Increasing Prevalence of Chronic Diseases

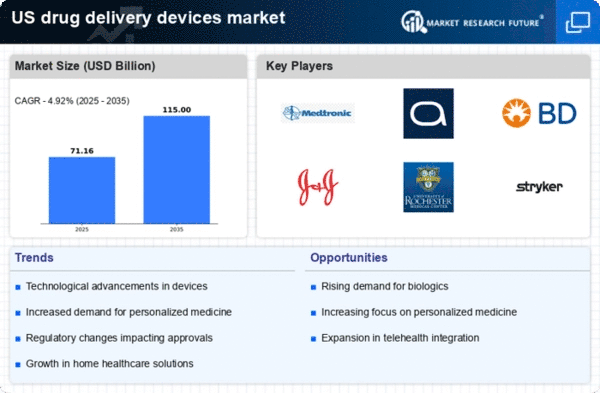

The rising prevalence of chronic diseases in the US is a significant driver for the drug delivery-devices market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders require consistent and effective medication management. The American Diabetes Association reports that over 34 million Americans have diabetes, necessitating reliable drug delivery solutions. This growing patient population is likely to propel the demand for devices that ensure accurate dosing and ease of use. As a result, the drug delivery-devices market is expected to grow at a rate of approximately 9% annually, reflecting the urgent need for innovative solutions that cater to the complexities of chronic disease management.

Growing Focus on Patient-Centric Solutions

The growing focus on patient-centric solutions is reshaping the drug delivery-devices market. Healthcare providers and manufacturers are increasingly prioritizing the needs and preferences of patients in the design and functionality of drug delivery devices. This trend is evident in the development of user-friendly devices that enhance the patient experience, such as auto-injectors and wearable drug delivery systems. Research indicates that patient satisfaction can improve adherence rates by up to 25%, underscoring the importance of this approach. As the healthcare landscape continues to evolve, the drug delivery-devices market is expected to expand, driven by the demand for solutions that empower patients and facilitate better health outcomes.

Rising Demand for Home Healthcare Solutions

The increasing preference for home healthcare solutions is a notable driver in the drug delivery-devices market. As patients seek more convenient and comfortable treatment options, the demand for devices that facilitate self-administration of medications at home has surged. This trend is supported by a growing aging population in the US, which is projected to reach 77 million by 2034. Consequently, the market for drug delivery devices tailored for home use is expected to expand significantly, with estimates suggesting a growth rate of approximately 10% annually. This shift not only enhances patient compliance but also reduces the burden on healthcare facilities, thereby driving innovation and investment in the drug delivery-devices market.

Technological Advancements in Drug Delivery Systems

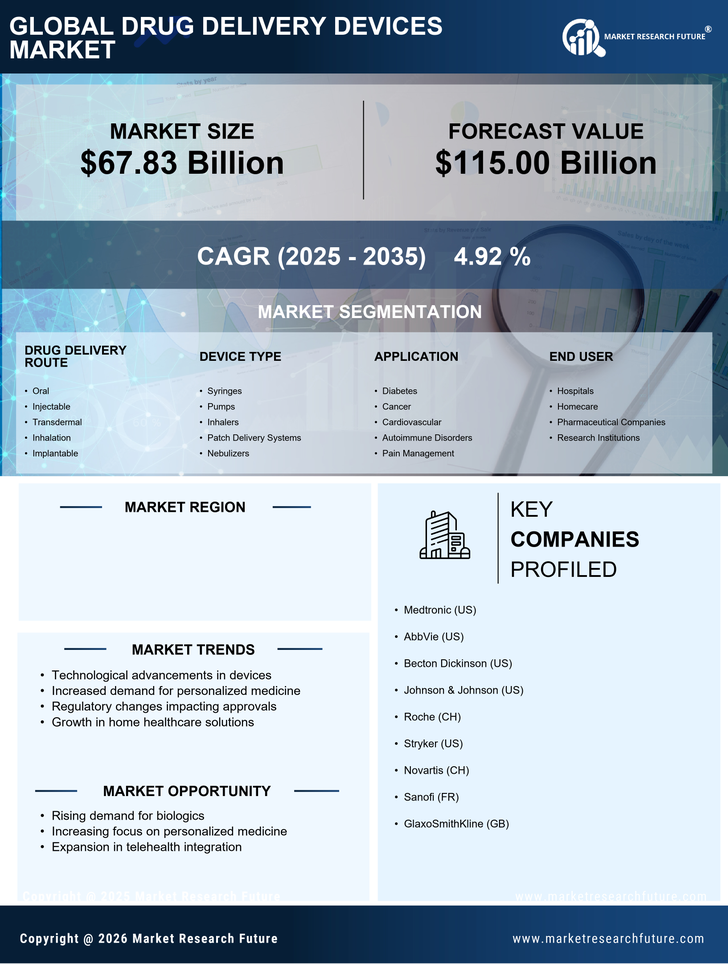

Technological advancements play a crucial role in shaping the drug delivery-devices market. Innovations such as micro-needles, smart inhalers, and implantable devices are revolutionizing how medications are administered. These technologies enhance the precision and efficiency of drug delivery, leading to improved patient outcomes. For instance, the introduction of smart inhalers has shown to increase adherence rates by up to 30%, which is vital for chronic respiratory conditions. Furthermore, the market is projected to witness a compound annual growth rate (CAGR) of around 8% over the next five years, driven by continuous research and development efforts aimed at creating more effective and user-friendly drug delivery devices.

Regulatory Support for Innovative Drug Delivery Technologies

Regulatory support for innovative drug delivery technologies is emerging as a key driver in the drug delivery-devices market. The US Food and Drug Administration (FDA) has been actively promoting the development of advanced drug delivery systems through streamlined approval processes and guidance documents. This regulatory environment encourages manufacturers to invest in research and development, fostering innovation in the market. For instance, the FDA's 2020 initiative to expedite the review of novel drug delivery devices has led to a notable increase in new product launches. This supportive framework is likely to enhance competition and drive growth within the drug delivery-devices market, as companies strive to meet evolving patient needs.