Rising Vehicle Production

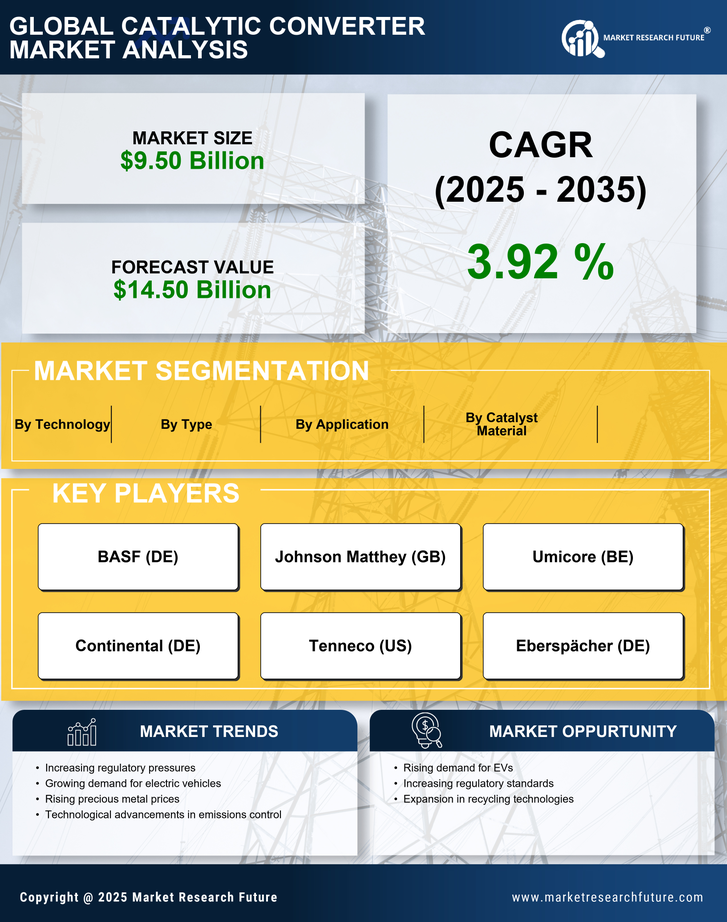

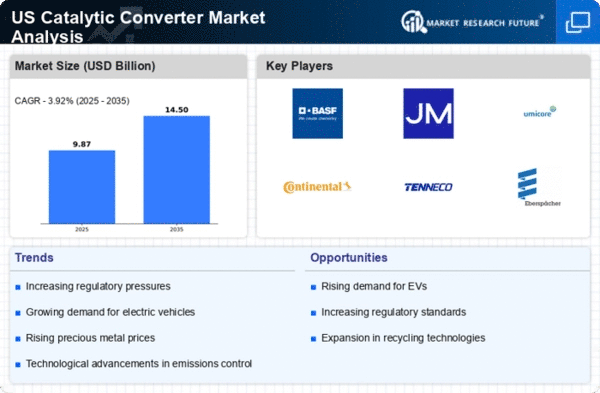

The catalytic converter market is significantly impacted by the rising production of vehicles in the United States. As consumer demand for automobiles continues to grow, manufacturers are ramping up production to meet this need. In 2025, the automotive industry is expected to produce over 15 million vehicles, which directly correlates with the demand for catalytic converters. Each vehicle produced requires a catalytic converter to comply with emission regulations, thereby driving market growth. This increase in vehicle production is likely to result in a corresponding rise in the catalytic converter market, with estimates suggesting a growth rate of around 4-6% annually. Consequently, the catalytic converter market is poised to benefit from the robust automotive sector, reinforcing its importance in the overall vehicle manufacturing process.

Increasing Emission Standards

The catalytic converter market is experiencing a notable influence from the tightening of emission standards across the United States. Regulatory bodies, such as the Environmental Protection Agency (EPA), have implemented stringent regulations aimed at reducing harmful vehicle emissions. This has led to an increased demand for advanced catalytic converters that can effectively minimize pollutants. As a result, manufacturers are compelled to innovate and enhance their product offerings to comply with these regulations. The market is projected to grow as automakers invest in technologies that meet or exceed these standards, potentially leading to a market value increase of approximately 5-7% annually over the next few years. This trend underscores the critical role of catalytic converters in achieving environmental goals and highlights the ongoing evolution within the catalytic converter market.

Expansion of the Automotive Aftermarket

The catalytic converter market is also influenced by the expansion of the automotive aftermarket in the United States. As vehicles age, the need for replacement parts, including catalytic converters, becomes increasingly important. The aftermarket segment is projected to grow at a rate of 6-8% annually, driven by the increasing number of older vehicles on the road. This trend presents a significant opportunity for manufacturers and suppliers within the catalytic converter market, as they can cater to the demand for replacement parts. Additionally, the rise of online retail platforms is facilitating easier access to catalytic converters, further boosting the aftermarket segment. This dynamic indicates that the catalytic converter market is not only reliant on new vehicle production but also on the ongoing maintenance and repair needs of existing vehicles.

Growing Awareness of Environmental Issues

The catalytic converter market is benefiting from a heightened awareness of environmental issues among consumers and policymakers. As public concern regarding air quality and climate change intensifies, there is a growing demand for vehicles equipped with effective emissions control systems. This shift in consumer preferences is prompting automakers to prioritize the integration of high-quality catalytic converters in their vehicles. In 2025, it is anticipated that nearly 70% of new vehicles sold will feature advanced catalytic converters, reflecting the market's response to environmental concerns. This trend not only supports the growth of the catalytic converter market but also aligns with broader sustainability goals, indicating a potential market growth rate of 5-8% in the coming years.

Technological Innovations in Catalytic Converters

Technological advancements play a pivotal role in shaping the catalytic converter market. Innovations such as the development of more efficient catalysts and improved substrate materials are enhancing the performance of catalytic converters. These advancements not only increase the effectiveness of emissions reduction but also contribute to better fuel efficiency in vehicles. The introduction of new technologies, such as hybrid and advanced catalytic converters, is expected to drive market growth. In 2025, the market for advanced catalytic converters is projected to account for approximately 30% of the total market share, reflecting a growing preference for high-performance solutions. This trend indicates that the catalytic converter market is evolving rapidly, with manufacturers focusing on research and development to meet the changing demands of the automotive industry.