held the majority share in 2022 contribution concerning the Urinalysis Test Market revenue. There are many reputable companies, including Siemens Healthcare GmBH. Abbott and Roche offer high-quality consumables for urinalysis testing, which is anticipated to spur the segment's growth. For instance, Multistix 10 SG Reagent Strips are provided by Siemens Healthcare GmBH for the diagnosis of kidney, Diabetes, and UTI. The introduction of new urinalysis instruments and an increase in approvals are anticipated to fuel market expansion.

Figure 1: Urinalysis Test Market, by Product Types, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Urinalysis Test Type Insights

The Urinalysis Test Market segmentation, based on Test type, includes Sediment Analysis and Biochemical Analysis. The Biochemical Analysis segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is because it rapidly develops and is essential to drug discovery and research. Methods of Biochemical Analysis offers a dependable, recurring review of the most recent developments in biochemical analysis implants for Urinalysis Test positively impact the market growth.

Urinalysis Test Application Insights

The Urinalysis Test Market data has been bifurcated by Application into Disease Diagnosis, Pregnancy, and Fertility. The Disease Diagnosis and Pregnancy segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period 2022-2030. This is due to the increasing prevalence of UTIs in the world. Around 150 million people worldwide experience urinary tract infections each year, according to the National Library of Medicine. Throughout the forecast period, the diabetes market is anticipated to expand at a lucrative CAGR. An essential screening procedure to identify diabetes is a urinalysis.

The CDC estimates that approximately 37.3 million people will live in the U.S. in 2022. S. affected by diabetes. There are 8.5 million people who have not yet received a diagnosis, compared to 28.7 million people who have. Consequently, a key market driver is the growing population of diabetic patients.

Urinalysis Test End User Insights

Based on End Users, the Global Urinalysis Test industry has been segmented into Hospitals and Clinics, Diagnostic Laboratories, and Home Care Settings. Diagnostic Laboratories held the largest segment share in 2022, It is anticipated that as the senior population grows, the prevalence of age-related disorders like diabetes, liver disease, and renal disease will increase significantly, further accelerating the market's expansion. Growing rates of urinary tract infections (UTIs) in developing economies are one of the main factors driving the market forward. UTIs (urinary tract infections) can spread to the kidneys and complicate pregnancies, increasing market demand if untreated.

Additionally, the 13.3 million individuals who experience acute kidney injury (AKI) annually are at risk of developing chronic kidney disease (CKD) or renal failure in the upcoming years, which is expected to fuel market growth further.

December 2022:

Recent research from Shanghai Jiao Tong University reveals that the discovery of a biomarker in urine for early-stage Alzheimer's disease (AD) is the first step toward the creation of a simple and inexpensive test. Researchers observed that people with AD, including those with subjective cognitive loss, had considerably greater amounts of formic acid, a metabolic product of formaldehyde present in urine, than people without AD.

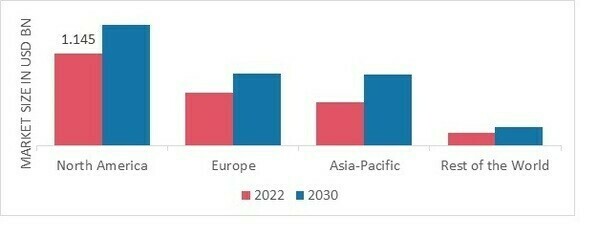

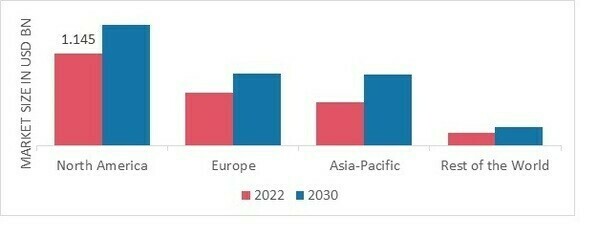

Urinalysis Test Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America Urinalysis Test market accounted for USD 1.145 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. This dominance can be attributed to strategic actions taken by important players, like licensing agreements to increase business footprint. For instance, Sysmex and Siemens Healthcare GmbH signed an exclusive licensing agreement in 2020 to distribute and support the automated urine analyzer CLINITEK Novus to North America's hospitals and reference laboratories.

The market will grow as a result of this agreement.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: URINALYSIS TEST MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe’s Urinalysis Test market accounts for the second-largest market share due to the availability of cutting-edge treatment facilities, government backing for the growth of the healthcare industry, an aging population, and an increase in the incidence of degenerative disc disease, rheumatoid arthritis, and osteoarthritis. Further, the Germany Urinalysis Test market held the largest market share, and the UK Urinalysis Test market was the fastest-growing market in the European region.

