Integration of Infotainment Systems

The automotive electronics market is witnessing a significant transformation with the integration of advanced infotainment systems. These systems are becoming increasingly popular as consumers demand seamless connectivity and entertainment options while driving. The market for automotive infotainment is expected to reach approximately $30 billion by 2026, reflecting a robust growth trajectory. This integration not only enhances the driving experience but also aligns with the growing trend of smartphone connectivity and app-based services. As manufacturers prioritize user-friendly interfaces and advanced features, the automotive electronics market is likely to evolve, incorporating voice recognition, navigation, and real-time information services, thereby creating a more engaging environment for drivers and passengers alike.

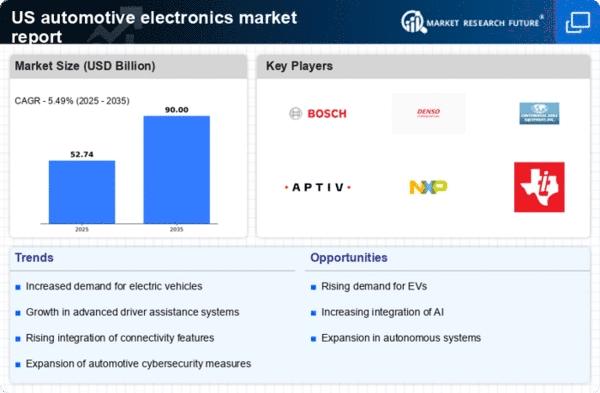

Shift Towards Electrification of Vehicles

The automotive electronics market is significantly influenced by the ongoing shift towards the electrification of vehicles. As more consumers opt for electric vehicles (EVs), the demand for specialized electronic components is expected to rise. This transition is supported by government incentives and a growing emphasis on sustainability. The market for electric vehicle components, including batteries and power management systems, is projected to grow substantially, with estimates suggesting a value exceeding $100 billion by 2030. This shift not only impacts traditional automotive manufacturers but also opens opportunities for new entrants in the automotive electronics market, as the need for innovative electronic solutions becomes paramount in supporting the electrification trend.

Emergence of Autonomous Vehicle Technologies

The automotive electronics market is on the brink of a revolution with the emergence of autonomous vehicle technologies. As companies invest heavily in research and development, the integration of sophisticated sensors, artificial intelligence, and machine learning algorithms is becoming increasingly prevalent. This trend is expected to reshape the automotive landscape, with projections indicating that the market for autonomous vehicle technologies could reach $60 billion by 2030. The implications for the automotive electronics market are profound, as the demand for high-performance computing systems and advanced sensor technologies will likely escalate. This evolution not only enhances vehicle safety but also transforms the overall driving experience, paving the way for a new era of mobility.

Rising Demand for Advanced Driver Assistance Systems

The automotive electronics market is experiencing a notable surge in demand for Advanced Driver Assistance Systems (ADAS). This trend is largely driven by increasing consumer awareness regarding vehicle safety and the desire for enhanced driving experiences. According to recent data, the market for ADAS is projected to grow at a CAGR of approximately 20% over the next five years. This growth is indicative of a broader shift towards integrating sophisticated electronic systems that assist drivers in various scenarios, thereby reducing the likelihood of accidents. As automakers invest heavily in these technologies, the automotive electronics market is likely to see substantial advancements in sensor technologies, camera systems, and software solutions, all aimed at improving vehicle safety and performance.

Growing Importance of Cybersecurity in Automotive Systems

The automotive electronics market is increasingly recognizing the critical importance of cybersecurity in vehicle systems. As vehicles become more connected and reliant on electronic components, the potential for cyber threats escalates. Recent studies indicate that nearly 70% of consumers express concerns about the security of their connected vehicles. Consequently, manufacturers are prioritizing the development of robust cybersecurity measures to protect sensitive data and ensure the integrity of vehicle systems. This focus on cybersecurity is likely to drive innovation within the automotive electronics market, as companies invest in advanced encryption technologies and secure communication protocols, thereby enhancing consumer trust and safety in an increasingly digital automotive landscape.