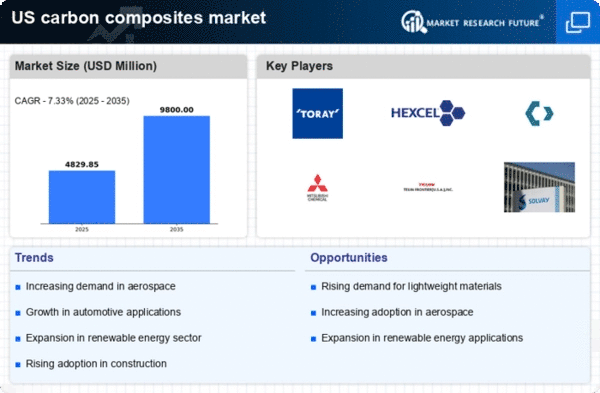

The carbon composites market is currently characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as aerospace, automotive, and renewable energy. Key players are actively pursuing strategies that emphasize innovation, sustainability, and technological advancement. For instance,

Toray Industries (Japan) has positioned itself as a leader in high-performance materials, focusing on R&D to enhance product capabilities. Similarly, Hexcel Corporation (US) is leveraging its expertise in composite materials to expand its footprint in the aerospace sector, while SGL Carbon (Germany) is concentrating on sustainable production methods to meet the growing demand for eco-friendly solutions. These strategic orientations collectively shape a competitive environment that is increasingly focused on technological differentiation and sustainability.

In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. This approach is particularly relevant in a moderately fragmented market where collaboration among key players can enhance operational efficiency. The competitive structure is influenced by the presence of both established firms and emerging players, creating a landscape where innovation and strategic partnerships are paramount for success.

In October 2025,

Hexcel Corporation (US) announced a partnership with a leading aerospace manufacturer to develop next-generation composite materials aimed at reducing aircraft weight and improving fuel efficiency. This collaboration underscores Hexcel's commitment to innovation and positions it favorably in a market that increasingly prioritizes sustainability. The strategic importance of this partnership lies in its potential to enhance product offerings and strengthen Hexcel's market position in the aerospace sector.

In September 2025, SGL Carbon (Germany) unveiled a new production facility in the US dedicated to the manufacturing of carbon fiber composites. This facility is expected to significantly increase production capacity and reduce costs, thereby enhancing SGL's competitive edge. The establishment of this facility reflects a strategic move to localize production and respond to the growing demand for carbon composites in North America, indicating a proactive approach to market dynamics.

In August 2025, Zoltek Companies (US) launched a new line of low-cost carbon fiber products aimed at the automotive sector. This initiative is indicative of Zoltek's strategy to penetrate new markets by offering cost-effective solutions without compromising on quality. The introduction of this product line may attract a broader customer base and enhance Zoltek's competitive positioning in a price-sensitive market.

As of November 2025, the competitive trends in the carbon composites market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance innovation and operational efficiency. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainable practices. This shift suggests that companies that prioritize R&D and sustainable solutions will be better positioned to thrive in the evolving market landscape.