The Asia-Pacific Urinalysis Test Market is expected to grow at the fastest CAGR from 2022 to 2030. VSI Electronics Pvt. Ltd. and other domestic urine analyzer producers. Some key elements driving the regional market growth are the presence of a sizable patient base with unmet clinical needs, the increasing adoption of advanced urine analyses, Ltd. and Medical Equipment India, and these three factors combined. Moreover, China’s Urinalysis Test market held the largest market share, and the India Urinalysis Test market was the fastest-growing market in the Asia-Pacific region.

Urinalysis Test Key Market Players & Competitive Insights

Major market players are spending much money on R&D to increase their product lines, which will help the Urinalysis Test market grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Urinalysis Test industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies manufacturers adopt in the Global Urinalysis Test industry to benefit clients and expand the market sector is manufacturing locally to reduce operating costs. The Urinalysis Test industry has provided medicine with some of the most significant benefits in recent years. The Urinalysis Test markets major players such as ACON Laboratories (US), Siemens Healthineers (Germany), URIT Medical Electronic Ltd (China), Roche Diagnostics (Switzerland), Beckman Coulter (US), Sysmex Corporation (Japan), DIRUI (China), Arkray Inc. (Japan),77 Elektronika Kft (Hungary) and others are working on expanding the market demand by investing in research and development activities.

DIRUI (China) With ongoing research and development, DIRUI began manufacturing urine strips in 1992. Today, the company's product portfolio includes 8 product lines for biochemistry, urinalysis, hematology, chemiluminescence immunoassay, gynecology, and blood coagulation analysis. Future predictions include the emergence of new disciplines like spectrometry and POCT. We offer customized laboratory solutions that can satisfy different customer needs. In more than 120 countries and regions, hospitals, reference labs, and other medical facilities use DIRUI diagnostic systems. All of DIRUI's products are CE certified, and some of them also hold FDA certification.

The company is an ISO 13485 and ISO 9001 certified manufacturer. In the international IVD market, DIRUI has successfully built a solid reputation. DIRUI provides the best platform for all employees and partners thanks to its top-notch manufacturing, research, and development capabilities. Currently, 1,700 of us are working toward a common objective: to become a premier provider of complete laboratory solutions, supporting human healthcare, enhancing life quality, and maximizing benefits for all.

Also, Beckman Coulter (US), leading the way globally in clinical diagnostics, Beckman Coulter Diagnostics has pushed the boundaries for more than 80 years to elevate the diagnostic laboratory's contribution to patient health. Our team's passion and creativity, along with the power of science and technology, are used to reimagine healthcare, one diagnosis at a time relentlessly. Our diagnostic solutions are used in intricate clinical testing in hospitals, reference labs, and doctor's offices worldwide. We are here to provide better, quicker diagnostic solutions that help us move from the present to the future.

We accelerate care by utilizing a broad clinical menu, scalable lab automation technologies, insightful clinical informatics, and lab performance optimization services.

Key Companies in the Urinalysis Test market include

- ACON Laboratories (US)

- Siemens Healthineers (Germany)

- URIT Medical Electronic Ltd (China)

- Roche Diagnostics

- Beckman Coulter (US)

- Sysmex Corporation (Japan)

- DIRUI (China)

- Arkray Inc. (Japan)

- 77 Elektronika Kft (Hungary)

- Cardinal Health (US)

- Quidel Corporation (US)

- Bio-Rad Laboratories (US)

Urinalysis Test Industry Developments

-

Q2 2024: Abbott Launches New CLINITEST Rapid COVID-19 Antigen Self-Test with Urinalysis Integration in Europe Abbott announced the launch of its new CLINITEST Rapid COVID-19 Antigen Self-Test, which now features integrated urinalysis capabilities for broader point-of-care diagnostics, expanding its product portfolio in the European market.

-

Q1 2024: Siemens Healthineers Unveils Atellica UAS 800 Urinalysis Analyzer in North America Siemens Healthineers launched the Atellica UAS 800, an advanced automated urinalysis analyzer, in the North American market, aiming to improve laboratory workflow and diagnostic accuracy.

-

Q2 2024: Sysmex Launches UF-1500 Fully Automated Urinalysis Analyzer Globally Sysmex Corporation announced the global launch of the UF-1500, a fully automated urinalysis analyzer designed for mid-sized laboratories, enhancing its diagnostic solutions portfolio.

-

Q3 2024: ARKRAY Opens New Manufacturing Facility for Urinalysis Reagents in India ARKRAY, Inc. inaugurated a new manufacturing facility in India dedicated to the production of urinalysis reagents, aiming to meet growing demand in South Asia and improve supply chain resilience.

-

Q2 2024: Roche Receives CE Mark for Cobas 6500 Urinalysis Work Area Roche announced that its Cobas 6500 urinalysis work area received CE Mark approval, allowing the company to market the fully automated system across the European Economic Area.

-

Q1 2024: QuidelOrtho Launches Sofia Q Urinalysis Analyzer in the U.S. QuidelOrtho Corporation introduced the Sofia Q Urinalysis Analyzer to the U.S. market, expanding its point-of-care diagnostic offerings for urinary tract infection and kidney disease detection.

-

Q4 2024: Beckman Coulter Launches DxU Iris Workcell for High-Volume Urinalysis Testing Beckman Coulter announced the commercial launch of the DxU Iris Workcell, a fully automated urinalysis system designed for high-throughput clinical laboratories.

-

Q2 2025: Sysmex and Siemens Healthineers Announce Strategic Partnership for Urinalysis Solutions in Asia-Pacific Sysmex Corporation and Siemens Healthineers entered a strategic partnership to co-develop and distribute advanced urinalysis solutions across the Asia-Pacific region, aiming to accelerate innovation and market reach.

-

Q1 2025: ARKRAY Launches AUTION ELEVEN AE-4022 Urinalysis Analyzer in Europe ARKRAY, Inc. launched the AUTION ELEVEN AE-4022, a new automated urinalysis analyzer, in the European market, targeting mid-sized laboratories and clinics.

-

Q3 2024: ACON Laboratories Receives FDA 510(k) Clearance for Mission U120 Urinalysis Analyzer ACON Laboratories announced it received FDA 510(k) clearance for its Mission U120 Urinalysis Analyzer, enabling commercial distribution in the United States.

-

Q2 2024: Bio-Rad Laboratories Appoints New President of Clinical Diagnostics Division Bio-Rad Laboratories announced the appointment of a new President for its Clinical Diagnostics Division, which oversees the company's urinalysis product lines.

-

Q1 2025: Eiken Chemical Launches New Urinalysis Test Strips for Early Kidney Disease Detection Eiken Chemical Co., Ltd. introduced a new line of urinalysis test strips designed for early detection of kidney disease, expanding its diagnostic product portfolio.

Urinalysis Test Market Segmentation

Urinalysis Test Product Type Outlook

Urinalysis Test Type Outlook

- Sediment Analysis

- Biochemical Analysis

Urinalysis Test Application Outlook

- Disease Diagnosis and Pregnancy

- Fertility

Urinalysis Test End User Outlook

- Hospitals and Clinics

- Diagnostic Laboratories

- Home Care Settings

Urinalysis Test Regional Outlook

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

| Attribute/Metric |

Details |

| Market Size 2024 |

2.89 (USD Billion) |

| Market Size 2025 |

3.11 (USD Billion) |

| Market Size 2034 |

5.97 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

7.52 % (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2034 |

| Historical Data |

2020 - 2024 |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product Type, Test Type, Application, End-User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

ACON Laboratories (US), Siemens Healthineers (Germany), URIT Medical Electronic Ltd (China), Roche Diagnostics (Switzerland), Beckman Coulter (US), Sysmex Corporation (Japan), DIRUI (China), Arkray Inc. (Japan), 77 Elektronika Kft (Hungary), Cardinal Health (US), Quidel Corporation (US), Bio-Rad Laboratories (US) |

| Key Market Opportunities |

· Rising incidence of diabetes, kidney, liver, and UTIs. · Increasing numbers of elderly people. · Age-related diseases are becoming more prevalent. |

| Key Market Dynamics |

· An increase in the number of elderly people. · Infections of the urinary tract are becoming more common. · Globally, the prevalence of chronic kidney disease is rising. |

Urinalysis Test Market Highlights:

Frequently Asked Questions (FAQ):

The Global Urinalysis Test market size was valued at USD 2.5 Billion in 2022.

The Global market is projected to grow at a CAGR of 7.52% during the forecast period, 2025 - 2034

North America had the largest share of the Global market

The key players in the market are ACON Laboratories (US), Siemens Healthineers (Germany), URIT Medical Electronic Ltd (China), Roche Diagnostics (Switzerland), Beckman Coulter (US), Sysmex Corporation (Japan), DIRUI (China), Arkray Inc. (Japan),77 Elektronika Kft (Hungary).

The Hospitals and Clinics category dominated the market in 2022.

The Consumables had the largest share in the Global market.